Precious metals advocates have been warning for years that the time to load up on a safe haven asset is before it’s needed, because by the time it is obviously needed it won’t be available. That seemed a bit hyperbolic in a world of smoothly functioning markets and apparently infinite horizons of steady growth and diminishing risk.

But that world is gone and just as Jim Rickards, Peter Schiff et al predicted, everyone suddenly wants gold and silver coins. And no one can get them. The US Mint is out of silver eagles and the Royal Canadian Mint has temporarily ceased operations. Even the miners themselves are closing due to coronavirus concerns. Here’s what the US Mint’s silver eagle sales looked like before they ran out:

The result: Massive new demand hits flat to diminishing supply, resulting in shortages, delays, and soaring premiums. Prices in the gold and silver futures markets — where speculators who have no intention of actually taking delivery can shove prices around at will — are down dramatically, but in the physical market, where actual metal changes hands, a silver eagle might cost one third to one half more than the (paper) spot price. And supplies are still constrained at those higher prices.

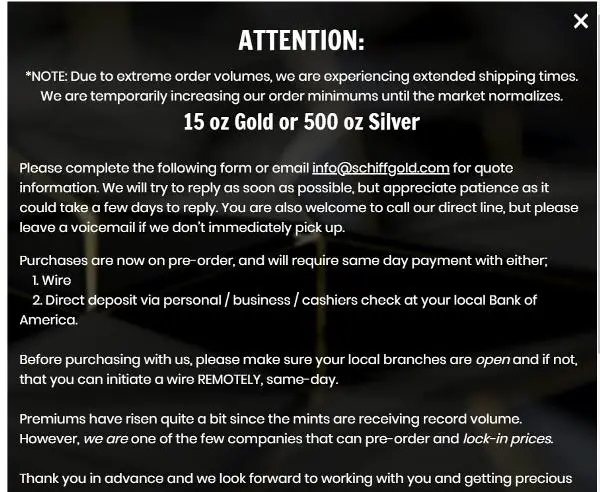

Here’s the disclaimer that comes up for visitors to the SchiffGold site:

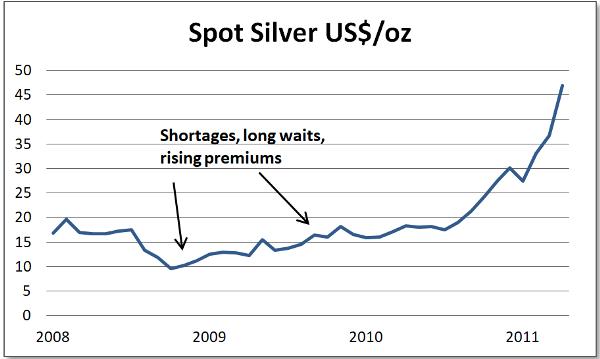

Something similar happened back in 2008, when precious metals prices tanked along with stocks in general, causing demand for gold and silver coins to soar, dealers and mints to run out of inventory and both premiums and wait times to jump. This was followed by an epic bull market in precious metals.

26 thoughts on "Get Your Gold And Silver Now Before They’re All Gone — Oops, Too Late"

“You can ignore reality, but you can’t ignore the consequences of ignoring reality.” – Ayn Rand

Bot some 2013 Perth year of the snake last week. Spot + $12

I literally just order a 2020 proof eagle last night from the Us mint. It’s on its way.

Don’t believe the BS

Silver is manipulated, and will not be allowed to rise. They print this garbage and metals sell themselves, sales tax plus over spot priçing then capital gains when you sell. You can make more money cutting grass….

They can manipulate the price for a very long time, but no one can suspend the rules of economics forever.

Let me share with you great on-line making money where you possibly can make upto 10,000 dollars once per month by doing work from your PC at home. Any kind of computer exclusive skills or even knowledge of programming language isn’t essential to do this internet based work, If you have general internet skills then you can definitely comfortably work on it. It can spare you loads of time in addition will get you good money simply by doing work for 4 to 5 hrs day to day.You can able to invest more valuable time with your loved ones and can go out for fabulous family tours with absolutely no job stress. Don’t waste time, go and check out this extremely good chance and bring happiness and joy in your life >>>>>>> url.rbuskirk.com/1zp9

I bought 500 oz of silver between $10-$12/per in 2009-2010 and sold it when it hit $49/oz in April 2011…. made a lot more money than “cutting grass” …… been buying more from 2018 to present day… going for 1000 oz this time….. one thing is for sure, it never is worth zero…

It was different then, sales tax, capital gains tax and under spot now.

LoL

Paper weights…

Buy bullets, the new gold.

Silver is a by product of gold mining now so it will not be worth squat….

That won’t happen again.

You bought it free from sales tax, capital gains and none manipulated. Hard to believe you got a sell off at the peak of it’s high when one is normally on hold for and hour to sell. Just saying….

True.

It is always reassuring to get the opinion of an expert in these matters.

It’s always reassuring to watch precious snowflakes melt when truth be told. It does not take an expert or even a millennial to see a ratio over 100 and not understand manipulation.

Put your helmet back on.

Don’t trip on the short bus.

Yes sir, rather interesting. “Spot price” is obviously meaningless now. There’s clearly very little silver to be had anywhere. Since receiving my last normal ASE shipment last week, the most reasonable price has been for random, used, South Korean rounds with some character on it for $24/round. There’s desperation in the air.

Monex had silver eagles at $16 and maples leafs at $15 on friday

No one has had any silver eagles for less than 21-25$. Looks like the days before the stock market crashed, panicked inflated buying. Toilet paper is the new currency. I had pulled 6 months of cash out months ago, that’s the next freak out, a run on the banks.

This will be bad for a few more weeks, really bad, and then there’ll be toilet paper and silver everywhere.

I just got word that silver and gold, remember gold?, will still be available, at a price.

Again monex has silver eagles for $16. How do i know? Because i work there. http://Www.monex.com. see for yourself

You cannot get delivery. Monex has to “hold it for you”

again. not true. its amazing how many assumptions people have are wrong. call 800-949-4653 ext. 2116 and see for yourself. 500oz minimum

When I bought gold from Monex years ago, I had to take a long drive into LA to pickup my metal at a Brinks office. After this experience, I would recommend buying PMs elsewhere.

Again not true. You can have delivered through USPS or UPS

I just checked on silver eagles and the ask price was $ 19.86 at Monex. Check it yourself.

Soon cash will be worth less than Charmin.

I just checked on silver eagles and the ask price was $ 19.86 at Monex.

It does now but not 6 days ago when i wrote the post. Early bird gets the worm.

Also the bid is just a $1 below the ask. So we will buy them near $19 if you want to profit off the premiums right now.

Are they available now? Post a link I need to get some