Written by Bryan Lutz, Editor at Dollarcollapse.com:

It’s no secret, the entire construction industry is financed by credit. If not, tall towers, malls, and chip factories would be financed by the savings of the rich.

But that would be much slower growth.

Instead, the economy runs on credit.

So here’s the secret:

Construction loans don’t get “paid-off.” They get refinanced.

The loan cycle moves from construction loans, to bridge loans, to permanent loans, which has several implications on jobs, and our credit-driven economy.

The first is that it allows for a large majority of blue collar workers to keep hammering away at the daily grind on construction sites everywhere.

It keeps many people employed.

As you can see, the BLS December jobs report shows, probably the biggest incline among all jobs by industry in the last few years. Wolf Richter, at Wolf Street dot com interprets each industry here.

Now, the Federal Reserve’s mandate is to maintain maximum employment while at the same time minimizing inflation, or maintaining it around the target 2%, so prices remain relatively stable.

The second implication is that the Federal Reserve must expand credit to maintain its employment mandate, so it must make credit available to banks to move through the three-fold loan cycle: from construction loans, to bridge loans, to permanent loans.

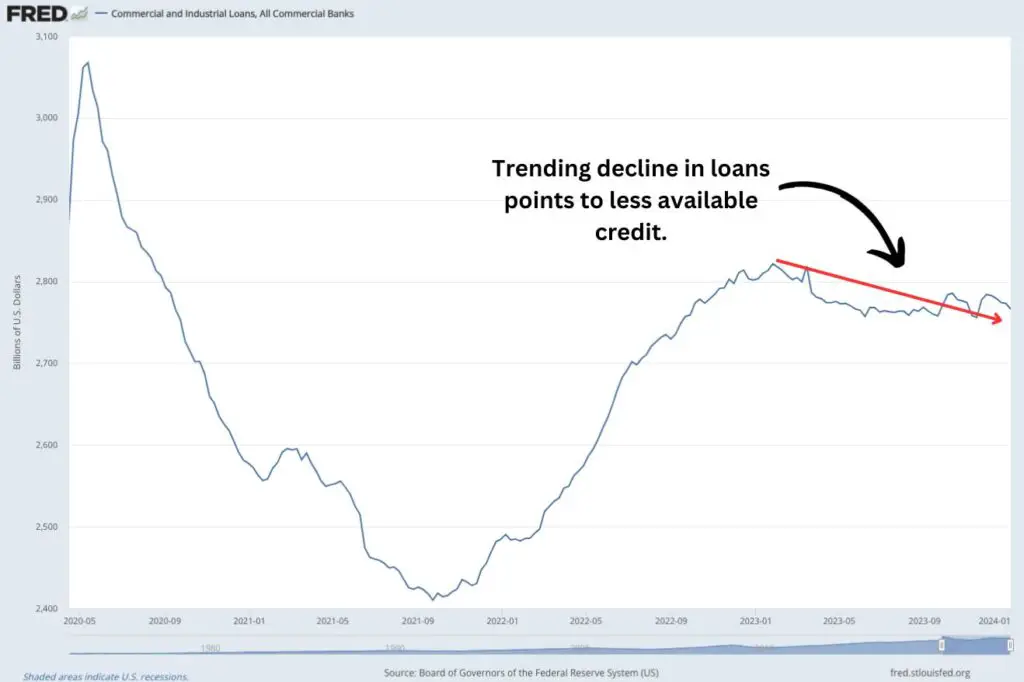

The problem is that across all industries, we are seeing a slow decline in commercial and industrial loans. Banks are reluctant to assume the risk of what may come next, or in the next few years.

So, we can assume that at some point, there will not be more credit available to start the real estate loan cycle with construction loans.

One way to fix this is to make the credit available for further construction. The Fed could print more money, to keep pushing the loan cycle forward.

However, there also looks to be trouble on the back end of the cycle… on real estate loans.

If you look back at the 2008 Housing Bubble and subsequent market crash, you see a similar pattern to what’s happening today.

In 2008, the real estate loans rose, flatlined, and then spiked up as a result of the Fed’s new strategy to simply erase bad credit from the economy through Quantitative Easing (QE). You can observe this credit jump around October to November 2008, as illustrated below.

Then in 2023, we had some refinancing due to a domino effect of bank crashes when SVB went down.

Is credit likely to be available at the back end of the construction loan cycle? And what about refinancing this time around?

That is an easy answer when you see how much credit is available for the start of the cycle.

The solution is to make the credit available to keep the cycle going, and prevent massive increases in unemployment, but…

To what end?

Commercial real estate is finding less use due to new remote work policies, downsizing, and retail bankruptcy.

And individuals are already pulling from their retirement savings, increasing their credit card use, and working two jobs. Will credit be available for these people to buy homes?

The thing is, in an inflationary environment based on fiat currency, there is no end.

There is only more expansion until there is so much money in the system that your ability to price a product or service becomes impossible. And the currency becomes meaningless…

Eventually, the Fed will likely have no choice but to return to QE (or a similar strategy), as drops in employment numbers will highlight the scarcity of available credit.

Sign up to the DollarCollapse mailing list and receive the simplest, most actionable guide to contrarian investing Nobody Knows Anything, free.

Follow us on Twitter here, or like us on Facebook here.