Regular contributor Michael Pollaro offers three more charts which tell a story that’s both disturbing and apparently misunderstood by a lot of mainstream analysts.

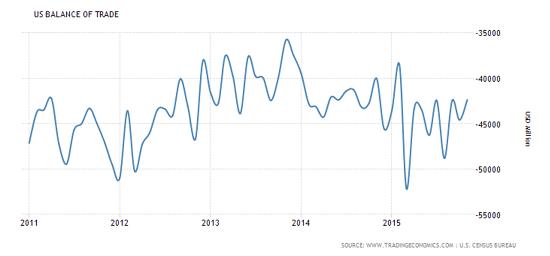

The US trade deficit (exports minus imports) has been getting smaller. Since a trade deficit subtracts from GDP growth, a shrinking deficit will, other things being equal, produce a bigger, faster-growing economy (that’s the mainstream take).

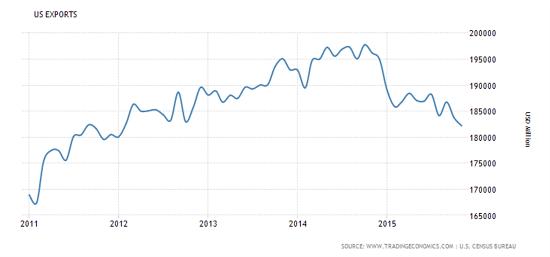

But other things aren’t equal. It turns out that the components of that trade balance figure are both shrinking. Exports — the stuff we sell to foreigners — have been declining since the dollar spiked in 2014. That’s not a surprise, since a strengthening currency makes exports more expensive and thus harder to sell. So other countries are buying less of our stuff, which though not surprising is a bad sign.

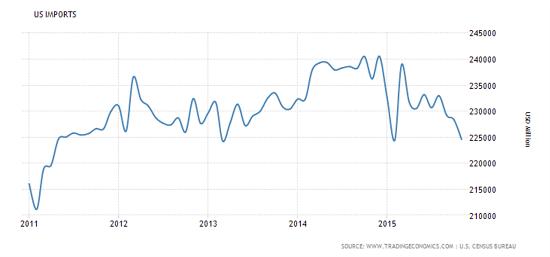

Meanwhile, imports — stuff we buy from abroad — have also plunged in the past year, which is partly due to cheaper oil lowering the dollar value of energy and other commodity imports. But it also means that even though French wine and German cars have become less expensive as the dollar has soared against the euro, we’re not buying more of them. So US consumers, even with all the money they’re saving at the gas pump, still can’t (or won’t) take advantage of a sale on imported goods.

If imports and exports are both falling, that means consumption is weak pretty much everywhere. And weak consumption means slow or negative growth, which contradicts the recovery thesis that now dominates policy making and the financial media.

It also makes last week’s market turmoil easier to understand. Falling trade means lower corporate profits, which, if history is still a valid guide, means less valuable equities. So it could be that the markets are simply figuring this out and revaluing assets accordingly.

20 thoughts on "The Shrinking Global Economy, In Three Charts"

Peaceful or otherwise, but cultural decapitation nevertheless. Invest in ammo.

wow .

so much , lets put in polite way, facts that are so far from truth.

lets analyze, shall we?

#ough French wine and German cars have become less expensive as the dollar has soared against the euro, we’re not buying more of them

in theory , yes. it reality when was time you went to german made cars show room? did you see cheaper cars?

#consumption is weak pretty much everywhere. And weak consumption means slow or negative growth,

no.

consumption is consumption . growth is growth.

lets imagine. you have 100 $, if you spent it, was it growth? if you saved it was it bad?

or worse, you dont have 100$, but you have credit, and spend on something, is it good thing? is it always?

and #2,

you showed chart w/ import/export falling, but it is in $$, so what if prices are falling, but physical volumes are rising is it bad?

#Falling trade means lower corporate profits

well ,real life stats don’t support this notion.

in 2015 year overall USA consumers/corps paid out to Uncle Sam 5% more taxes than in 2014, if its recession in USA, where did people/corp take more monies?

# misunderstood by a lot of mainstream analysts.

sir, you pretend you know something, in reality you dont.

you still operate under umbrella GROWTH=CONSUMPTION , so more CONSUMPTION is better. in real life it is not

good luck

alx

Assets are only worth what the next sucker, er ‘investor’, will pay for them.

Massive Rapefugee Cover-up in Sweden:

https://www.youtube.com/watch?v=ltJqVvtEqoM

So where is the chart on demand–the incomes of people? Demand has been dropping because of wage stagnation and the bank failure that just occurred that hurt a lot of people as they lost jobs and the new jobs don’t pay as much. Foreign countries protect their markets with taxes and we don’t so it’s just not a higher dollar it’s we are being taxed out of other markets because these countries are protecting their manufacturing for good reason. The only thing I agree with Trump is that we have stupid people promoting our trade legislation. However, the people doing it aren’t stupid their only looking out for their interests, but they don’t align with the working class and small business in this country. Demand will continue to fall even with more deregulation, anti union tactics, and lower taxes. Austerity with corruption will be the undoing. Bernie 2016

Eight years of Obama only made things worse.

Dan

I was once told a conservative is a progressive that has been hit by reality. I really think you prove this correct.

Hi Dan, the economic pressures are current immense debts and huge, beyond-comprehension unfunded social liability programs.

There IS NOT enough money to pay for our debs UNLESS we drastically devalue our currency. But by how much? China is in deep trouble. Will they devalue by 15%? That’s the talk. Currency wars will follow. If a total of 50% be the result then your standard of living will go down that far. Perhaps you can handle that. But what about your poor neighbors? This will be a major catastrophe for the world’s economies. Major War might be one outcome. Martial Law another. Both?

As long as you can make your credit agency look the other way, everything is just great. And already there is much political pressure to keep the credit agencies away from government bond activities.

Look around your room. All you see came out of the ground. Men worked to make the stuff of walls, plaster and paint and all that other stuff in your room. Honest money is value given to real work and real goods. The money which paid for the things in your room had declining value because it’s value has been depreciating as our debts piled. Imagine how our current 20 TRILLION dollar debt will be paid if the FED raises interest rates to say, 5%? Can you calculate 5% interest on 20 TRILLION dollars? That’s the tax payer cost of interest to pay the lenders (again, the taxpayers). Will there be money pay for the entitlements?

Do not pass GO! Do NOT Collect $200.00. Game over. (This is when we each add up our assets. And this is when the REAL Game begins.) Welcome to survival ville, the All America game.

When money loses it’s value in an honest economy, we can all KNOW the loss. But Our economy is NOT an honest economy. It is a prop of fake, or fiat currency. Backed by politically evil promises of our government.

It’s worth reading Genesis 3:17-18.

All wealth must therefore must come out of the ground. Neither God, nor government is capable of providing it. Since the fall of man, in the beginning, we must toil for it. But as men are prone to sin (wrong thinking), we shall from time to time be corrected by the Master of natural Law.

.

The smart money is moving out of the market into high rated bonds. I saw the collapse coming in 2007 and moved out of the market into cash and investment property. Go see the movie The Big Short and see how the totally irresponsible the investment banks have been since allowing them to become too big to fail. Remember who were the prime movers of deregulation and who are trying to kill regulation? These are people who don’t care about the future but only care about cashing in and getting rich. Bernie 2016 And I will add the TPP will be the final dagger and would call your Congressmen to kill it. The President will try to sell it but he’s wrong and misguided on this issue. It’s based on the Korean agreement and it has been a loser for small businesses as all the others have been.

Taxes and the prospect of rising taxes, FATCA, regulations so burdensome even with the best and most expensive attorneys compliance is a nightmare, surveillance and the prospect of even less, or no privacy, bail-ins on the horizon and probable derivatives implosion followed by banks and brokers closing – do we wonder why people are hunkering down? Do we wonder why people are taking less risk if the future they see is bleak?

Governments and politicians never admit error. Do we need any of them at all?

If we were to change the money system from debt based to a new currency just printed and limited to a percentage of GDP, and denied governments the ability to borrow at all, we’d eliminate debt, solve the sovereign debt crisis and eliminate the need for taxes and surveillance to keep the population under control.

Debt has not constrained the politicians. Nor has debt prevented war. Perhaps we do not trust them enough to expect them to limit their lust to a percentage of GDP. After all, they lie about the numbers now. But some new system is needed.

What if we governed ourselves locally and did away with the Federal Government entirely? At least then the rascals would be in our own backyards.

Martin Armsrong follower, eh?

Why not? If Central Banks and Governments and the CIA and banks are prepared to spend $50,000 to $100,000 a pop for him to help them change their perspective he must be doing something right.

http://thegreatrecession.info/blog/fed-official-confesses-fed-rigged-stock-market-collapse-certain/