A couple of decades ago, when the post-war baby boom generation was in its prime earning and tax-paying years, governments had a chance to guarantee the survival of their financial systems.

But they blew it. Instead of controlling spending, running surpluses and banking the proceeds against the inevitable retirement of millions of boomers, most chose other priorities, whether military, social or (in the US case) both guns and butter. The result, in virtually every developed economy, is pretty much the same: Massive debts and little spare cash heading into the demographic tsunami.

Now there’s no mathematically feasible way to slow down spending and borrowing, since retiree health care costs will eat any conceivable fix and still be hungry.

Japan, with the world’s oldest population – and not coincidentally the most indebted government relative to GDP – is leading the stampede towards the cliff:

Japan’s Fiscal Discipline Wavers as Aging Pressure Mounts

(Bloomberg) – Japan looks set to surrender one of its most effective tools for curbing social spending as aging pushes up health, pension and eldercare costs.

Key advisers to the finance ministry recently dropped a recommendation to cap annual increases in social spending at 500 billion yen ($4.6 billion), suggesting instead that limits be calibrated with aging costs, without offering details.

They also favored a five-year delay in the government’s target for achieving a surplus in the primary balance, a move that won support from advisers to Prime Minister Shinzo Abe this week.

With the government’s mid-term economic policy plan to be released later this month, here’s a look at key metrics in Japan’s battle to get its finances in order. They show economic growth has boosted tax receipts and narrowed the deficit, but that government debt is still piling up.

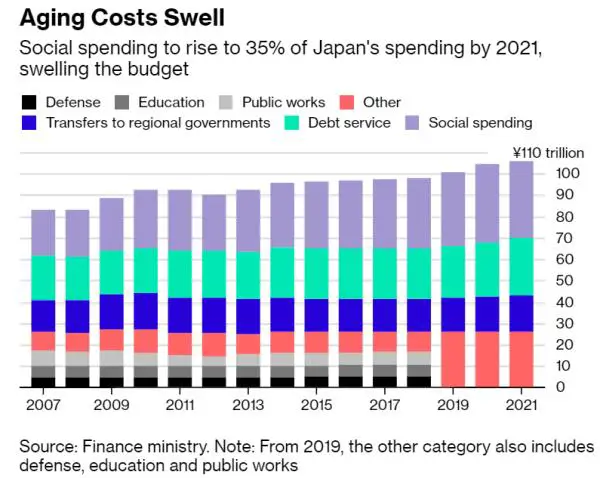

Aging Costs Swell

While social spending is the main driver of Japan’s swelling budgets, and public outlays have increased every year since Abe came to power in late 2012, the 500 billion yen cap has been a success. Social spending in the current fiscal year that started April 1 is projected to rise by the same amount as the cap, to 32.97 trillion yen. Economists including Mizuho Research Institute’s Akihiko Noda are concerned that removal of the cap could see spending accelerate at a time when Japan should be adopting a stricter limits.Prolonged Primary Deficit

Getting a surplus in the primary balance, which measures the government’s fiscal position excluding interest payments on its borrowings, has been a key target in tackling Japan’s debt problem. Pushing back the ambitious goal from 2020 to 2025 is another sign that Japan is a long way from getting on top of the debt problem.

There’s a chart in the above article that deserves to be taken out and analyzed separately, so its full absurdity can sink in. Breaking out the components of Japan’s government budget, it shows that the combination of social spending and interest already dwarfs everything else. But notice what happens in the projections through 2021. Social spending – what old people have been promised – rises as it obviously has to, while interest costs barely increase, despite the fact that ongoing deficits will grow the overall debt load dramatically. The people making these projections apparently think that interest rates will not only not rise but might actually fall from the currently zero-ish range they now inhabit.

Bloomberg gets why this is, um, risky:

The central bank’s massive monetary stimulus has saved the government about $45 billion in borrowing costs since Governor Haruhiko Kuroda took the helm at the BOJ in 2013. If inflation eventually picks up and the BOJ looks to exit its current policy, rates would rise, making it much more costly for the government to service bonds it sells in the future and possibly blowing out the debt-to-GDP ratio. The BOJ could then feel pressure to keep interest rates low to make sure the government’s debt servicing costs are manageable, according to Bloomberg Economics’ Yuki Masujima.

In other words, a time is coming when Japan will feel pressure – either from rising inflation or a weakening currency or both – to let interest rates move back to historically normal levels. But this will blow up the budget, making higher rates politically and financially impossible.

The result: a currency death spiral in which the yen plummets while the government continues to create new credit, with no end in sight. And a perfect illustration of where the rest of us are headed.

Also see There’s a number that ends this cycle, but what is it? and Here’s when everyone should have known Argentina would implode.

9 thoughts on "Japan Shows Why — And How — All Fiat Currencies Are Doomed"

Japan is already broke. For example, JGB interest accounts for over 40% of her tax revenue.

Nevertheless Japanese government can keep on going because BOJ provides limitless money. The reason why Yen does’nt fall is U.S. treasury is bolstering it to keep U.S. influence on Japan. That is to say, politics. So it would be dollar- yen collapse simultaneously.

It all going digital, save your Pennies for the #SnapChange

Why does anyone outside Japan except the Yen at this point? The emperor has NO CLOTHES, there I said it. Seems the world must live in this financial fantasy land or we are dead.

Japanese economy system is different from Western one. It is a kind of socialism. Taro Aso is the finance minister well known as an advocate of Nazis type economy model. That is: Government can spend limitless monney when it holds it’s own central bank, Bank of Japan. That is to say, an ouroboros economy which is destined to terminate itself. Every thing depends on whether people doing business with Japan will be aware of the fiction or not. When they would, Yen should go down the cliff.

What about MMT? Debt and Deficits don’t matter per se. Print more money contrary to traditional and historical thinking. The idea seems to be propagating among an ever growing number of economists….Is it all a bunch of nonsense and accounting shenanigans? Throw the baby out with the bathwater and start over.

If MMT was effective communism would have worked.

The USSR could have simply printed money until industrial production grew large enough to support the population. But history has proven 1000 times that economies don’t work that way.

Put simply if MMT worked any stupid government plan would be effective. Governments could simply print until the economy was strong.

Jim Rickard;s book: “The Road to Ruin” is worth reading for answers to your questions here. I think MMT is a failed construct/policy and Jim’s book gives a great deal of evidence to prove this assertion – too much to comment on here. My book also puts the Austrian school of economics to the fore: Sound money, Free markets and Small (limited) governments. We are working in UK here: http://harrogateagenda.org.uk/

We are but a small band of enthusiasts but growing more as times become tougher and people become more aware of the fraud and corruption rife in the American dominated global financial system. My book is being serialised each week here:

https://www.theburningplatform.com/2018/06/02/the-financial-jigsaw-issue-no-3/#comment-1632166 . You might find some answers also by following each week.

Start over ? Use gold and silver as currency/money again ?