“They made their hearts diamond-hard lest they should hear the law and the words that the LORD of hosts had sent by his Spirit through the former prophets. Therefore great anger came from the LORD of hosts.”

~ Zechariah 7:12

Written by Bryan Lutz, Editor at Dollarcollapse.com:

When diamonds are found, they are lacklustre.

They need refinement, polish, and cutting to realize their value.

In fact, without this important work, they look something like large pieces of shattered, dull, tempered glass.

That’s what our dollars have become today.

Because of greed, the pursuit of comfort in government services, and the illusion of political power, our money has become like rough diamonds.

Although we still act like it’s as valuable as it once was.

It is not.

The reverse has happened.

The more US Dollars get printed, the less valuable they become.

Granted the dollar’s relative value does remain high because of its status as the world’s reserve currency…

At home, it’s different.

The dollar’s value must be supported by a productive economy.

Except the more the government prints, the more money exists, which creates a gap between actual goods and services being produced and the money in circulation.

As that gap widens, the rougher our diamonds become.

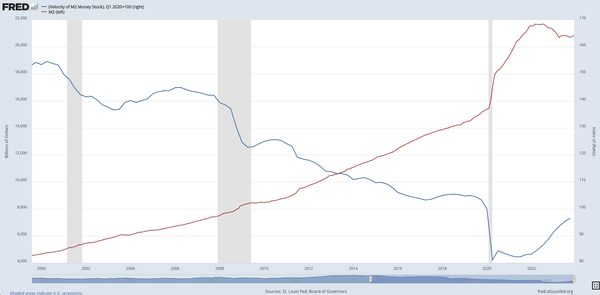

You can see that gap in the velocity of money to M2 Supply.

|

See the gap? As it widens, the less actual positive economic change occurs, which is the root of money – money’s purpose.

Money should be used to transfer real goods and services. And if used properly, to create and build value over time.

But since the early 2000s(maybe earlier if we want to talk about inflation), we’ve seen the real value of the US economy decline, becoming severely reliant on financial products(junk bonds, derivatives, etc).

Financial products that create nothing physical, and have provided no real service other than the increase of numbers on a computer.

Here’s one recent example that points out a sign of the times:

America’s largest bank, JP Morgan is sending signals of stability and profit earnings, while at the same time, it’s quite oversold when you look at the 100 and 200-day moving average. Now the bank’s CEO, Jamie Dimon is saying the quiet part out loud.

He knows there’s something up with the banks and the money system.

Bloomberg reports:

Dimon Sells $150 Million of JPMorgan Shares in First Sale

“JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon and his family sold $150 million worth of the bank’s stock, following through on last year’s announcement that he would begin selling shares for the first time since taking the helm 18 years ago.”

This stock sale doesn’t come as a surprise.

Dimon announced his intentions in October last year, after some comments with bearish sentiment, and some insights into Federal Fund interest rates possibly increasing to 7%.

Last year on Oct.27, 2023, BNN Bloomberg reported:

Jamie Dimon Plans to Sell 1 Million JPMorgan Shares Next Year

“Wells Fargo & Co. analyst Mike Mayo noted that Dimon’s stock-sale plan “comes after his bearish comments that include the possibility of interest rates increasing to 7%, and an ‘uninvestable’ banking sector” due to the burden of proposed Basel III Endgame requirements.

“The timing of his first sale with these comments got our attention,” Mayo said in a research note, adding that the plan also serves as “a reminder that the CEO is getting closer to retirement.”

And then there’s this if you’re not clueless…

I don’t think any reader at dollarcollapse is, but… because of your natural inclination to seek out in-depth, alternative information…

You are probably well aware of this:

The CEO of America’s largest bank would be one of the most well-informed people about what’s going on behind the scenes at the Federal Reserve.

And he’s also one of the closest minds viewing JP Morgan’s balance sheet every chance he gets.

But, we can’t know anything for certain…

Informed or not, retiring or not, the US dollar is becoming less shiny than it once was by the day – a diamond, become rough.