The “pension crisis” is one of those things — like electric cars and nuclear fusion — that’s definitely coming but never seems to actually arrive. However, for pension funds the reason a crisis hasn’t yet happened is also the reason that it will happen, and soon:

The Risk Pension Funds Can’t Escape

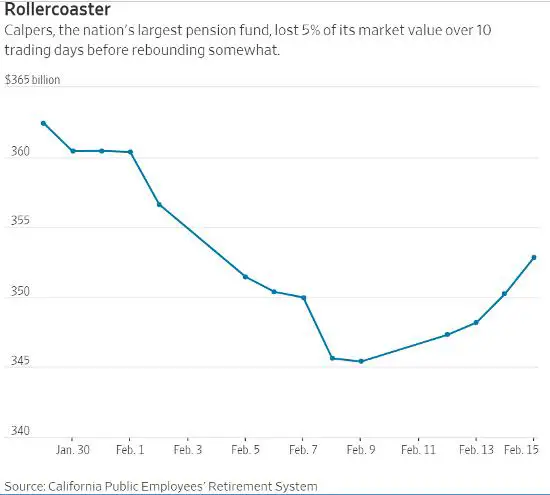

(Wall Street Journal) – Public pension funds that lost hundreds of billions during the last financial crisis still face significant risk from one basic investment: stocks.That vulnerability came into focus earlier this month as markets descended into correction territory for the first time since February 2016. The California Public Employees’ Retirement System, the largest public pension fund in the U.S., lost $18.5 billion in value over a 10-day trading period ended Feb. 9, according to figures provided by the system.

The sudden drop represented 5% of total assets held by the pension fund, which had roughly half of its portfolio in equities as of late 2017. It gained back $8.1 billion through last Friday as markets recovered.

“It looks like 2018 is likely to be more turbulent than what we have experienced the last couple of years,” the fund’s chief investment officer, Ted Eliopoulos, told his board last Monday at a public meeting.

Retirement systems that manage money for firefighters, police officers, teachers and other public workers are increasingly reliant on stocks for returns as the bull market nears its ninth year. By the end of 2017, equities had surged to an average 53.6% of public pension portfolios from 50.3% one year earlier, according to figures released earlier this month by the Wilshire Trust Universe Comparison Service.

Those average holdings were the highest on a percentage basis since 2010, according to the Wilshire Trust Universe Comparison Service data, and near the 54.6% average these funds held at the end of 2007.

One reason public pensions are so willing to bet on stocks is because of aggressive investment targets designed to fulfill mounting obligations to millions of government workers. The goal of most pension funds is to pay for those future benefits by earning 7% to 8% a year.

“Equities always take up a disproportionate share of the risk budget that any plan has,” said Wilshire Consulting President Andrew Junkin, who advises public pension funds. “You can never get away from it.”

That stance paid off during 2017’s market rally as public pensions had one of their best years of the past decade. They earned 12.4% in the 2017 fiscal year ended June 30, according to Wilshire Trust Universe Comparison Service.

But the risks are sizable losses during market downturns, which then can lead to deeper funding problems. The two largest public pensions in the U.S.—California Public Employees’ Retirement System, known by its abbreviation Calpers, and the California State Teachers’ Retirement System—lost nearly $100 billion in value during the fiscal year ended June 30, 2009. Nearly a decade later, neither fund has enough assets on hand to meet all future obligations to their workers and retirees.

Many funds burned by the 2008-2009 downturn tried to diversify their investment mix. They lowered their holdings of bonds as interest rates dropped and turned to real estate, commodities, hedge funds and private-equity holdings. These so-called alternative investments rose to 26% of holdings at about 150 of the biggest U.S. funds in 2016, according to the Public Plans Database, compared with 7% more than a decade earlier.

At the same time, the amount invested in stocks crept upward as markets roared back—and equities remain the single largest holding among all funds. The $209.1 billion New York State Common Retirement Fund increased its equity holdings to 58.1% as of Dec. 31 as compared with 56% as of June 30. That allocation is now higher than the 54% held as of March 31, 2008.

The $19.9 billion Teachers’ Retirement System of Kentucky now has 62% of its assets in equities, close to the 64% it had in 2007. It sold $303 million in stocks Jan. 19-20 to rebalance its portfolio following gains. From Feb. 6-8, as U.S. markets plunged, the fund bought another $103.5 million of stocks.

“We are definitely a long-term investor and look to volatility as an investing opportunity,” said Beau Barnes, the system’s deputy executive secretary and general counsel.

Calpers had a chance to pull back on stocks in December and decided against it. Directors considered a 34% allocation to equities, down from 50%. They also considered a higher allocation.

In the end, the fund opted to raise its equities target to 50% from 46% as of July 1 and its fixed-income target to 28% from 20%. It had 49.8% of its portfolio in equities as of Oct. 31, according to the fund’s website. That is close to the 51.6% it had in stocks for the fiscal year ended June 30, 2008.

To put the above in historical context:

Thirty or so years ago, state and local politicians and the leaders of their public employee unions had a shared epiphany: If they offered workers hyper-generous pensions they could buy labor peace without having to grant eye-popping and headline-grabbing wage increases. And if they made unrealistically high assumptions about the returns they could generate on pension plan assets they could keep required contributions nice and low, thus making both workers and taxpayers happy. The result: job security for politicians and union leaders and a false sense of affluence for workers and taxpayers.

This scam worked beautifully for as long as it needed to – which is to say until the architects of the over-generous benefits and unrealistic assumptions retired rich and happy.

But now the unworkable math is coming to light and pension funds are responding with two strategies:

1) Roll the dice by loading up on equities – the most volatile asset class available – along with “real estate, commodities, hedge funds and private-equity holdings.”

2) Buy the dips. As the above highlighted quote illustrates, stocks have been going up so steadily for so long that pension fund managers now see “volatility as an investing opportunity.” When the next downturn hits they’ll throw good money after bad, magnifying their losses.

Eventually a real bear market will shred the duct tape and chewing gum that’s holding the public pension machine together. And several trillion dollars of obligations will migrate from state and local governments to Washington, which is to say taxpayers in general, at a time when federal debts are already soaring.

24 thoughts on "Find The Sentence That Dooms Pension Funds (Don’t Worry, It’s Highlighted)"

“We are definitely a long-term investor and look to volatility as an investing opportunity…”

Noticed the post @ seeking alpha, FWIW IMHO we are in a lull before the “perfect” storm given the WSJ (article cited) along w/ an article/study geared toward bond investors which mentioned there are some big ticket items kept off balance sheet

“…Rising pension costs mean the percentage of general fund dollars cities pay to the California Public Employees’ Retirement System will have doubled by fiscal year 2024-25, according to the Retirement System Sustainability Study the league released Thursday.

…The study,… doesn’t include data on retiree healthcare benefits, often called other post-employment benefits, or OPEB…”

http://www.bondbuyer.com/news/how-a-growing-pen...

http://www.cacities.org/2018PensionSurvey

My own take on the article/study is there is nothing to prevent more self inflected damage,… or said another way, major problem(s) are caused by politicians and the people that run the bureaucratic system because they are unable to think critically about real world problems (like basic finance)

http://www.TinyURL.com/FinanciallyLiterate

For example in my home town (San Diego) we see for three decades plus, the public pension portfolio custodians (i.e. politicians) have allowed giving away (off balance sheet) a 13th pension payment

http://www.TinyURL.com/SanDiegoSpikingPension

Compounding this basic middle school math “error” is public employ leadership (i.e. public pension recipients) who see no problem w/ not requiring fully funding the portfolio (basically this seems akin to only paying a “minimum credit card payment” but happens on a SUPER SIZED scale!!!)

http://www.TinyURL.com/PensionRebuttal

So is it no wonder the “pension debt grows” AND given the “California rule” which implies the tax payers are the designated financial backstop for this whole mess (w/ serious knock on effects)

http://www.TinyURL.com/DifferentDay

Bottom line, this lull before the economic storm is the time one should prepare for TSHTF!!!

I think this year is it, at least serious things will start this year. When this year do you think will things begin to fall apart? April? I think anywhere from September to December is more likely. Its going to be big, fast and violent.

Have a gut feeling “business as usual” (i.e. relative calm) can continue longer than you might suspect (i.e. TSHTF might not happen in 2018),… this is because all central bankers, sheeple investors and joe six pack (i.e. the proverbial “man/women on the street”) are too self absorbed to grasp the BIG picture

In other words WRT to “stocks,…” looking at the PE ratio which appears high according to recent historical norms (of the past 50 years or so,…), IMHO I’d say “higher” PE ratios are somewhat justified because there are now fewer stocks out there (looking back 20 years) because of M&A and share buybacks,…

The plain and simple idea being,… when there are fewer stocks BUT lots more money because central bankers (all around the world) have created more supply, the end result is the remaining stocks are bid UP in price!

As far as joe six pack (i.e. the proverbial “man on the street”), when TSHTF (i.e. when a majority of people finally wake up) its going to be ugly!!!!!

Going through my eMail yesterday or so,… a friend who flew in the USAF and is now flying the 777 for one of the majors sent me an article:

WHY FIGHTER PILOTS KNOW THAT QUICK REACTIONS ARE FOR LOSERS

“…I know to ‘respond’ and not to ‘react’.

Years of instructing in flying training and exposure to situations that require critical thinking in demanding environments, have taught me that to ‘react’, is to die.

I’ve seen it countless times in young, inexperienced aviators and normally it’s because they haven’t had a plan for the event they’ve encountered…”

http://www.linkedin.com/pulse/why-fighter-pilots-know-quick-reactions-losers-tim-davies/

So given systemic problems w/ the way various public pension portfolios are managed, FWIW one of the hedge strategies I’m personally putting in place is taking is ag classes, because aside from systemical “idiocracy” in the economic investing realm, the same “idiocracy” is happening w/ in the environmental realm,…

http://www.youtube.com/watch?v=iTKaTcdwCYM

http://www.sandiegouniontribune.com/news/environment/sd-me-water-use-surges-20180221-story.html