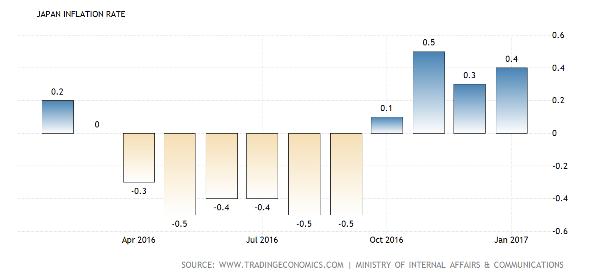

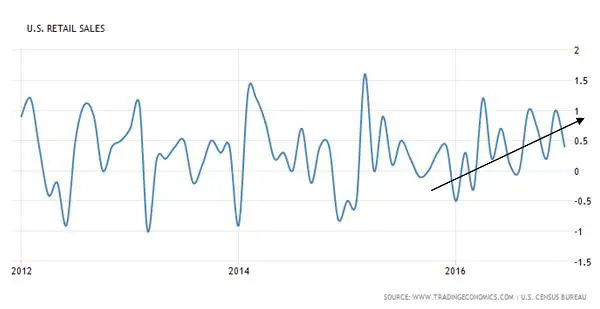

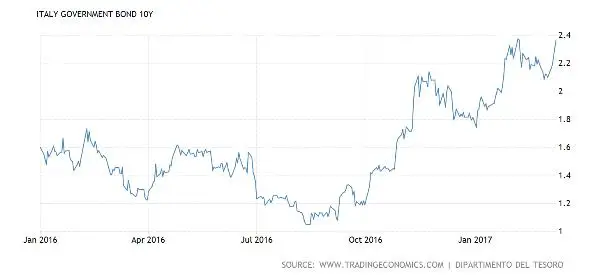

Inflation is back, thanks to the past few years’ exuberant borrowing and currency creation. Meanwhile, populist politicians are gaining traction in Europe, threatening both the European Union and the eurozone.

The world has never seen this combination of excessive financial leverage and widespread political upheaval, so expect the next few years to be bad for most “risk-on” financial assets and great for safe havens like gold and silver.

8 thoughts on "Podcast: Inflation + Populism = Soaring Gold"

Counter argument to debts are unsustainable because an interest rate hike would loose al tax income to interest payments would be: Governments never pay an interest rate, as long as central banks monetize all debts, Because the interest they receive on their bunds is given back to the treasury. So the effective interest rate for government under monetisation is 0.

Bullion banks manipulation = Plunging gold price