Guest Post by John Rubino originally posted on his substack:

Remember that imminent commercial real estate bust? It seems to have started.

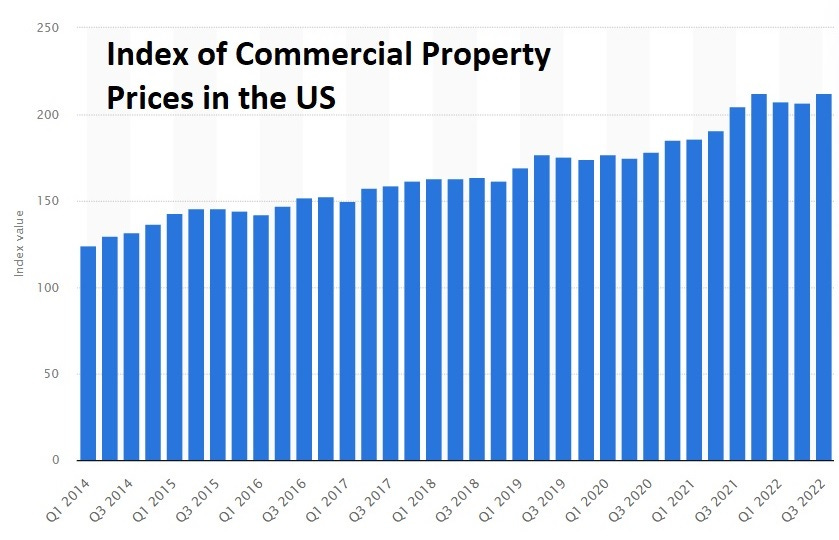

Beginning with a little background, the second half of the 2010s was a great time for massive buildings that could be financed for next to nothing and filled with pre-pandemic workers who still thought a “job” meant commuting to an office every day. The average price for a piece of commercial real estate rose by about 70% between 2014 and 2021.

Then inflation spiked, interest rates followed, and people who had worked from home during the pandemic demanded to keep doing so. Older office buildings emptied out and refinancing became crazy expensive.

Here’s a snippet from a much longer and more detailed look (from Wolf Richter’s Wolf Street site) at the losses that are now being realized on office building sales:

Union Bank is trying to sell its headquarters tower at 350 California, and lease back a portion of it. The tower was originally listed for sale last year at $250 million. Union Bank then pulled the listing and relisted it in February for 52% off, at $120 million.

And Wells Fargo tried to sell its 550 California tower in 2022 for $160 million. It pulled the listing and will try again in 2023. This time, it may be marketing the tower at a discount of 67% off the original listing price, shooting for around $53 million, according to the San Francisco Business Times.

At this point, no one knows what anything is worth. There have been no transactions since the free money era ended. But given the price cuts by Wells Fargo (-67%) and Union Bank (-52%) on their towers, a sense of reality appears to be settling in.

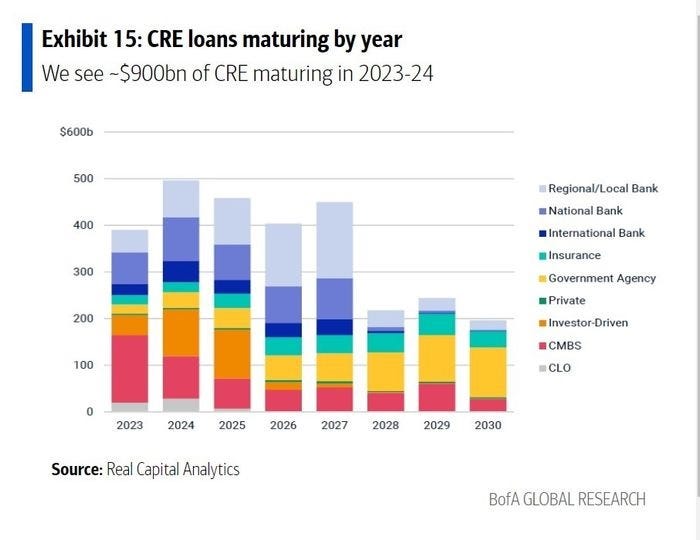

There are three reasons why losses of this magnitude will soon become the norm. First, there’s a ton of debt coming due on commercial real estate:

Second, the securitization of commercial real estate paper has ground to a halt. US commercial mortgage-backed security (CMBS) issuance totaled just $5.98 billion in Q1, a 79% decline from the $29.01 billion record in Q1 2022. You have to go back to 2012 to find a lower number. In other words, buildings aren’t selling and bonds aren’t being created to lubricate the financial machine.

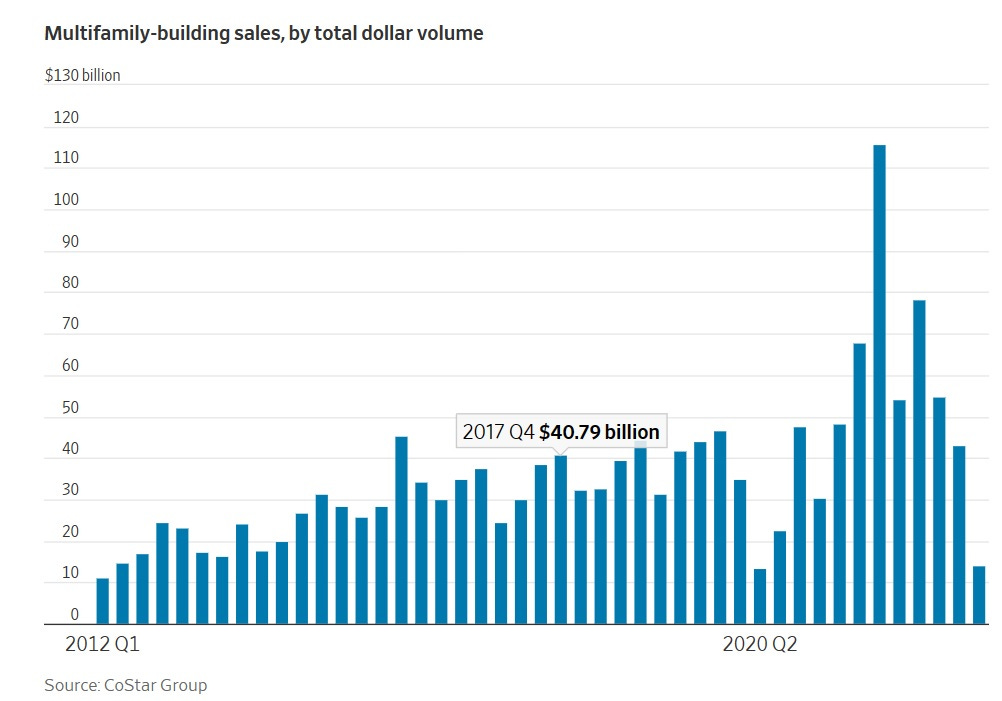

Third, it’s not just office buildings that are overbuilt, overleveraged, and about to plunge. Apartments, the brightest stars in commercial real estate during the just-ended housing bubble, have seen rents plateau, making multi-family housing way less profitable than expected. Sales of apartment buildings, as a result, are drying up:

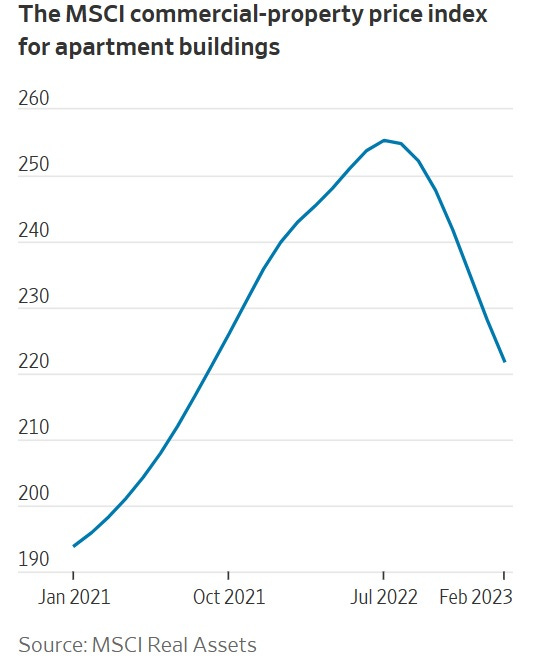

When no one wants to buy, sellers generally have to lower their prices, and that’s actually been happening since last summer:

Now this combination of below-plan apartment cash flow and falling sale prices is about to collide with aggressive refinancing schedules. The result? From the Wall Street Journal:

But there is one type of sale most everyone expects more of: forced sales. A number of investors bought buildings in recent years with short-term, floating-rate debt. Because of rising interest rates, those loans cost a lot more to pay down than they did when building owners first borrowed the money.

The remaining balance of many floating-rate loans will come due this year, and borrowers whose buildings aren’t bringing in enough cash every month might have to sell their buildings to pay off their debts.

There’s no obvious way to avoid the coming bust. If interest rates stay high, debts can’t be refinanced. If rates fall, it will be because some big part of the economy has broken, in which case office buildings and apartment complexes will see their customer bases shrink disastrously. Either way, the future holds a surge in the previously mentioned “forced sales” at prices that will erase a big part of the industry and force some kind of government bailout.

Guest Post by John Rubino originally posted on his substack.