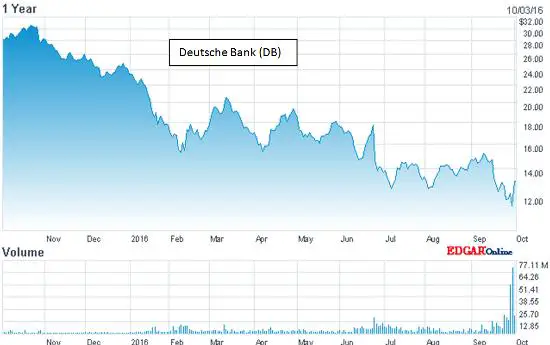

Deutsche Bank, Commerzbank, the Italian banks…it’s getting ugly across the pond, and the worst is yet to come. Here’s a brief look at the reasons why, including derivatives, ridiculous capital rules, dumb lending practices and, of course, negative interest rates. If you’re looking for short sale candidates, Europe’s banks should be on the list.

"We Track the Financial Collapse For You,

so You'll Thrive and Profit, In Spite of It... "

Fortunes will soon be made (and saved). Subscribe for free now. Get our vital, dispatches on gold, silver and sound-money delivered to your email inbox daily.

6 thoughts on "Podcast: European Banks In The Eye Of The Storm"

This is a really brilliantly simple podcast, I played it for my 14-year old and he seemed to understand most of it. BRAVO!! GREAT JOB !!! You must have worked very hard (or are outstanding) at defining terms a layman would not understand, about the only vague term was “balance sheet” or “book” for a bank.

I got paid $104000 in last 12 months by doing an on-line job from my house and I was able to do it by working part-time for 3+ hrs on daily basis. I’m using a business model I found online and I am excited that i was able to make so much extra income. It’s really beginner friendly and I’m just so grateful that i learned about it. Check out what I do… http://libr.ae/Oa3k

All people, everywhere, should prepare for the, severe, shortages that come with war and financial collapse. And, know, your politicians have turned against you, for money.