The early stages of a housing bubble are fun for pretty much everyone. Homeowners see their equity start to rise and feel smart for having bought, home seekers have to pay up, but not too much, and fully expect their new home to keep appreciating. People with modest incomes feel a bit of pinch but can still afford to stick around.

But later on the bad starts to outweigh the good. Existing homeowners still enjoy the ride but would-be buyers find themselves priced out of their top-choice neighborhoods. And residents who aren’t tech millionaires find that they can no longer afford to live where they work. Consider the plight of a teacher or cop pretty much anywhere in California these days:

Housing prices drive Davis teachers out of town. Legislators could give them a break from parcel taxes.

Drew Barclay has a master’s degree in education and three years of experience as an English teacher, but, like most new teachers in Davis, he can’t afford to live there.

Instead, Barclay, 31, shares a rental in Sacramento that costs him $950 a month — about 40 percent of the $2,550 he brings home each month after taxes.

He is so certain that he won’t be able to qualify for a loan for a home in Davis on his $47,000 annual salary that he hasn’t bothered to house hunt. The median price for a house in the city in March was $682,500, according to tracking firm CoreLogic. Renting also is prohibitive, with the average rent in Davis about $2,500 a month, according to Zillow, a real estate website.

Davis Joint Unified officials hope to get a little help from state legislators. Last week, the state Senate voted 24-8 to waive the annual school district parcel tax of $620 for teachers and other employees of the Yolo County school district.

Davis school board member Alan Fernandes said that about two-thirds of the district’s teachers live outside Davis where housing is less expensive. He said the bill would encourage more of the district’s teachers to live in the community they serve.

Davis Joint Unified regularly passes parcel taxes to keep class sizes down and to support classroom programs. In 2016, 71 percent of Davis voters approved Measure H, a yearly tax of $620 on each parcel of taxable real property in the district for eight years. The measure raises $9.5 million a year to support math, reading and science programs and reduced class sizes for elementary grades.

But the roughly $50 a month exemption isn’t likely to help Davis Joint Unified teachers enough to make buying a house affordable. The teachers are some of the lowest-paid educators in the region, with some of the highest health care costs.

Barclay said he knows teachers 10 or 15 years older than he is who are renting rooms in other educators’ homes to get by. He said some teachers have weekend jobs to make enough money to pay their bills.

“Because I’m fairly certain I can’t put down permanent roots here, I don’t see this position as a permanent one,” Barclay said of his job as an English teacher at Davis Senior High School.

California school districts have responded by offering signing bonuses, housing stipends, computers and free tuition to educators who sign up with their districts.

When housing costs reach this point there’s no real fix. Raise taxes to increase teacher pay and there’s political trouble. Cut back on other services and the quality of life declines. “Streamline” the schools and educational outcomes and teacher morale plummets.

There’s a limit, in other words, to the ascent of home prices beyond which the system starts to break down. And when the people who make a town run smoothly – teachers, firefighters, cops, sanitation workers – can no longer afford to live there, that town has clearly crossed the line.

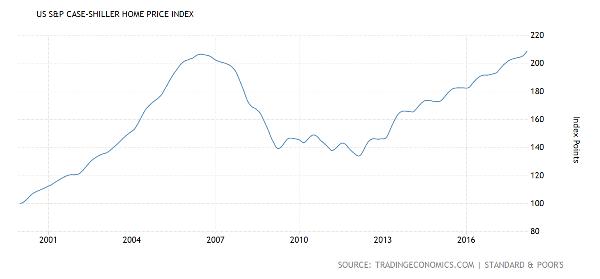

Based on the Case-Shiller home price index, which is now back to its 2007 housing bubble peak, there are a lot more Davis, CAs out there, with all the pathologies that that implies.

A housing bubble, of course, is just a symptom of a bigger problem. Easy money distorts the workings of a market economy by causing the prices of many assets to soar beyond all reason, enriching the owners and impoverishing the users. Typically, when housing reaches this point so have stocks and other financial assets, CEO salaries, corporate concentration, political corruption and a long list of other evils that feed on low interest rates and lax lending standards. The confluence of resulting problems then brings the cycle to a noisy end.

Housing says we’re getting close.

8 thoughts on "Housing Bubble Pathologies Start to Bite – Yet Another Sign the Cycle Has Peaked"

The market is insane and full of greed and stupidity right now. Below is a very small home in Monterey, Ca that is selling for $659K, just over $1000 per square foot!!! Beyond insanity. The rents here are going up to the stratosphere. And landlords are getting greedy and asking exorbitant rents for their properties. I feel it’s coming to a breaking point. Most decent homes in this area are selling for $800k or more….that makes for one massive payment. I recently saw a studio apartment (450 sq. ft.) renting for $1700 per month….a few years ago that was a house payment. It can’t go on much longer.

https://www.zillow.com/homedetails/1246-Prescott-Ave-Monterey-CA-93940/19308532_zpid/?fromHomePage=true

its pure insanity and yes fueled only by very cheap rates and little money down the fed and politicians who are controlled by WALL ST have destroyed this country with a society of dept and outrageous price increases on everything. Purely unsustainable and it will effect all of us when day of reckoning arrives

Maybe there is also a housing shortage and it’s not just financial games that are driving this market higher.

Fearing the top was in I sold last year. Woo Hoo!