The way markets usually work is that on any given day (or in any given year) some asset classes are up while others are down. Investors, as a result, are always torn between the impulse to pile into the best looking sector and the urge to diversify against the unexpected.

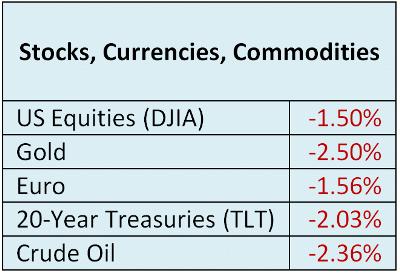

But sometimes it doesn’t matter what you own because the only safe asset is cash under the mattress. Friday, March 6 is looking like one of those days. Some major asset classes an hour before the market close:

These are really big moves for stock indexes, currencies and commodities, but the real carnage is in individual stocks and bonds, where losses of 5%-10% are common.

What does it mean when everything falls against the dollar? That depends on whether today is just a blip in the long, generally-positive trends that have dominated the financial markets for the past few years, or whether it’s a sign that US interest rates are finally ready to go up, ending the era of preternaturally easy money for governments and corporations. If the latter then there are some serious air pockets under a whole range of financial instruments.

Then the question becomes: How bad does it have to get before the US backs off and rejoins the currency war? Probably not too bad. Another few days like this should be all it takes for the “rising interest rates in June” meme to be walked back.

So the “good news is bad news” attitude of the markets could easily give way to its opposite, where the worse the economic news the better the markets like it, because it brings the next round of QE and falling interest rates that much closer. The perversity of the whole thing feels overwhelming at times. But like most disruptions in the natural order, it’s temporary. A system with this much debt can’t tolerate normal interest rates. But it also can’t tolerate steadily rising leverage. So this too (whatever it is) shall pass.

3 thoughts on "The Day The Dollar Crushed Everything"

Thanks for that laugh John!

“The Day The (Fiat IOU a)Dollar Crushed Everything”…

EXCEPT MY STACK of physical Precious Metals!

It just Keeps On Growing! LOL!

What a Blessing it is to have Wall St. Morons manipulating the paper prices lower to psyche out the Market and Sheople, so that those few remaining with a lick of commonsense can snatch up these bargains in History’s oldest form of Money/Currency, and the best part is that there are NO LINES either!

Thank You LORD!

And thanks to those who still support “Made in the U.S.A”

Those American Gold & Silver Eagles are without a doubt, the Best, and last Honest thing still made in America, and as well, those workers at the U.S. Mint are perhaps the only ones left in the entire federal civil gov’t who actually earn an honest day’s pay and produce anything of Value for this Country. SALUTE!

Cheers, S. Rex

Strong dollar is good for imported stuff, but then who’s buying? More deflation dollar goes higher. More jobs cuts to boost profits, less people are spending dollar goes higher and around in spiralling deflation. The average Joe sees inflation, but corporations and bankers are seeing deflation. I think they call it Biflation, just depends on where you are at in the food chain I guess. Just don’t let the music/printer stop!

As has been said before, “there are no markets, only manipulations”