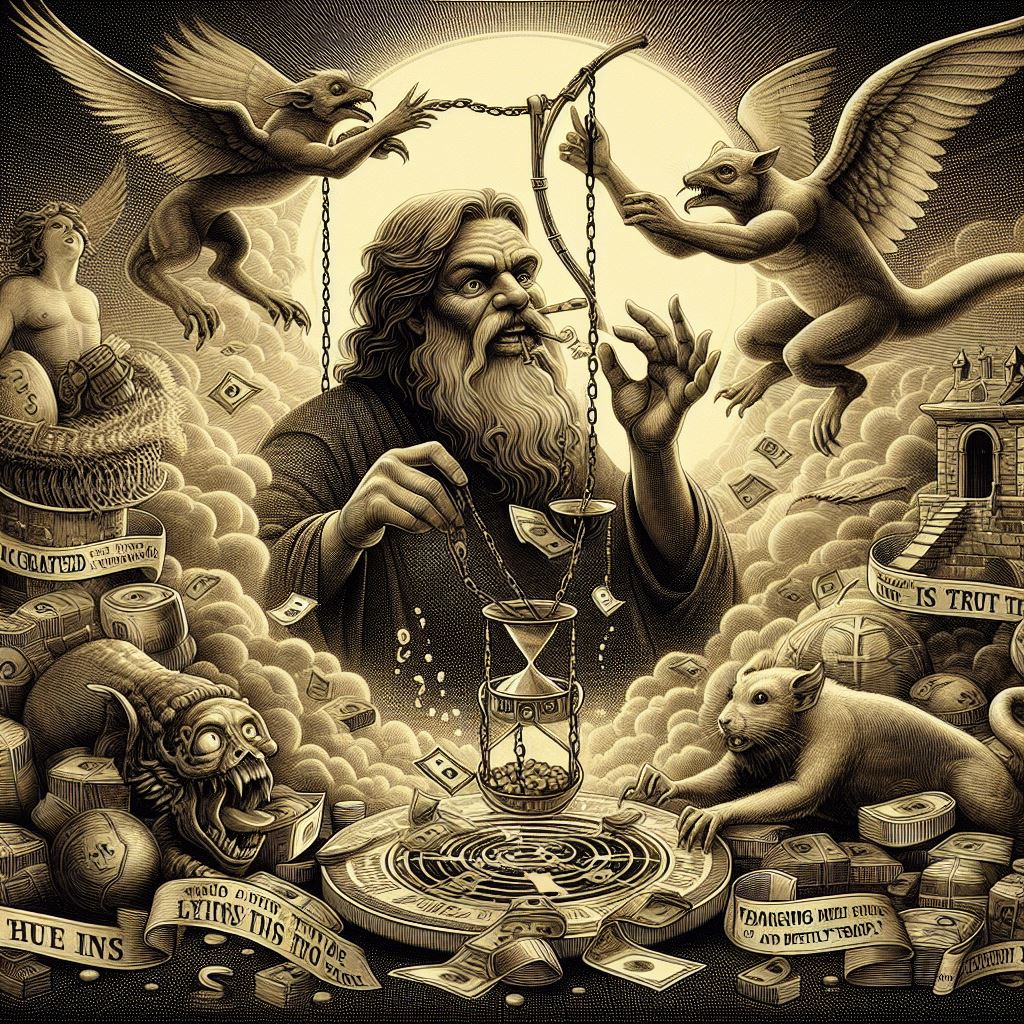

“Wealth created by a lying tongue is a vanishing mist and a deadly trap.”

~ Proverbs 21:6

Written by Bryan Lutz, Editor at Dollarcollapse.com:

Looking back, one of the best meme’s of the Biden Era probably isn’t “Let’s go Brandon.”

I’d say it was the stickers you started to see plastered on gas pumps every across the nation when gas prices went up.

The sticker was a picture of Biden smiling and pointing saying, “I did that.” – positioned to point at the price of gas.

Of course, gas prices were skyrocketing at the time from Biden’s new environmental policies, which made many American’s furious. Others, including Biden, in their self-righteous rage, blamed oil companies for high prices like the concept of supply and demand never mattered in the first place.

Well now…

Who will take credit for the coming bank failures of 2024?

There were five banks that failed last year due to rising interest rates, and bank’s over-leveraging themselves with commercial real estate, bad loans, and questionable bonds.

This year promises more bank failures for similar reasons…

Last year, five banks failed.

In 2010, over 150 banks failed.

In 1989, over 500 banks failed…

So what are we looking at this year?

Here’s a correlation to consider. Consider the correlation between government policies and the economic prosperity.

For example, the government’s willingness to take on new debt, print more money to execute its policies, and fund foreign wars.

In 1978, government debt was just above $789 Billion.

Now we’ve past $34T.

A slight increase, indeed.

As more fiat money entered the American economy, it had a real effect. Inflation started to run rampant in the 80s. And Paul Volcker, Federal Reserve Chairman at the time, fought against it with full force. He raised interest rates to record levels, causing mass unemployment, homes repo’d, and… bank failures.

Today, the current Federal Fund interest rate is at 5.5%.

Volcker raised interest rates to about four times that –> 20%.

Yet, we’re already starting to see bank failures at 5.5%.

And that means, five bank failures is just the beginning but it also means more debt is having a greater effect on the economy as a whole.

Here’s how that’s worked out for banks in the same time frame.

Since 1978, the number of FDIC insured banks has decreased. In an inverse relationship between the amount of government debt, fiat money circulating the economy, and the amount of bank failures.

More debt, more bank failures.

That is what fiat does…

So when you see more bank failures happen in the coming years you know what to say.

Fiat did that.

One thought on "Fiat Did That: Government Debt and Bank Failure’s Inverse Relationship"

$34 trillion is just the tip of iceberg. What about unfunded future liabilities. Some estimates say it could be as high as $200 trillion. What say you?