Incrementum, creator of the epic annual In Gold We Trust chart-fest, just posted its monthly Gold Compass update. As usual, the charts tell an interesting story:

Let’s start with the fact that no “strong” fiat currencies are left out there. All are evaporating when measured against real money, just at different rates (though the yen is clearly one to watch in the short term):

For those who see the recent stock market rally as an all-clear buy signal, consider Warren Buffett’s favorite metric: total equity market value versus the size of the economy. By that measure, this is emphatically not the time to be loading up on Big Tech stocks:

If stocks are overvalued, what’s cheap these days? Commodities, for sure. The Goldman Sachs Commodities Index is the cheapest versus the S&P 500 since the beginning of the fiat currency experiment:

Within the commodities space, what’s especially cheap? Gold, for one thing. As the market value of equities has expanded, the total value of the world’s gold has risen a lot less:

Incrementum has a model that assigns probabilities to future gold prices. It currently shows a 75% chance of $3,000+ by 2030:

What’s even cheaper than gold? Gold mining stocks. The GDX gold miner ETF has been declining versus the underlying metal since early 2000 and is now close to its decade lows:

Same thing for the silver miners. The SIL silver miner ETF is down by half versus the underlying metal since 2014:

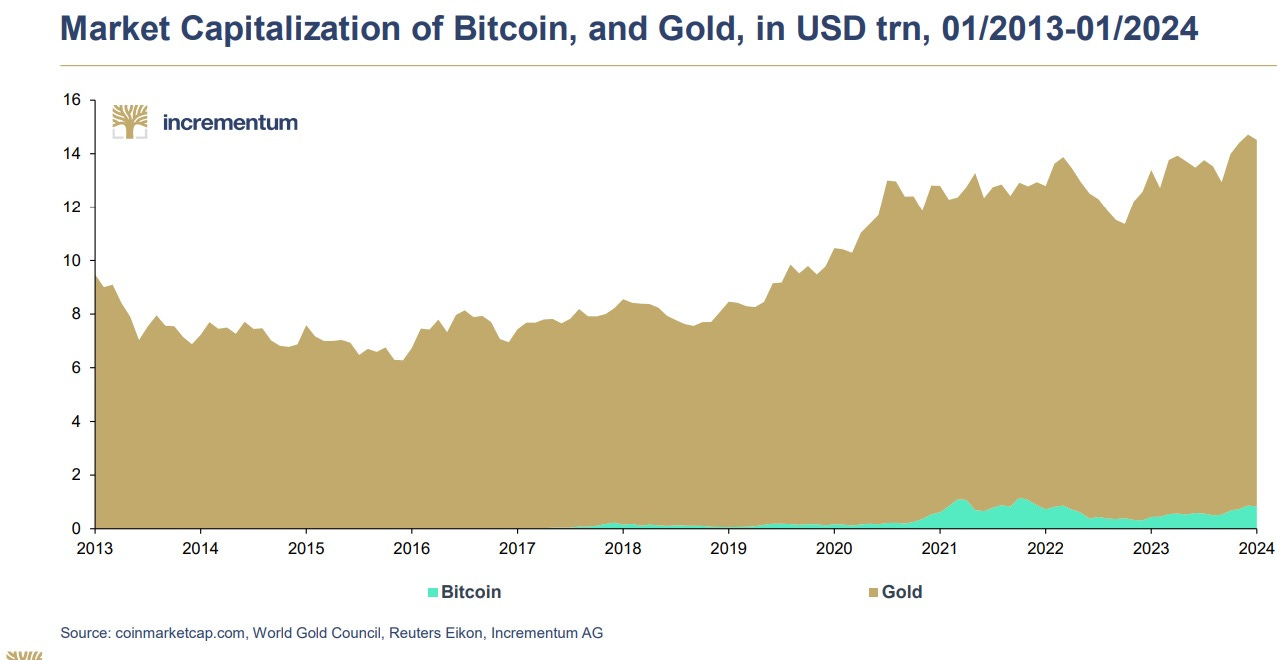

The next chart compares gold’s market cap to Bitcoin’s. That the world’s gold is maybe 15 times as valuable as its bitcoin might surprise a lot of people who, given the amount of press cryptos receive, probably think Bitcoin is a lot bigger.

Two possible implications: 1) Bitcoin is way less important than it seems, or 2) It has a lot further to run as it takes its place alongside gold at the center of the post-fiat currency monetary system. We’ll just have to see how that plays out.