There are several ways to build and then sell a junior precious metals miner. One is to find and delineate a deposit that’s instantly ready to contribute to an acquiring company’s bottom line. See Great Bear Resources.

Another strategy is to just go out and find ounces. Don’t worry about whether those ounces are economic at current prices. Trust that in the world to come – which is highly likely to feature much higher gold/silver prices and franticly acquisitive established miners – today’s uneconomic deposits will eventually be worth acquiring. Especially if those deposits are huge.

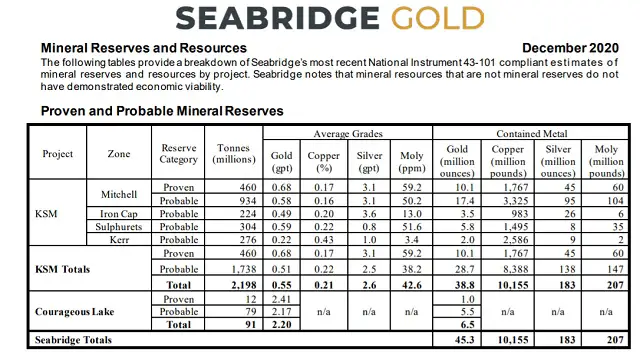

That’s what Seabridge Gold has been doing for the past 15 or so years, with notable success. In its five North American properties (note the politically stable location, also a big selling point), it now has 70+ million ounces of proven, probable, and inferred gold, plus a lot of copper and silver. And it’s still finding more.

Those reserves work out to around one gold-equivalent ounce per share of stock outstanding. The current stock price? US$18.

To put this in perspective, today a viable junior miner might have one million ounces of gold, while a potential tier-one deposit like Great Bear’s might hold 10 million ounces. So Seabridge is off the charts big by comparison.

The tricky part is of course that its ounces are relatively high-cost, which makes them valuable only if gold keeps rising. So here’s the scenario in which Seabridge gets taken out at a massive premium:

Debt continues to soar worldwide, forcing governments to run their printing presses flat-out, which in turn leads to higher inflation and ever-greater financial instability. Major currencies lose creditably and plunge (i.e., inflation spikes in a disorderly, scary way) while gold and silver — competing forms of money that can’t be inflated away — soar.

In that environment, two things happen. First, previously uneconomic gold and silver deposits become viable and are revalued accordingly. Second, steeply rising metals prices make it easy to extrapolate even higher prices down the road, which in turn makes it easy for a Newmont or Barrick to justify a stratospheric take-out premium for a giant bundle of ounces like Seabridge. One transaction and Newmont’s anxiety over its future reserves disappears for a generation.

Put another way, a miner with Seabridge’s strategy is an option on higher gold prices. If gold goes up by X, Seabridge stock should rise by 3X. Or 5X. Whatever, some big multiple.

For more information on Seabridge:

Corporate presentation

Fact sheet

Recent financials

Live webinar Thursday August 5

Full disclosure: DollarCollapse staffers own shares in this and most of the other stocks mentioned in the “Who’s Next” series.

——————————–

Is the Worst to Come? 28-Page Paper Says…

We are in the midst of an unprecedented, speculative bubble, which inevitably leads to an equally unprecedented collapse. Even though the Dow keeps climbing, real estate values are hitting all-time highs… and things “seem” normal… they’re not. It’s all outlined in this 28-page paper, and its impact on your money is unlike anything we’ve seen in our lifetimes. I tell you all about it in this presentation.

7 thoughts on "Junior Gold Miner Takeover Candidates — Seabridge"