One of the defining traits of financial bubbles is the willingness of traders and investors to interpret pretty much everything as a buy signal. Rising corporate earnings mean growth, while falling profits mean easier money on the way. War means more revenues for defense contractors and easy money for everyone else. Blizzards means consumer spending will rebound in the Spring. Inflation means higher asset prices for speculators while deflation means, once again, easier money for everyone. When people are this optimistic they find the silver lining in every black cloud and happily to buy the dips with borrowed money.

A timely example is Greece’s threat to leave the Eurozone, default on its debt and go back to using drachmas. This could be seen as either the beginning of a chain reaction that destroys the eurozone and the rest of the world as we know it, or as an excuse for vastly easier money. So far — in a sign that the bubble is still expanding — each new twist (like last weekend’s announcement of de facto capital controls) has been accompanied by European Central Bank reassurances and market acceptance of those promises.

Another case in point is China’s twin weekend announcements that two major companies defaulted on their debt while the government eased bank reserve requirements. The pessimistic take on such things happening simultaneously would be that China’s financial sector is in crisis and the government is desperately and probably impotently trying to stop the bleeding. But the European and US markets saw only the liquidity side of the story and bid up risk assets pretty much across the board.

When we change our minds

But in the life cycle of every bubble there comes an emotional phase change. Dark clouds start to obscure their silver linings and new highs get harder and harder to achieve. Think home prices rising beyond middle-class affordability in 2007 or tech stocks hitting 50-times sales in 1999. Only unambiguously good news can keep the bubble going, and because few events are that pure, the crowd gets nervous and the spin gets negative. Faster growth means tighter money; a weak dollar means inflation while a strong one means falling corporate profits. War means instability, extreme weather means lower near-term growth. So sell the rallies and hide out in cash.

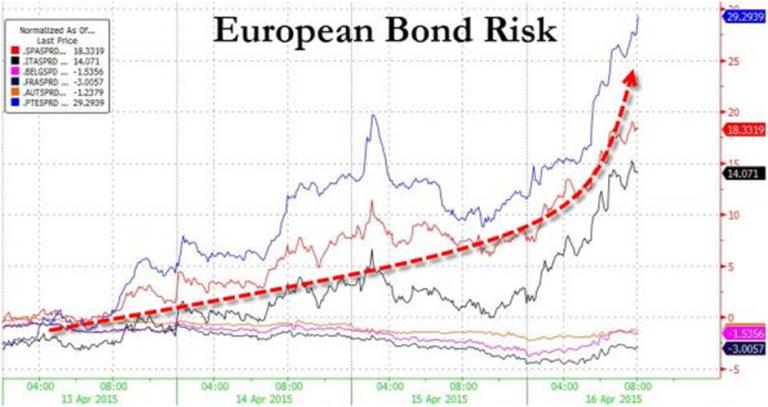

The world isn’t quite at this point — or maybe it is. The following chart (from Bloomberg) shows the impact of Greece’s impending loan deadline on a measure of risk in peripheral eurozone bond markets. Greece is the blue line; the black and red are Italy and Spain.

There’s no way to know until after the fact if the dark night of the market’s soul has begun. But when it comes, that’s how its first stage will look.

3 thoughts on "When All News Is Bad News"

The difference between now and 2008 when the housing bubble collapsed is that the central banks are clearly determined not to permit any of the many bubbles they have created to collapse.

Essentially what we have is a situation like 1929 building (only far worse) where by all rights the markets should crash — but the central banks are stepping in and saying — no, we won’t have that — and making unlimited cash available to keep the bubble growing.

They are buying stocks outright and they are making ZIRP cash available to companies who use it to big up their failing share prices.

And once you start this game there is no turning back – the central banks will ride this (i.e. keep infusing cash) until the bull tosses them into the cheap seats smashing them to pieces.

There is no way to play this and profit from it. Because we are so far up the mountain now we need oxygen to breathe. When we fall we smash in pieces on the rocks below.

There will be no ‘winning’

The only question one must have is obviously why in the christ would the central banks do such a thing? Why commit suicide?

There must be something very nasty lurking in the shadows that we are not being told about — and that they fear more than ramping endless bubbles.

The problem is the end of cheaply extractable oil. What we are experiencing should come as no surprise because Colin Campbell, one of the leading petro engineeers on the planet, predicted all of this in 1998 in an article in The Scientific American:

THE END OF CHEAP OIL Global production of conventional oil will begin to decline sooner than most people think, probably within 10 years

Feb 14, 1998 |By Colin J. Campbell and Jean H. Laherrre http://www.scientificamerican.com/article/the-end-of-cheap-oil/

HOW HIGH OIL PRICES WILL PERMANENTLY CAP ECONOMIC GROWTH For most of the last century, cheap oil powered global economic growth. But in the last decade, the price of oil has quadrupled, and that shift will permanently shackle the growth potential of the world’s economies. http://www.bloomberg.com/news/articles/2012-09-23/how-high-oil-prices-will-permanently-cap-economic-growth

HIGH PRICED OIL DESTROYS GROWTH According to the OECD Economics Department and the International Monetary Fund Research Department, a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. http://www.iea.org/textbase/npsum/high_oil04sum.pdf

BUT WE NEED HIGH OIL PRICES: The marginal cost of the 50 largest oil and gas producers globally increased to US$92/bbl in 2011, an increase of 11% y-o-y and in-line with historical average CAGR growth. http://ftalphaville.ft.com/2012/05/02/983171/marginal-oil-production-costs-are-heading-towards-100barrel/

Steven Kopits from Douglas-Westwood said the productivity of

new capital spending has fallen by a factor of five since 2000. “The vast

majority of public oil and gas companies require oil prices of over $100 to

achieve positive free cash flow under current capex and dividend programmes.

Nearly half of the industry needs more than $120,” he said http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

Sanford C. Bernstein, the Wall Street research company, calls the rapid increase in production costs “the dark side of the golden age of shale”. In a recent analysis, it estimates that non-Opec marginal cost of production rose last year to $104.5 a barrel, up more than 13 per cent from $92.3 a barrel in 2011. http://www.ft.com/intl/cms/s/0/ec3bb622-c794-11e2-9c52-00144feab7de.html#axzz3T4sTXDB5

THE PERFECT STORM (see p. 59 onwards)

The economy is a surplus energy equation, not a monetary

one, and growth in output (and in the global population) since the Industrial

Revolution has resulted from the harnessing of ever-greater quantities of

energy. But the critical relationship between energy production and the

energy cost of extraction is now deteriorating so rapidly that the economy as

we have known it for more than two centuries is beginning to unravel. http://ftalphaville.ft.com/files/2013/01/Perfect-Storm-LR.pdf

WATCH THE VIDEOS….every Canadian should know about this

Comer Vs The Bank of Canada Case – Totally hidden by MSM

https://www.youtube.com/watch?v=40Jz0LPQAQY

https://www.youtube.com/watch?t=417&v=jGFsOwowlbU