Written by Bryan Lutz, Editor at Dollarcollapse.com:

Ever since Nixon took the US Dollar off the gold standard in 1971, gold has acting accordingly. There are three relationships that traders, investors, and I suppose many gurus out there have been able to rely on to predict gold’s future pricing. Now, gold is breaking three of the most prominent indicators.

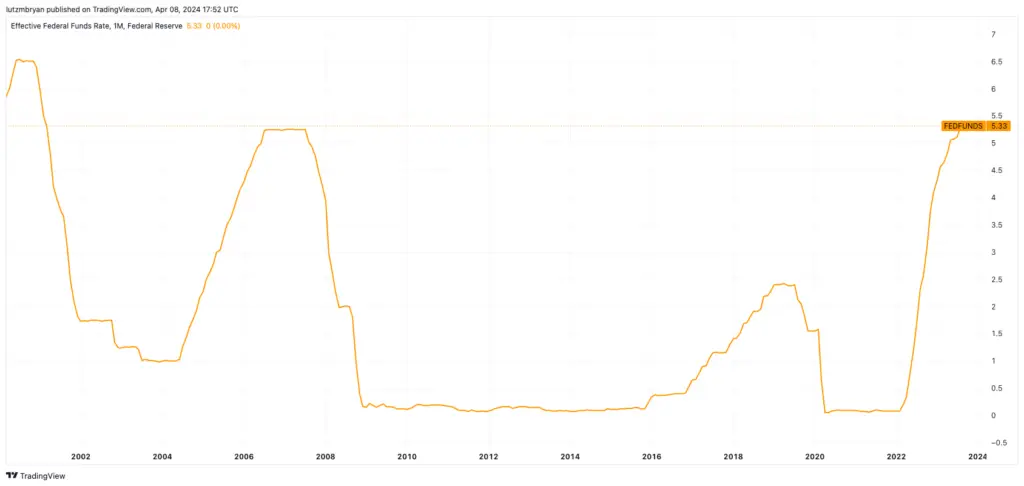

1. Federal Fund Interest Rates

When the Federal Reserve raises interest rates, it pushes the value of the US dollar up. The effect drives the price of gold down.

So there’s an inverse relationship between the price of gold and the Federal Fund Interest rates.

You can see how this works below:

Gold

Federal Fund Rates

From 2004 to 2007, interest rates rose, slowly flatlining the price of gold. Then when interest rates dropped, and were held at 0% for years, the price of gold went up.

Then again, when the interest rate dropped in 2019, you see the price of gold move from below $1200 to over $2000.

If you zoom into the early 2000’s, there are more examples, but that happens every time. Whenever the Fed lowers interest rates, gold rises relatively quickly.

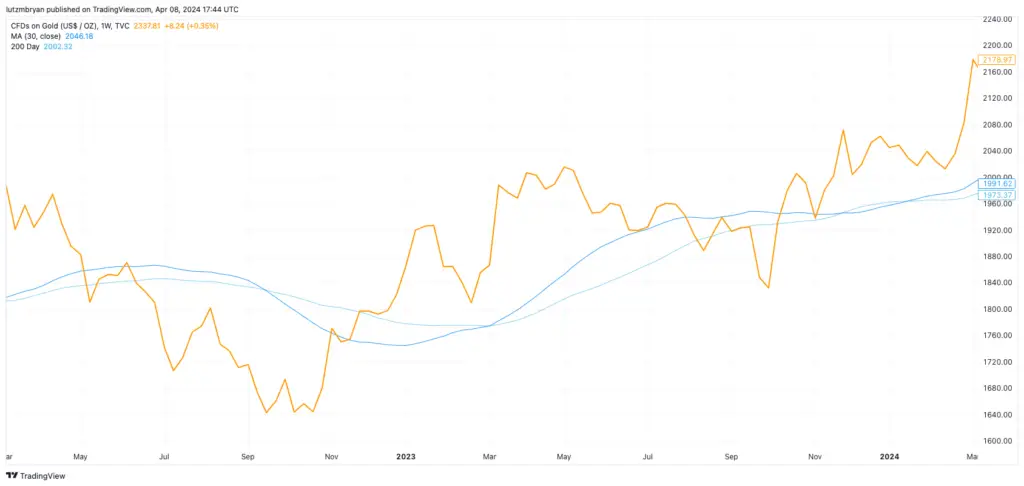

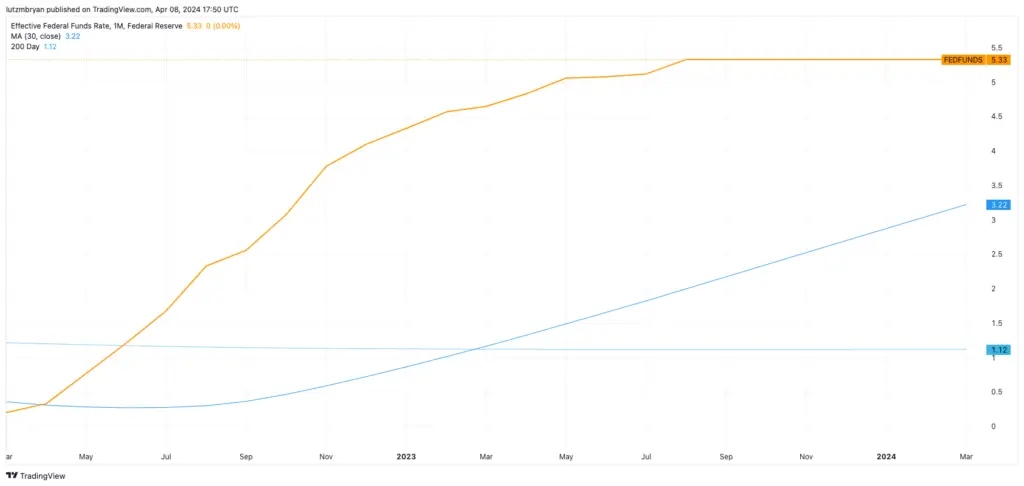

Except something is different today. In the past two months, gold has broken out past $2200 to almost $2300. Yet, there’s no change in Federal Fund interest rates.

Gold

Federal Fund Rates

2. Bond Yields

Here’s another example of how gold is breaking out and defying conventional behavior.

The conventional relationship between gold and the 10-year treasury bond is this:

When yields go up, gold goes down.

And that’s because there’s an opportunity cost to holding gold when a person can make more money from bonds. So people drop gold and go for yields…

Except not this year, ever since October of last year, 10-year treasury bond yields and gold have generally been rising together.

Gold

10-Year Treasury Bonds

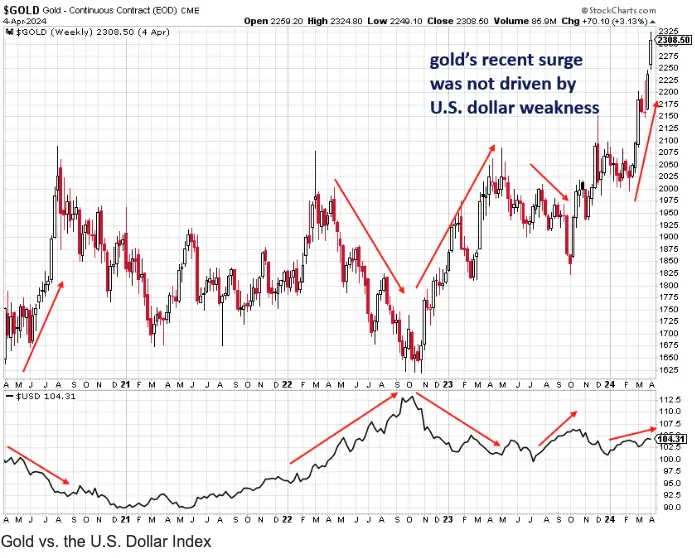

3. Dollar Strength

The last example, is the strength of the US Dollar. Gold and Treasury yields are both influenced by the US Dollar. When the dollar rises in value, it can make gold more expensive in other currencies, which reduces demand for gold lowering its price. Then a stronger dollar can also mean increased prices for US Bonds, lowering yields.

That being said, a strong dollar historically lowers the price of gold. Not since the beginning of March…

Since the start of March, the strength of the dollar slowly rose. Yet, the price of gold continues to make leaps and bounds.

(source: Jesse Colombo, BullionStar)

In conclusion, the recent behavior of gold prices, defying long-established correlations with Federal Fund interest rates, bond yields, and the strength of the US dollar, signals a significant shift in the financial landscape. These anomalies suggest that traditional indicators, once reliable predictors of gold’s movement, may no longer be as dependable in the current economic environment.

What do we have to thank for this?

1. America’s sovereign debt crisis.

2. A long history of the weaponization of the dollar leading to geopolitical tension.

3. The market is possibly over-speculating.

In any event, all three breaks in conventional behavior show the strength of gold in the market. And, that gold most likely has much higher to go.

Sign up to the DollarCollapse mailing list and receive the simplest, most actionable guide to contrarian investing Nobody Knows Anything, free.

Follow us on Twitter here, or like us on Facebook here.