In his book The Postcatastrophe Economy, iTulip’s Eric Janszen notes that financial bubbles don’t repeat. That is, yesterday’s bubble is never tomorrow’s because hot money likes to chase the next big thing, not the last big thing. Which explains how US equities, government bonds, fine art, and trophy properties like London penthouses can all be sizzling while US houses, the epicenter of the previous decade’s financial orgy, just sit there.

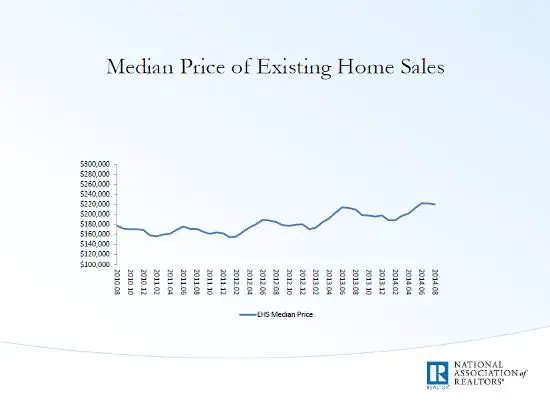

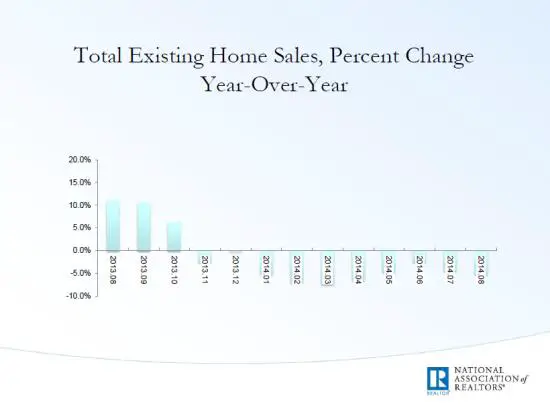

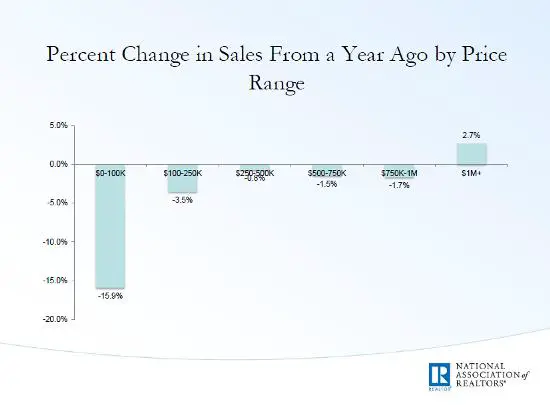

Some charts from the National Association of Realtors illustrate just how boring the US housing market has become:

To summarize the first three charts, overall sales have declined year-over-year for ten straight months, prices are barely up from a year ago, and near-term trends imply more of the same. The fourth chart explains why: All the positive action is in high-end properties while the entry level part of the market is imploding.

There are several reasons for this:

1) Today’s college students are graduating with so much debt that many can’t even conceive of buying a house. Instead, their choice is between a cheap apartment or a bedroom in their parents’ home.

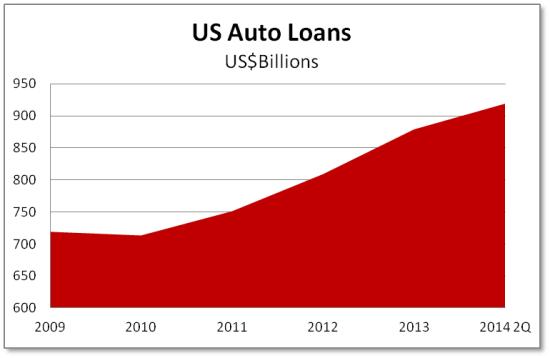

2) US consumers, after a few years of deleveraging, are once again borrowing, but in large part this is to pay for necessities like gas and food. When they buy something discretionary, it’s now likely to be a new car. Auto loans are rapidly approaching the $1 trillion milestone achieved by student loans a couple of years back.

3) Back in 2004-2007, banks handed out home equity lines of credit (HELOCs) to pretty much anyone with a house and a heartbeat (heartbeat frequently optional). Those loans generally require only interest payments for the first ten years and then begin demanding repayment of principal. So the loans made during the housing bubble are now starting to step up, hitting their owners with hundreds of dollars of extra monthly payments at a time when they’re already strapped. For more see Why the Real Estate Market Remains Fragile.

Rich folks, meanwhile, own the stocks and bonds that have soared lately, so they’re ready and able to diversify out of financial assets and into real stuff like million-dollar houses. Take these extravagant buyers out of the equation and the housing market for the rest of us is contracting at what looks like a steady 5% per year, with no end in sight.

So what does this mean for the overall economy? Specifically, can a country as dependent on consumer spending as the US generate sustained growth when the one major asset owned by most families isn’t participating? The answer is probably not. For the wealth effect (rising asset prices leading people to spend more) to really get going, all the pressure is now on the narrow shoulders of the stock market.

And so is all the risk. If stock prices were to correct from their current record levels, the impact would be directly painful for the 1% who are now buying those mansions, and at least scary for the 99% who aren’t losing on the stocks they were never able to buy, but can’t escape the ubiquitous headlines about “crashes” and “crises” and such. The net effect would be to snuff out the recovery and leave a desperate government with only one remaining weapon: a high-profile monetary shock designed to replace the scary headlines with a perception that our bold, innovative leaders once again have our backs. Japan has already reached this point (see Abenomics Approaches Moment of Reckoning), Europe is getting there (Pressure Builds on ECB Chief) and the US, unless housing turns around or stocks double from here, will be there soon.

Welcome to the brave new world of global coordinated monetary debasement.

20 thoughts on "Why Isn’t Housing A Bubble?"

Hey! I know this is kind of off topic but I was wondering if you knew where

I could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having problems finding one?

Thanks a lot!

Hi! I just wanted to ask if you ever have any trouble with hackers?

My last blog (wordpress) was hacked and I ended up losing months

of hard work due to no back up. Do you have any solutions to prevent hackers?

I just helped my son buy a house in Colorado Springs. The prices there just keep going up. I have bid over asking price several times and still lost. Finally won on a short sale and almost at closing now. Its strange the economy is a disaster and housing is going up so fast.

I am on vacation in the Philippines now and housing here is unaffordable for 95% of the population and still going up in price. Its getting so high I’d rather buy a cheap place in Florida. Land is definitely cheaper in Florida than the PI.

Its seems where ever there is any money flowing right now we see very high inflation,otherwise we see deflation a little.

Maybe we are back to better buy now while you can or you’ll be left out. But then maybe we will see 100 year mortgages next. Just some rambling thoughts.

He obviously doesn’t live anywhere near Seattle where prices have exploded

the past four yrs…Double digit for each of the last two!!!

Sooner or later tho, real estate will collapse along with the stock market!

Residential real estate minor echo bubble, area specific. Next stock market crash will lower housing, more so in inflated areas. Will be nothing like previous housing crash but will decline. Commercial real estate loans may be more vulnerable during next downturn than residential loans. Just purchased a nice brick home in Tennessee on 2.2 acres for $56/sq ft at 3.25%. Never thought I’d see such a low rate.

My question is how can housing prices climb when incomes aren’t? The only way is a return to the lending practices of yesterday. I hear/read positive hype but figure it’s from the small percentage of the class structure that is doing well. It’s sure not from the rest of us. In fact, I read very little, if anything, on any comments section that isn’t, obviously, written by the upper classes.

There is a residential real estate bubble, but it is in rental housing because of all the REO’s being held off the markets. Rent here is up by more than 40% in the last 12-24 months but with much of that coming in just the last few, the vacancy rate is less than 1% in this county (pop 276,000) and when you go to look at the rare open rental housing unit there is a line to get inside, followed by a bidding war no matter how obsolete and crappy the place is. Apartment complexes have 2, 3 and even 4 year waiting lists. Units on Craigslist invite bids starting at XYZ unimaginable rents.

I realized I can’t afford to stay, but all the other regions I have looked at are the same. Now I am looking at selling up and moving out to another country, in part because I do not want to be here when the USA collapses and breaks up the way the USSR did in 1991, and it will when people can’t feed their kids because they now live in rental POVERTY!

Is it fair to say that there are bubble real estate metro areas that are being fueled to record prices because of low mortgage rates and boom in industries that do well in zero interest environment?

Two areas that I am familiar are Greater Boston and Metro New York. Lots of areas in Metro New York that are within 45 minute train ride have houses selling a record prices for mid- high end homes. Metro New York real estate booms with booming bond markets and sky rocketing stock prices both direct beneficiaries of cheap money.

Greater Boston has seen the mid-high end homes hit record prices as mutual fund business thrives when stocks only go up, education bubble feeds the huge number of schools in Greater Boston, tech companies have been booming as the nasdaq rises ( a far cry from the desolation of the Boston tech scene when the DotCom bubble burst), and construction is booming.

No one can believe that prices can go any where but up for Boston, New York, San Fran, and there are certainly other bubble real estate zones. The average American who lives in these special real estate zones is now absolutely convinced that real estate will continue to climb in the future because the aren’t making any more real estate/great communites with great schools are a solid investment/ no one ever lost money buying real estate in ________ (Palo Alto, Menlo Park-CA, Wellesley-MA, Westfield-NJ, Summit-NJ).

Do we live in an area of no national real estate bubble, but instead regional bubble for areas that benefit from low interest rates created by the Federal Reserve?

Will these special areas continue to thrive when interest rates normalize some time in the future?

These regional bubbles remind me of the book “Fiat Money Inflation in France”, by Andrew Dickson White, which described France post revolution and how towns with government offices or stock market/trading thrive while the country folk were starving? Are we merely experiencing a similar experience to what happened in France so many years ago?

Regards

In some hot areas such as San Diego, prices definitely are not declining at any sort of annual clip. And in San Diego the low end of the market is the hottest of all.

I think you are mistaking the greying of baby boomers (and their propensity to move from the rust belt to a warmer climate) for a housing implosion. Here is the premiere website for san diego home price monitoring : http://piggington.com/ btw.

The first part of the article doesn’t really jibe with what I am seeing. I live in Spokane WA and Housing in the $150-$250 range is way overpriced, not quite to 2006 levels but almost there. Inventory on “for sale” and “rental” homes is way up but people selling are not willing to budge, they’d rather have the home sit empty or on the market. Bubbles are funny as when they are inflating there are a lot of transactions so the bubble inflates quickly but when its time for prices to come down there is a stubbornness and reluctance to acknowledge…classic denial. I am renting now and will continue to do so until the sellers come out of denial…or financial reality hits them.

A few thoughts: Sellers are not always at the drivers seat, there is a large cohort of homes still under water. They will slowly bleed themselves until the banks finally step in. Wife and I took our losses in 2009, lost $50,000 in hard money and $50,000 in blood sweat and tears. We were relocating from Boston to Chicago. We we considered renting, etc. We thought it best to sell and realize the loss then to slowly bleed and be chained to the cash outflow of the house. Slowly been saving up, investing (where the upside has been) and are in a much better position to buy. We could have outflowed cash to support a deperciating asset, but instead took our money and invested it into stocks. However… we are NOT in a hurry to buy. Happy to sit on the sidelines and watch the system collapse.

Money is still very cheap, $2000 a month goes a long way in servicing a $250k home. People don’t buy a home, they buy a payment. Barring another economic shock to the system, and as long as rates are low, home prices are unlikely to move much to the down side. now, real estate is a local game. Spokane is a young hip place with solid young inmigration (people moving there cause it is a nice place to live). Your area will not likely see much more downside.

I now live in the Chicago burbs. Prices are continuing to slide and will continue to do so.I watch it daily. Homes that were $750k are down to $450k and STILL sitting. Imagine the underwater folks who can’t sell. The younger kids coming in want city life. The burbs are full of older mature couples who are over-housed in 5 bedroom structures. The homes that are moving are retirees who are selling their homes for what they paid in the 90’s. We’d probably see more selling if these boomers had any real equity besides what they put into the house.

Lastly, this is all a function of interest rates. Home prices will collapse if rates move up…and that is why we will see “extended period” talk for the next few years. Or war. What is it good for? Economic shuffling!!!!

So, thanks for letting me rant. To my friend in Spokane…prices may not come down for you. BUT, keep an eye out for that “must have” home…and be ready and able to close quickly. If there is distress out there for on that prefect home…it moves within days. Be able to close quickly, but wait for that perfect home! You may not get a price discount, but you get the “best of breed” real estate…the stuff that does not trade often, with great views, or near the train or whatever you want. May take some time…but you will get the “A” property in the “A” location.