The premise of a currency war is that by devaluing its currency a country is able to sell things overseas more cheaply, which gooses its growth at the expense of its trading partners.

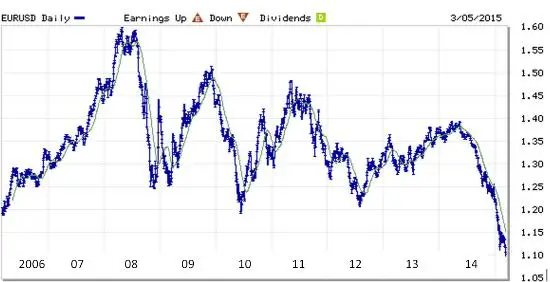

If it actually works that way, then you’d expect this chart of the euro plunging against the dollar…

…to be reflected in some sort of strong-dollar related downturn in the US. And right on cue, the Fed reported this morning that American manufacturers are now in the sixth month of a new-orders slowdown:

If things continue to play out according to script the coming year will be slightly better than expected for Europe (but only slightly because of all the other messes those guys have made of their common currency experiment) and quite a bit worse than expected for the US (because we actually think we’re recovering).

Then comes the next and final stage of the cycle, where the US realizes that it’s tipping back into recession, with all the unacceptable things that that implies for the equity bubble, tax revenues and campaign contributions, and shifts gears from tightening to open-the-floodgates loose, hoping to push the dollar back down against the euro, yen and yuan. The difference this time around will be that, as Europe is now discovering, easing monetary policy when interest rates are already zero means pushing into negative numbers. And that means yet another leap of faith into uncharted, experimental, very possibly disastrous territory.

10 thoughts on "What Do These Two Charts Have In Common?"

As I’ve tried to express before, the fact that it takes so long for crappy ideas and policies to manifest is, ironically, precisely why they persist. Who knows how much longer things will muddle along,can but it will probably be longer than any of us seriously imagine. Frankly, personally, I have no complaints financially whatsoever, and all I see is almost bubble-like economic activity all around, and have for several years now. Maybe it’s because I live in south Florida, or maybe because I’m in the construction business, or maybe I just don’t see the “other” neighborhoods, but I honestly don’t see anything like my idea of a recession.

I will say this though, the US economy may not be growing at the desired 3-4% annual rate but it is still growing, and even if it weren’t it would still seem fine because an awful lot of activity must occur to just maintain the status quo. I actually would prefer south Florida to have a depression just so so many people wouldn’t be here. It’s crazy.

I just bought a car last month (year 2014) and was amazed at the asking prices. The 2015s just came out and their asking prices are a good 20% higher. Go figure.

The problem for the USA in the near future is the huge decline in capital spending by oil companies. This is somewhat related to the strong dollar, since a strong dollar pushes oil prices lower. But far more important factors are the slowing Chinese economy and Saudi frustration with non-OPEC producers.

As Jay Hanson said years ago, oil production levels can be maintained artificially high if one or more of the inputs are mispriced. If the case of USA shale oil production, capital was and is mispriced. A lot of the development was financed with junk quality debt sold at AAA prices. Central planners think they are being cute with zero interest rates, but it is just an exercise in can kicking.

Nothing can go bad in the US. We are the indispensable nation. Relax.

Yep… The Romans were thinking the same about themselves, as the British, The Spanish, the French, the Greeks before them, the Persians, the Babylonians… etc. All Empires are due to collapse one day or another, the US are not immune.

How can things get bad for the US? The FED still has plenty of digital dollars left!

Politicians never knew how to run an economy. They are all lawyers or connected banking pawns. Who in turn love chaos. It creates undeclared wars that never end. These Banksters love financing that stuff. So all the nations wealth is squandered. None for the states but plenty for wars. We won’t bail our children out of college debt but will bail out those who produce nothing whatsoever yet destroy those that do. Where are all the Statesmen today? If these politicians were to look at fate herself, they would realize it is themselves they need to save the country from.

It is a very slow process to the currency graveyard,but,it looks like they all will get there one of these days!

Good write-up! Here is my take on the report ,,, and it isn’t good!!!