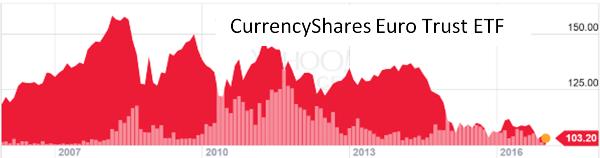

ECB Chairman Mario Draghi’s announcement of bigger and better QE this morning should have surprised no one. The fact is that the eurozone is coming apart at the seams and the only tool left to delay the inevitable is easier money. As the following chart illustrates, the euro has been declining since 2008, with the descent accelerating lately.

And more is coming. The only way for Italy, Greece and possibly France to keep it together is for their currency to plunge relative to those of their trading partners, thus making it easier to sell domestically-produced stuff abroad. So euro parity with the dollar will generate headlines when it happens but will just be a way-point on a journey to much lower numbers. That is, if the whole global financial system doesn’t blow up first.

What’s a European saver to do? Sitting on a euro-denominated bank account generated a 30% loss of real purchasing power during this “recovery,” which for the average European more than offset the trade benefits of a cheaper currency (hence the recent political turmoil). So going forward, cash is clearly not an attractive way to preserve capital.

Gold, on the other hand, is made for this kind of situation. In the past decade it has more-or-less doubled in euro terms. The difference between a 30% loss and a 100% gain is not lost on the people living through it, so expect European gold demand to rise going forward.

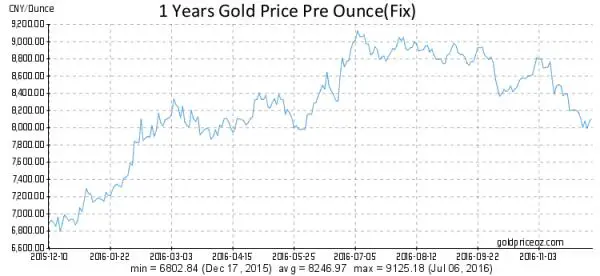

Meanwhile, the same thing is happening in China, where the yuan has been falling steadily and is now at a multi-year low to the USD.

The difference is that many Chinese seemed to have understood what was coming and have for the past decade been loading up on gold. The result: currency devaluation actually improves the finances of large numbers of gold-owning citizens.

For Americans there are two lessons here:

1) Because we’re making the same mistakes as Europe and China – borrowing more than we can ever hope to pay off and papering the growing mess over with artificially-low interest rates and aggressive currency creation – the dollar won’t last long as the only major currency that’s appreciating. We’ll eventually be forced to devalue, which will take the currency war to a new and vastly more dangerous stage.

2) When the above happens gold will soar in dollar terms just as it is now rising in euro and yuan terms. So today’s US savers have a choice of role models: Will we be impoverished Europeans with shrinking bank accounts or enriched Chinese with ever-more-valuable stacks of gold?

32 thoughts on "Euro Devaluation Accelerates – Millions Of Europeans Wishing They’d Bought Gold"

Durrrr!!! 99% of the worlds Harry and Lloyds (Dumb and Dumber) have substantially ALL their liquid assets in stocks, bonds (about to enter decade long bear market), and shabby pieces of paper with pictures of Presidents, Turd World turdballs, ancient Latino revolutionaries, and soon to be Harriet Tubman LOLOLOL! You know, pieces of worthless paper issued from nothing, backed by nothing, yielding nothing, and most importantly, not even worth a bucket of spit no matter what the denomination. More silver for me please, at a price that is so low no miner can or will build a new silver mine.

Here, here! I agree! Perfectly said! I am buying more silver as we speak!

If someone is not stacking by now, and the majority are not, then I don’t know what it will take to wake them up. Maybe a good mini crash before the big one….

Why wake them up?! My experience is that people refuse to listen to common sense and will always say that you are wrong. Then, when the SHTF, they will expect everyone to bail them out! BLANK THEM! Just keep on buying silver and gold QUIETLY. You will be the winner and you will be better off in the future.

A collapse is the only thing that will wake most people up. I’ve stopped warning people unless they ask me about it.

The only way the people will learn is to lose vast amounts of their wealth from their misplaced faith in paper.

I got paid 104000 bucks last year by freelancing online and I did it by working part-time for 3+ h /daily. I’m using work opportunity I stumbled upon online and I am so thrilled that I was able to earn so much extra income. It’s really user friendly and I am just so grateful that I found out about it. This is what i did… http://statictab.com/h8vxywm

A “golden opportunity” for long term thinkers.