For as long as most gold and silver investors can remember, the paper markets — that is, banks and speculators placing bets with futures contracts — have set the price of those metals. And within the paper markets, “the commercials” — fabricators and big banks — have consistently fooled speculators like hedge funds into going long or short at exactly the wrong time.

The data series that tracks this relationship is known as the commitment of traders report (COT), and it’s been a pretty reliable indicator of precious metals’ short-term trajectory.

Right now that’s bad news for gold and especially for silver, because the speculators — who, remember, are usually wrong at the extremes — are exuberantly long the latter, implying that the silver recovery is due for a correction. Here’s a recent piece from well-known metals trader Dan Norcini:

Silver Commitments of Traders – Halloween is Arriving Early This Year

By that I mean, it just keeps getting scarier and scarier.My guess is that every speculator on the planet is long silver/short gold or outright long silver.

That of course is an exaggeration but I am not exaggerating when I categorically state that the silver market is a train wreck just waiting to happen. As I have said before, and will say so again – I would rather miss any more upside in this market than get long now, not with a trade so lopsidedly jammed with speculators on the long side. I will leave that for the daredevils and others who like driving the stagecoach as close to the edge of the mountain pass road as they possibly can.

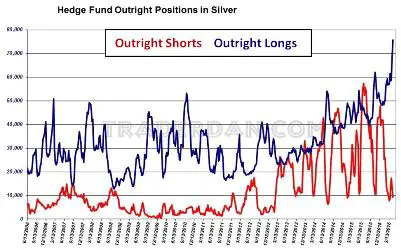

Here is a look at the hedge fund outrights:

Yet another all time record high! Tell me we do not have a buying frenzy taking place in the silver market! I suppose it can keep going higher and the specs can keep piling on more and more longs but when it breaks, it is going to be ugly – unless you are short and then it will be a thing of beauty to behold a mass exodus of hapless specs who ended up buying the top in this thing.

Commercial interests and Swap Dealers have been more than happy to offload silver into the hands of speculators at these prices. If I were long this market, and I am not, I would get some downside protection through the use of options at the very least.

On the other side of this argument is London metals trader Andrew Maguire, who in his latest interview on King World News asserts that gold and silver are entering new, post-paper age in which physical demand sets prices:

Western central planners have finally lost control of the gold market. There is an unprecedented liquidity drain out of London markets into physical markets in the East. It’s flowing out of the paper market into the physical exchanges. These events are unprecedented, forcing changes in the behavior of paper markets that are not comprehended by paper-centric analysts who are puzzling over outdated chart patterns and synthetically extracted data.

Just this week things came to a head. An overwhelming number of bearish observations appeared in the blogosphere. I see a lot of hand wringing about open interest structure which historically at these levels has resulted in a major rinse lower. But the gold market is increasingly driven by global physical benchmarks. The physical market dog is starting to wag the paper market tail. Anyone trading paper-centric historical patters is driving forward while looking in the rear view mirror.

Maguire goes on to say that if this is indeed the long-awaited physical take-over of the precious metals markets silver will not only fail to correct, it will go up faster than gold, bringing the gold/silver ratio down to more historically normal levels.

For those getting back into precious metals after the brutal bear market of the past few years, the prospect of the Eastern physical markets taking over from the Western paper markets is welcome. But it adds another layer of complexity to an already opaque market.

So here again, the only rational response is to embrace the short-term uncertainty and dollar-cost average. Since both camps in the above debate see precious metals much higher a few years hence, just buy a little at a time and don’t try to play the squiggles. Leave that to the pros.

16 thoughts on "Interesting Silver Debate: Do Old Indicators Matter Or Is Physical About To Overrun Paper?"

Just like I said – Gold and silver will be gaining on all fronts as the QE train is being continued (after FED, BOJ and ECB) – the war on cash will send gold up and up. http://independenttrader.org/war-on-cash-a-piece-of-a-bigger-puzzle.html

There will be no change.

I never try to time markets. It takes a tremendous amount of time and effort to do the research, to take the right, short-term positions. I have more important things to, so I don’t normally care what the short-term implications are.

But, from a short-term perspective, if you need to sell some coins to pay the electric bill, now might be a good time.

Again, this is a ‘short-term’ speculation based upon charts. Eventually, Bill Holter’s prediction that the COMEX will default is a complete certainty, in my mind. If you want to wait a couple weeks before diving in… fine. If you want to ‘dollar-cost-average’ your entry in to gold… fine.

But, any delay always has a potential downside.

And when I say ‘gold’, I don’t mean some ETF. Get it in your grubby little hands and put it under your mattress, or give it to someone that you trust. Safety deposit boxes are a safe bet, in places like where I live (Taiwan). But, not in America.

John Little

omegashock dot com

I’m skeptical of the “longs”. I don’t understand why they’re suddenly thinking clearly when the same craziness has been going on for years. Japanese government bonds are so hot that only the Bank of Japan can afford them, for example. China’s brain child to create another $ trillion in credit last quarter was so clever it hurts. Jobs are practically scarce in the US and interest rates MAY go up a quarter point this summer: Nearly 2% GDP growth here we come, and maybe some price inflation too, baby! And Europe is always doing better. Who needs PMs in that environment? Maybe it’s a general commodities play, or maybe there won’t be any more “green” technology companies going bankrupt so the demand for silver is about to skyrocket to supply all those solar panels that are needed to meet the booming energy demand that oil is too cheap to supply.

Norcini and Maguire are both honorable, intelligent people. Norcini’s true expertise historically is with agricultural commodities and Maguire has been calling for the “Big Move UP” for precious metals since before water ran downhill. Even in older normal times precious metals can be tricky; in our “new normal” paper trades are probably more a crap shoot than anything. John’s advice is great. Regularly accumulate small amounts of physical over time. I consider watching daily market moves for metals as colorful entertainment.

I agree, and for a few other reasons as well. Financial privacy is quietly eroding so making many smaller purchases of PMs over time still keeps you under the radar. (I think $10 k is still the magic number above which reporting requirements kick in.) Confiscation is even less likely if the Feds don’t know you have anything. Secondly, at most dealers there is not a big (or any) discount for buying, say, 10 or 20 gold bullion coins vs 5 or 6, so there is no great cost in dollar-cost-averaging especially since no one has a clue as to what prices will be doing in the short run, and there won’t be a paper trail. (BTW, you may know this but others may not: Try to find a local dealer you trust and build a relationship vs buying online. I haven’t found there to be a big difference in price, and that relationship will probably prove valuable. You never know. At least try not to buy ALL your PMs from one source. Diversify.)

How can anyone know the true price of precious metals when ‘paper metals’ rule the market?

If you can continue to beat the price down Indefinitely while regulators seeing Wall Street jobs look the other way, is there really a ‘market’ at play here? Or is it just a ‘players market’?

If I were a large silver producer I would do my best to start a cartel. If necessary I’d ‘invert’ all my corporate offices anywhere in the world beyond the reach of the SEC. And one fine day, right after a ‘smackdown’, I (along with my brethren) would announce a new silver price 30% higher than the ‘fix’ on that day. If a handful of large producers participated, it would make no difference what the small ones sold, unlike the OPEC producers.

THEN we would have a ‘real market’ again, just like in most other commodity markets.