Precious Metals Stock Watch

Fortunes will soon be made in precious metal stocks because metals look set to begin a massive, new bull market. Your timing is everything, so

Fortunes will soon be made in precious metal stocks because metals look set to begin a massive, new bull market. Your timing is everything, so

Uncensored, contrarian breaking news the mainstream media doesn’t want you to see. Updated and current so you can survive and THRIVE in spite of the

“I want to assure Guyanese that there is nothing to fear.” – Guyana’s President, Irfaan Ali — Written by Bryan Lutz, Editor at Dollarcollapse.com: —

Historically, fresh all-time-highs portend drawdowns for gold. Why this time may be different. Gold finally did what many of us have been waiting

Originally posted by Adam Hamilton on his blog at ZealLLC.com: The mid-tier and junior gold miners recently finished reporting their latest quarterly results. These smaller

Originally posted by John Rubino on his substack: Signs are multiplying that the US housing bubble is about to pop. To start with the headline

Originally posted by Charles Hugh Smith on his blog, Oftwominds.com: What’s no longer affordable is eventually jettisoned, including high-rent homes and apartments. Recency bias can stretch

Written by Bryan Lutz, Editor at Dollarcollapse.com: “If you tell a lie, tell a big one.” – Jospeh Goebbels — Aside from innovation, BOOM

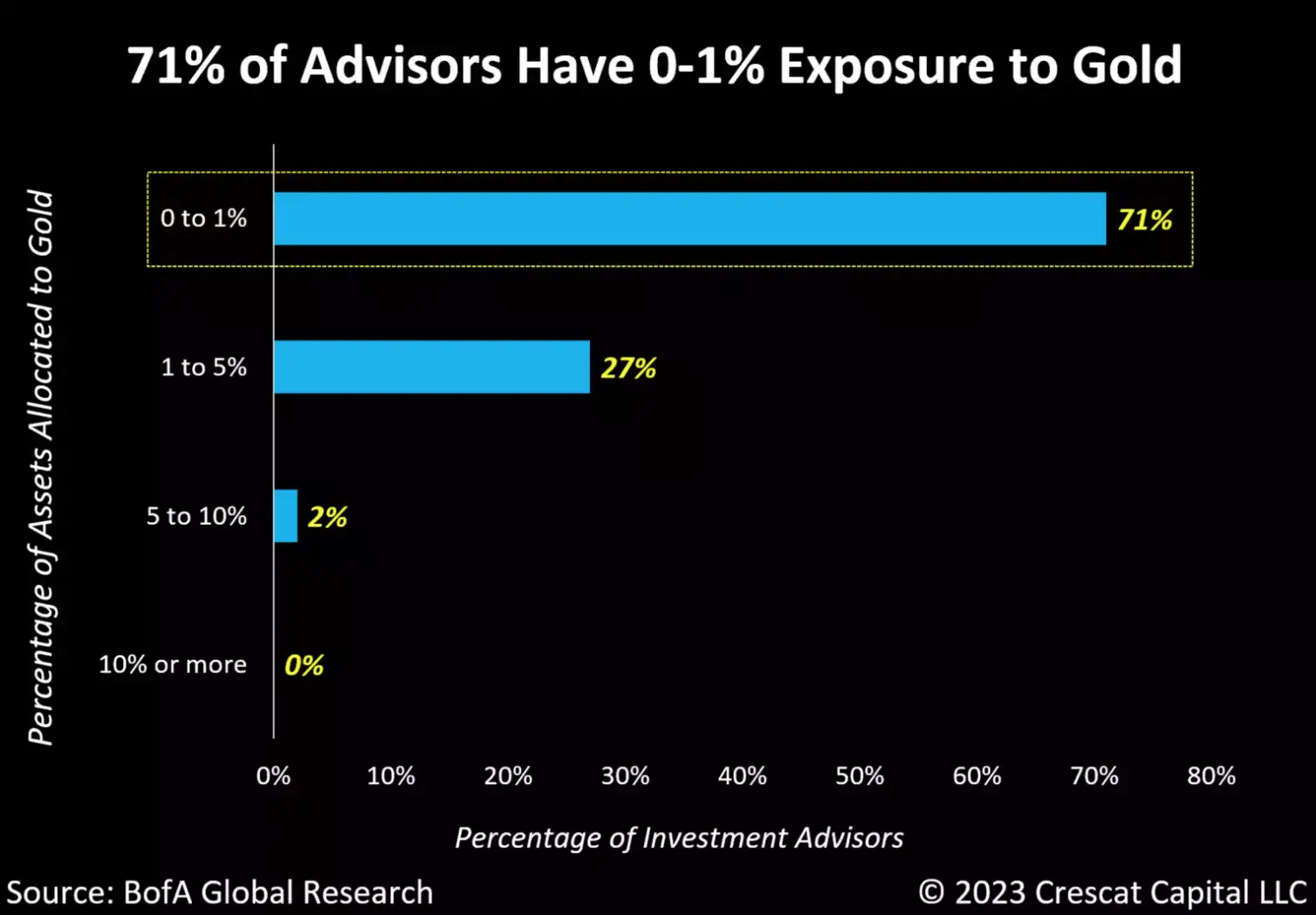

Originally posted by Crescat Capital: A Profusion of Recession Indicators Despite the growing popularity of the soft-landing narrative, the current scenario presents a

Originally posted by Adam Hamilton on his website, ZealLLC: Gold stocks have mostly ground lower to sideways since spring, leaving this contrarian sector really out

Written by Bryan Lutz, editor at dollarcollapse.com: “When Gold argues the cause, eloquence is impotent.” — Publilius Syrus — This thanksgiving gold investors everywhere have

Written by Charles Hugh Smith. Originally posted on Oftwominds.com: If Black Friday is a bust, it may be a harbinger of what the mainstream has

Written by Bryan Lutz, editor at dollarcollapse.com: “The mack currency system is far more stable than crypto.” – Bill Baroni, a lawyer(prison consultant) who was

Written by Bryan Lutz, editor at dollarcollapse.com: If you have been watching the inverse relationship between the price of gold and the value of the

Originally posted by Adam Hamilton on his blog at zealllc.com: The major gold miners just finished reporting fantastic Q3 results. A potent combination of higher

Originally posted by John Rubino on his substack: One of the many surprising things about the Everything Bubble was the way interest rates kept rising.

Originally posted by Charles Hugh Smith on his blog at Oftwominds.com: Social trust, a baseline measure of social stability, has eroded. Consider this description of

Cut through the clutter and mainstream media noise. Get free, concise dispatches on vital news, videos and opinions. Delivered to Your email inbox daily. You’ll never miss a critical story, guaranteed.