The conventional view of inflation is that it’s not only low, but dangerously low and in need of aggressive stimulus.

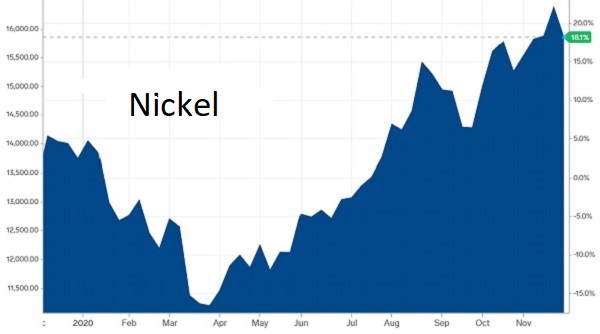

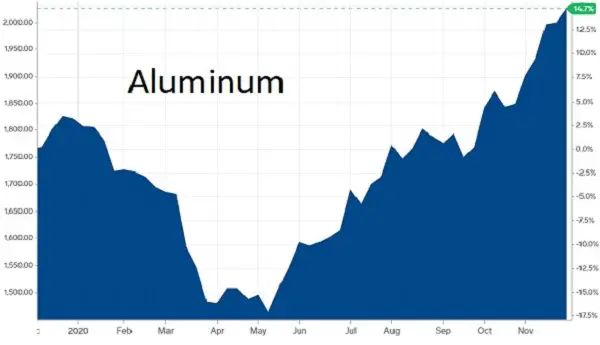

But that view is increasingly hard to defend, given all the things that are soaring in price. Consider:

The above charts are for industrial commodities that, while not something individual consumers tend to buy (and therefore not part of the official “cost of living”) do affect the price of consumer goods. When they go up, so eventually do the prices of cars, TVs and buildings.

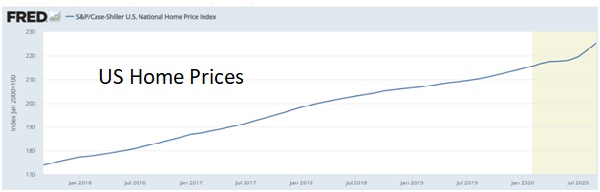

Speaking of buildings, the next chart shows US home prices – which have been rising steadily since the bottom of the last recession – steepening this year. Note the upward inflection at the far-right. Home prices are now higher than they were during the previous decade’s housing bubble, and they’re accelerating.

And last but not least, the US dollar – whose rate of decline is the official definition of inflation – has begun to fall versus not just real things but even against the other crappy fiat currencies.

Add it all up and today’s world has emphatically stopped looking deflationary or even disinflationary. Price increases are now wide-spread, and it’s just a matter of time before people start to notice and act accordingly.

25 thoughts on "Inflation Is Back, Big-Time"