New Age monetary policy has begun to resemble the form of insanity in which a patient repeats the same behavior while expecting a different outcome.

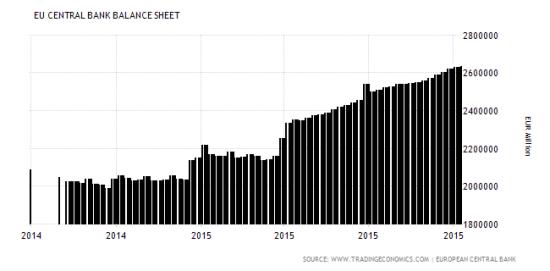

Throughout the developed world, interest rates are at record lows and central banks continue to pump out newly-created currency. Yet growth remains tepid, inflation is nonexistent and debt of every type continues to mount. And instead of recognizing that somewhere in their guiding theory lurks a fatal flaw, governments and central banks just keep upping the ante. Today it was Europe, where central banks have been expanding their balance sheets (i.e. running the printing presses) aggressively…

…and forcing down interest rates…

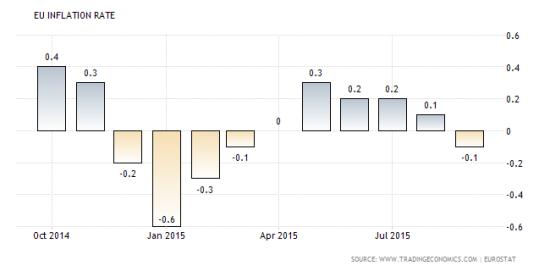

…to no avail. Europe’s inflation rate has been falling all year…

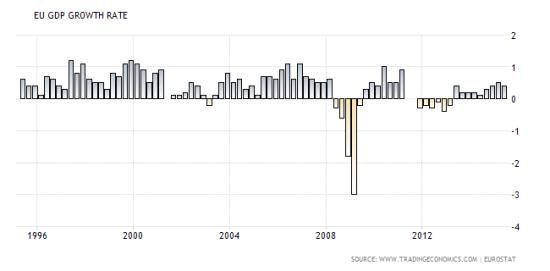

… and GDP growth remains below 1% annualized. That’s nowhere near fast enough to keep up with the accumulation of government debt and unfunded liabilities. The hole in which the EU found itself during the Great Recession keeps getting deeper despite ZIRP and QE.

So what does the European Central Bank do? It promises even easier money:

Mario Draghi: ECB prepared to cut interest rates and expand QE

(Guardian) – Mario Draghi, the president of the European Central Bank, has stunned markets by signalling that he is prepared to cut interest rates and step up quantitative easing to stave off the risk of a renewed economic slump in the eurozone.The value of the single currency dropped sharply on foreign exchanges on Thursday as Draghi announced that the ECB’s governing council had discussed expanding its €1.1tn (£795bn) bond-buying programme and cutting the rate on reserves held at the central bank.

This “discount rate” is already negative, at -0.2%, meaning banks effectively have to pay the ECB for holding their reserves – a measure aimed at keeping money flowing around the economy.

Speaking after the ECB’s latest policy meeting in Malta, Draghi revealed that some members of the governing council had favoured taking more action to stimulate the economy immediately. He blamed the slowdown in emerging markets, including China, for renewed weakness in the eurozone.

“While euro area domestic demand remains resilient, concerns over growth prospects in emerging markets and possible repercussions for the economy from developments in financial and commodity markets continue to signal downside risks to the outlook for growth and inflation,” he said in his opening statement.

Draghi said the ECB could also step up the scale of QE. A decision is likely to be made at the December meeting of its governing council, when its latest economic forecasts will be available. As Draghi spoke, the euro dropped by 1.5 cents against the dollar, to $1.117.

“The governing council is willing and able to act by using all the instruments available within its mandate, if warranted, in order to maintain an appropriate degree of monetary accommodation,” Draghi said.

The dollar spiked as the euro tanked, of course, adding to the headwinds that have caused a brutal corporate earnings season — and the emerging market/commodities complex turmoil Draghi blamed for tepid European growth. For those seeking QE’s fatal flaw, that would be a good place to start.

17 thoughts on "Europe Admits QE Has Failed, Promises More Of It"

There is a flaw in this report, inflation does NOT remain tepid. In this region (Oregon) inflation is now worse than it ever was during the Ford and Carter administrations and just because TPTB will not report it does not mean it is not there. It is running at LEAST at 15% and I would not be surprised to find it closer to 20% if properly measured and truthfully reported.

This means two things, first the monetary fire hosing IS creating inflation so that consumers are being saddled with the stealth tax of inflation to pay off all that gifting of wealth to the top 10%.

Second, using this as a more appropriate GDP deflator we see real growth in depression era rates. Most of us agree that while the Great Recession post 2008 bottomed out it was just a new lower plateau and we have not seen real growth (for 90% of us) since then. But, from there I believe we have started another plunge downward that is simply being hidden by rigged statistics.

What is wrong with these idiots….Lie….that is what our government does.

Negative interest rates and in reality negative Gdp in Europe. That’s astonishing. The U.S. is in the same boat. The only difference is the U.S. has a world class propaganda machine and military to back the toilet paper dollar. The world is hanging by lies.

Just think of it this way. If not for QE and other monetary shenanigans instituted by those crazy central banskters none of us would probably be here to lament its existence. The entire economy would have ended in the scrap heap and we’d be too busy planting next season’s turnips, or even worse.

Our kids may have to reinvent fire.

Let’s hope not 😉

I don’t believe that. I think that an ounce of cure back then, would have prevented the TON of cure that will have to be used now. That is if our economy is not terminal at this point, which is arguable. Besides…planting those turnips may have been a good thing. Get the welfare mooches off their butts or they starve under that circumstance.

If that were true they would not have broken every market, bent every rule and stifled all dissent. they could have left the system slip into a very bad recession, even a short depression, but they didn’t. The did “whatever it took” to prevent its collapse. Believe me, if the system breaks, and it can still break, it won’t be just the “moochers” working their arses off hoeing those fields or starve. You can bet on that.

Ok, you can believe that if it gives you any comfort. Besides, the biggest welfare mooches are in Wall Street and in the arms industry.

And the war on savers and sanity continues.

HOT DOG!! As soon as I saw the DOW sky rocket after more poor corporate earnings and forecasts came out I knew some central banker shot his wad. This time it was Draghi of the ECB. He’s been out of the limelight lately but now he’s back. I wish only the worst for Europe for they deserve it.

The problem is – among others – wage growth. It has been anemic. No meanigful wage growth means no meaningful pick up in demand.

and there won’t be any.

Git yer popcorn ladies and gentlemen….

Any day now Yellens’ gonna have a press release saying that the Feds’ going to QE4 ! She’ll say “I have no choice as the government will raise the debt ceiling” (whether we like it or not) and “they are going to have to counter the flood of euro and yen coming to our shore.” Here comes inflation!

Yep! Here comes hyper-inflation and depression.

Nothing like a bunch of pointy-headed academics in collusion with Wall Street and High Street banksters. Everything the touch they destroy. Coming soon to a country and neighborhood near you!