Written by Dave Skarica:

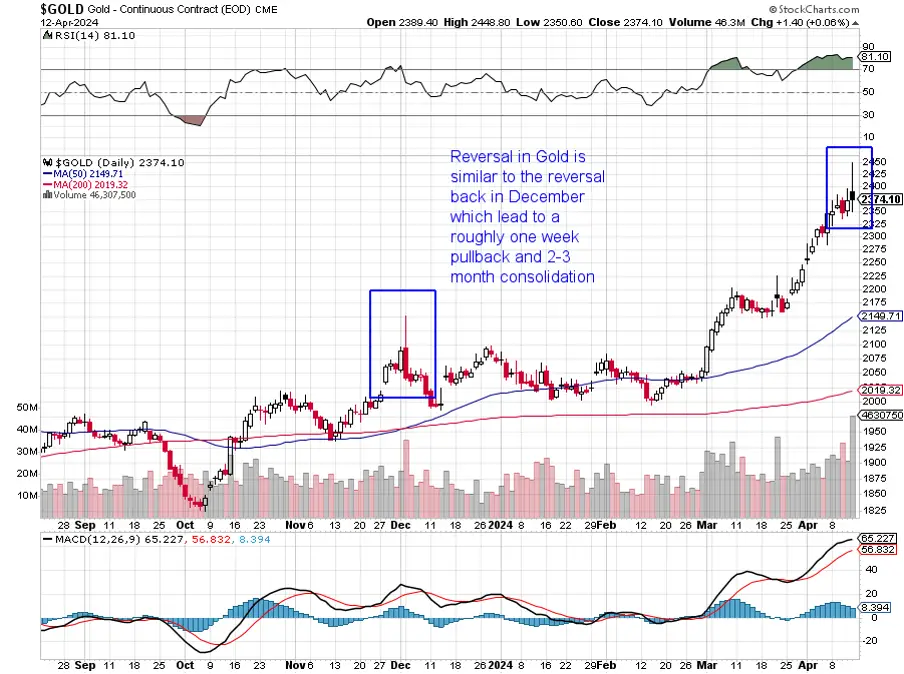

In this week’s stock chart we look at gold. Gold came out of the gates firing on Friday up nearly to $2400 an ounce. Despite strong jobs numbers and inflation numbers which suggest the Fed is no longer going to cut rates aggressively or even at all gold and silver have still been breaking out.

Why is this? I think it’s because as I have pointed out, 10s of trillions in debt are being rolled over this year and I think the precious metals market is anticipating there may be some sort of funding problems when this debt hits the market (eg it could push rates higher or the Fed may have to start to monetize the debt).

WIth that said Gold was going straight up over the past 6 weeks and a pullback is needed. I do not think this has to be a huge pullback.

As I write on the weekend Iran has attacked Israel which should give a bid to gold on Monday. However, we will see if this rally fades.