Since their introduction in 1993, exchange traded funds (ETFs) have become a huge hit with retail (that is, small individual) investors, for a very good reason: As “passive” funds that just match a given market or sector with minimal trading and extremely low fees, ETFs offer exposure to equities without requiring a lot of judgment. And after debacles like the 2008-2009 crash the one thing individual investors do not trust is their own stock-picking judgment.

Towards the end of bull markets, however, small investors tend to rediscover their inner stock-picker. Just in time to get creamed in the subsequent crash.

And here, apparently, we go again:

Investors Unchain Themselves From ETFs as Stock Volume Surges

(Bloomberg) – Individual stocks are hot again, with investors eschewing passive strategies and piling into single shares at the fastest pace in five years. It’s the latest sign of calm returning to the equity market after last August’s meltdown.Among Standard & Poor’s 500 Index constituents, about 2.3 billion shares have changed hands each day since early November, compared with 106 million a day in the SPDR S&P 500 ETF Trust, the biggest such security tracking the benchmark gauge. The ratio between the two has almost doubled since reaching a four-year low in September and on Nov. 30 hit 24, the highest level in almost six years, data compiled by Bloomberg and FBN Securities Inc. show.

A rising appetite for individual shares is a hallmark of easing tension in the stock market as investors drop their obsession with economic and political shocks and focus on the ability of companies to boost earnings or be taken over. Demand is rising after the S&P 500 recovered from its first correction in four years, returning to a range that has confined stocks for most of this year.

While individuals are deciding that they can beat the market, institutions are running hard in the opposite direction:

Institutions Dump Stocks For Fifth Consecutive Week

(Zero Hedge) – Over the past month (and year) the market may appear rangebound driven mostly by a handful of top stocks, but below the surface the “smart money” continues to sell.But while the traditional “smart money” marginal buyers may have said enough especially after the Draghi debacle, the traditional source of stock demand remains as buybacks by corporate clients picked up last week, and the four-week average trend is tracking slightly above levels we saw this time last year.

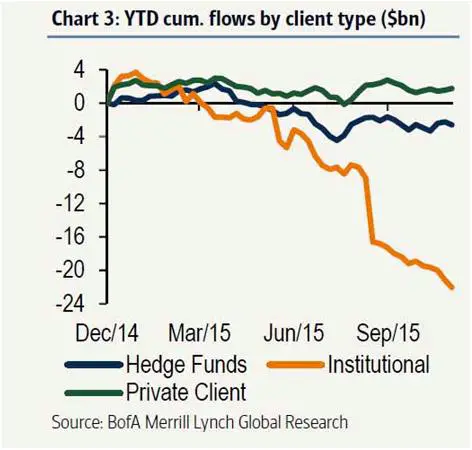

As the chart below shows, while Private Clients have been small net buyers of stocks in 2015, hedge funds are net sellers but nothing compares to the revulsion by big institutions whose selling has been relentless.

To sum up, while the broad market averages tread water, the biggest professional investors are selling their shares to 1) small investors who suddenly think they can beat the market and 2) corporate treasurers who have been ordered to buy back their companies’ shares at prevailing prices so the CEO can “earn” a nice year-end bonus.

We’ve seen this play before, and unfortunately it always ends the same way, with a brutal lesson in the nature of financial markets and the individual’s lowly place within them.

5 thoughts on "The End is Near, Part 6: Individual Investors Rediscover Individual Stocks"

6 months later. Market is rallying even when bad news appears. Big money seems to be in as much as retail.

I know 3 people who became multimillionaires investing in individual stocks. I don’t know anyone who became a multimillionaire investing in funds. The ones who got rich bought high-quality companies that are conservatively managed and that raise their dividends annually. I am 45% in individual stocks and will not sell. The other 55% is cash, sitting on the sidelines until stock valuations (PEs) get in the mid-teens again. At that point, I will start buying individual stocks again.

People do get rich off of mutual funds, but it isn’t the investors, it is the fund companies collecting 3% front loads and 1.5% of AUM annually. The only decent funds for retail investors are ETFs, as far as fees go. But then you end up owning a lot of crap. Buffett said you only have about 20 good ideas in your investing life. So pick 20 great companies and go with them. For life.

Oh man. The poor suckers. Bet they’re piling into FANGs.

http://youtu.be/u06DpcFXc4U