In normal times, some asset classes are expensive others are cheap, making it easy to use historical relationships to decide where to invest. That’s not the case today. Every major asset category, including stocks, bonds and even precious metals, are looking at best temporarily overbought by past standards, and at worst (in the case of stocks and bonds), wildly overvalued. Here’s a discussion with some tentative advice.

"We Track the Financial Collapse For You,

so You'll Thrive and Profit, In Spite of It... "

Fortunes will soon be made (and saved). Subscribe for free now. Get our vital, dispatches on gold, silver and sound-money delivered to your email inbox daily.

4 thoughts on "Podcast: A Tough Time To Manage Money"

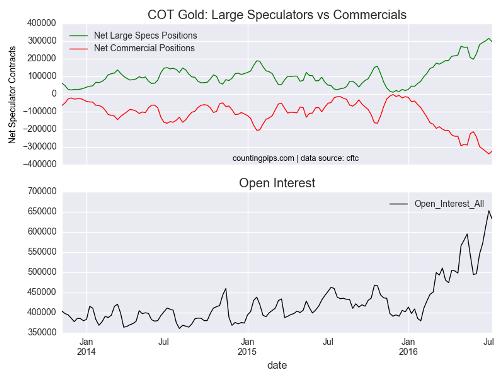

Two important things to understand here: The “commercials” in the gold and silver markets aren’t the producers to any significant degree. They’re bankers … and they aren’t selling product. They’re “naked shorts” … selling a promise to deliver what they don’t have and likely can’t get in sufficient volumes to deliver on what they owe.

They aren’t “bearish.” They’re seeking to knock down the price or at least cap it as part of an officially-sponsored campaign to suppress prices … and to make plenty of money for themselves in the process. It’s been working beautifully … until now. Lately, their bear raids have come to nothing. No follow-through. No lasting effect, but they’ve had to add ever more shorts to the pile, which increases their risk.

No one should get the idea from looking at the COT report that the extreme short position is the result of legitimate hedging by producers or garden variety bearish speculation.

As for the retail buying of coins by the public, it’s funny how that demand was insatiable up until a few months ago and has now fallen off a cliff, even as gold and silver have risen.

That demand, which so many assumed was coming from the little guy retail investor, was, in fact, coming from one buyer … JP Morgan. They were accumulating physical silver … and to a lesser extent … physical gold coins as fast as they could. Why? My guess is they know damn well metals prices can’t be held down indefinitely, and they want to hedge their short futures positions … and be in a position to make beaucoup beaucoup when the metals scream higher … all while they settle their losing short bets in cash at yesterday’s closing price when the exchange can’t make good on what they promised.

It’s a racket … and right now, it’s not going so well for the banksters. May they what they deserve … which are prison sentences, but I’d settle for their being knocked out of the game and an end to the manipulation.