The homebuilders are happy. US retail sales are up. Even France is “turning the corner.”

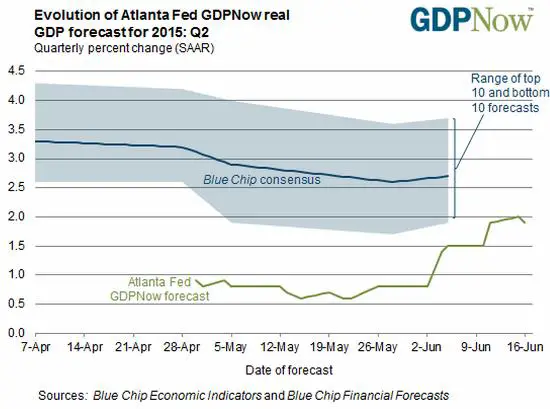

And now the Atlanta Fed, which has lately been both far more pessimistic and far more accurate about US growth than other mainstream economists, is creeping towards the Blue Chip consensus. It recently bumped its Q2 growth forecast growth to 2%, more than enough to offset the negative Q1 reading. If this forecast holds, then first-half growth will be at least marginally positive, with serious momentum heading into the Fall.

That’s quite a change, but not an improvement. In fact it illustrates the corner into which the developed world has painted itself. By borrowing another $57 trillion since 2008 and pushing interest rates down to zero and below, the (formerly) rich countries are now living in an “all news is bad news” world.

Consider: If growth stays low then all that new borrowing was worse than wasted, increasing leverage and financial fragility while leaving central banks and governments with few options going forward. If the past seven years’ debt orgy didn’t ignite a boom, will another binge be worth the effort? Will borrowers be energized by -2% rates if 0% left them cold?

On the other hand, as now seems at least plausible, if the past few years’ monetary and fiscal experimentation does end up generating a bit of growth, what then? With the prices of financial assets at records and hard assets like trophy real estate and fine art far beyond previous records, rising growth will, as the Fed keeps promising, trigger rising rates, and not necessarily in an orderly fashion. The recent bond market excitement, in this scenario, is just a taste of bigger, nastier things to come. See Bond Market Turmoil: Yields Hit Fresh Highs in June.

What will spiking bond rates (which is to say a collapsing bond market) do to the rest of the financial system? That’s not easy to answer. Government borrowing costs would obviously rise as trillions of dollars of short-term debt is rolled over at higher rates, sending deficits back to Great Recession levels. Corporations would find selling bonds to buy back stock a suddenly bad deal and would probably stop — pulling a major prop from beneath stock prices. On the other hand, all the money pouring out of bonds would have to go somewhere, and could well flow into equities, sending valuations into the stratosphere and finally pulling retail investors in at the very top.

The conclusion? Beyond a certain point leverage stops helping and starts hurting. And the fact that no amount of growth leads to a happy outcome for the US, Europe and Japan implies that we’re there.

19 thoughts on "Is The Fake Recovery Becoming Real? And Would That Be As Bad As It Seems?"

….All time hit the dollarcollapse Find Here

I may be wrong but I think the Central banks want collapse. I think they want to make level the playing field of countries in order to gain control. One world government control is the goal people. The Pope is providing his okay to one world government to help the poor which is a lie. Nobody in America is willing to cut even a nickle from the budget unless it is in the military because military cuts makes America weaker at a certain point.

The stuff is getting ready to ht the fan and it is not because of some incompetence of accident. It has been planned. The politicians know it is close and that is why they are going after private citizens guns. They cannot take a chance that the politicians and bankers won’t be blamed for the pain coming ahead.

Your first choice dollarcollapse Find Here

…

Some time hit the goldsilverworlds Find Here

We are probably seeing a bounce due to lower oil prices. However, with lower oil prices comes a reduction in investment in the energy sector, and a decline in relatively high paying jobs. For example, the Baker-Hughs Rig Count has declined for 28 straight weeks, basically falling off a cliff. http://www.businessinsider.com/baker-hughes-rig-count-june-19-2015-6

As much as I hate to admit it (because I didn’t invest accordingly) from my perspective the economy is doing very well – bubble-like well, in fact. People say that some people are still struggling but all I see it ridiculous consumption. The roadways are packed, lots of new cars, restaurants are packed, hotels are full, air fares are crazy (and you better book months in advance), construction is everywhere, etc. Maybe growth isn’t much over 2% but just the baseline is pretty awesome even if growth were zero.

http://www.firstrebuttal.com/2015/06/16/the-feds-fatal-flaw-a-predictable-end/

Thanks.

It’s “doing well” in a very, very, very, VERY few places, and you’re just lucky enough to be in or around one of those places. The vast majority of the United States is already resembling a Third-World nation…. because THAT’S WHAT IT ALREADY IS!

Your first choice dollarcollapse Find Here

The Atlanta Fed may have got a tap on the shoulder by the Powers that be and told to “improve” their numbers.

Tragedy and Hope

A History of the World in Our

Time

by Carroll Quigley, 1966

Pg. 326-327: It must not be felt that

these heads of the world’s chief central banks were themselves

substantive powers in world finance. They were not. Rather, they

were the technicians and agents of the dominant investment bankers

of their own countries, who had raised them up and were perfectly

capable of throwing them down. The substantive financial powers

of the world were in the hands of these investment bankers (also

called “international” or “merchant” bankers)

who remained largely behind the scenes in their own unincorporated

private banks. These formed a system of international cooperation

and national dominance which was more private, more powerful,

and more secret than that of their agents in the central banks.

This dominance of investment bankers was based on their control

over the flows of credit and investment funds in their own countries

and throughout the world. They could dominate the financial and

industrial systems of their own countries by their influence over

the flow of current funds through bank loans, the discount rate,

and the re-discounting of commercial debts; they could dominate

governments by their control over current government loans and

the play of the international exchanges. Almost all of this power

was exercised by the personal influence and prestige of men who

had demonstrated their ability in the past to bring off successful

financial coupe, to keep their word, to remain cool in a crisis,

and to share their winning opportunities with their associates.

In this system the Rothschilds had been preeminent during much

of the nineteenth century, but, at the end of that century, they

were being replaced by J. P. Morgan whose central office was in

New York, although it was always operated as if it were in London

(where it had, indeed, originated as George Peabody and Company

in 1838).

Thanks for this. Good insight … likely true. The nail that sticks out does get hammered home. Can’t have one of your insiders questioning the big lie.

Thanks Thomas. For more insight see;

http://www.thirdworldtraveler.com/Banks/Tragedy_Hope_excerpt.html

http://home.hiwaay.net/~becraft/mcfadden.html

God bless! (Everyone get to confession, before God strikes)

OK, but the Quigley reference dates from 1966, and describes an era when a true gold standard existed. Now that central bankers have the power to create money with a few taps on a keyboard, has the balance of power changed?

Nick, The central bankers have even more power now, because without government expenditure having to be measured to gold reserves, they can print to infinity. Moreover,the people have no wealth protection having little gold and silver in their possession. See;

http://www.rense.com/general66/rosen.htm

The MONEY POWER

When questioned about the ways in which the Jews have

gained power, Mr. Rosenthal said:

“Our power has been created through the manipulation

of the national monetary system. We authored the quotation. ‘Money is power.’ As revealed in our master plan, it was essential for us to establish a private national bank. The Federal Reserve system fitted our plan nicely since it is owned by us, but the name implies that it is a government institution.

From the very outset, our purpose was to confiscate all the gold and silver, replacing them with worthless non-redeemable paper notes. This we have done!”

When asked about the term ‘non-redeemable notes,’ Mr.

Rosenthal replied:

“Prior to 1968, the gullible goy could take a one dollar Federal Reserve note into any bank in America and redeem it for

a dollar which was by law a coin containing 412 1/2 grains of 90 per cent silver. Up until 1933, one could have redeemed the same note for a coin of 25 4/5ths grains of 90 per cent gold. All we do is give the goy more non-redeemable notes, or else copper slugs. But we never give them their gold and silver. Only more paper,” he said contemptuously. “We Jews have prospered through the paper gimmick. It’s our method through

which we take money and give only paper in return.” (The economic problem of America and the world is ultimately a Jewish problem, or as Henry Ford stated: “The Money Question, properly solved, is the end of the Jewish Question and every other question of a mundane nature.”

Can you give me a example of this we asked?

“The examples are numerous, but a few readily apparent

are the stocks and bonds market, all forms of insurance and the fractional reserve system practiced by the Federal Reserve corporation, not to mention the billions in gold and silver that we have gained in exchange for paper notes, stupidly called money. Money power was essential in carrying out our master plan of international conquest through propaganda.”

When asked how they proposed doing this, he said:

“At first, by controlling the banking system we

were able to control corporation capital. Through this, we acquired total monopoly of the movie industry, the radio networks and the newly developing television media. The printing industry, newspapers, periodicals and technical journals had already fallen into our hands. The richest plum was later

to come when we took over the publication of all school materials. Through these vehicles we could mold public opinion to suit our own purposes. The people are only stupid pigs that grunt and squeal the chants we give them,whether they be truth or lies.”

And more from Professor Quigley

Pg. 324: the powers of financial capitalism had another far-reaching aim, nothing less than to create a world

system of financial control in private hands able to dominate

the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences.

The apex of the system was to be the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations. Each central bank, in the hands of men like Montagu Norman of the Bank of England, Benjamin Strong of the New York Federal Reserve

Bank, Charles Rist of the Bank of France, and Hjalmar Schacht

of the Reichsbank, sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.

http://www.thirdworldtraveler.com/Banks/Tragedy_Hope_excerpt.html

Really, it’s all good! The mega-rich got mega-richer, the political class got more bought off, fascism increased, spying increased, freedoms decreased, savings decreased, et al.

I’m getting Ready for the Oligarchy!