Excerpted from Katusa Research:

These days, silverbugs have every reason to shout from the rooftops.

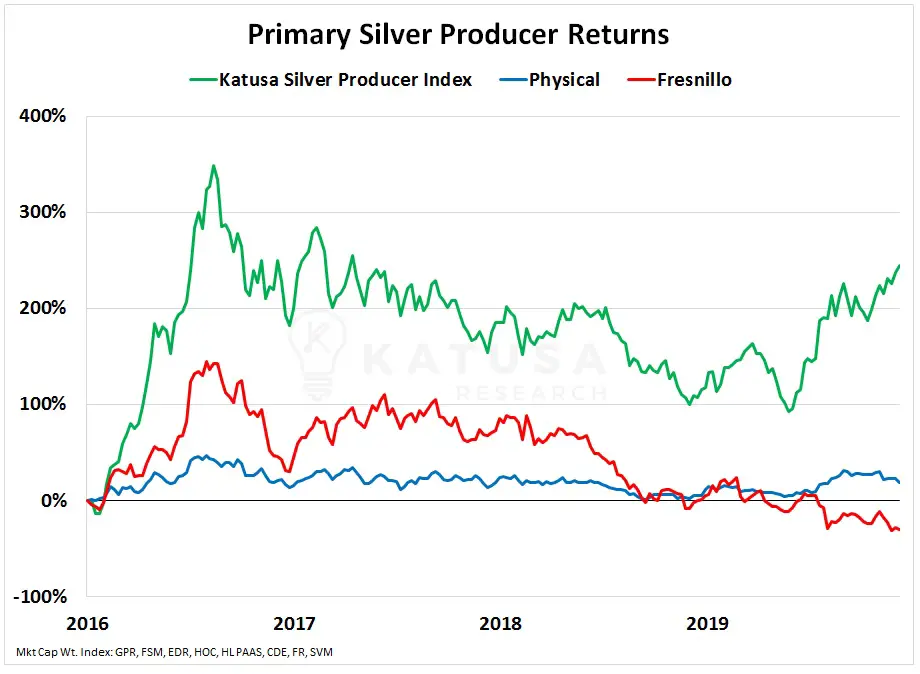

Even with spot silver trading mostly rangebound, many silver stocks are at or near levels not seen in 3 years.

Volume is picking up, momentum is picking up and the top silver companies have performed very well in 2019.

So, what can we expect if this is just the early innings of a massive silver run?

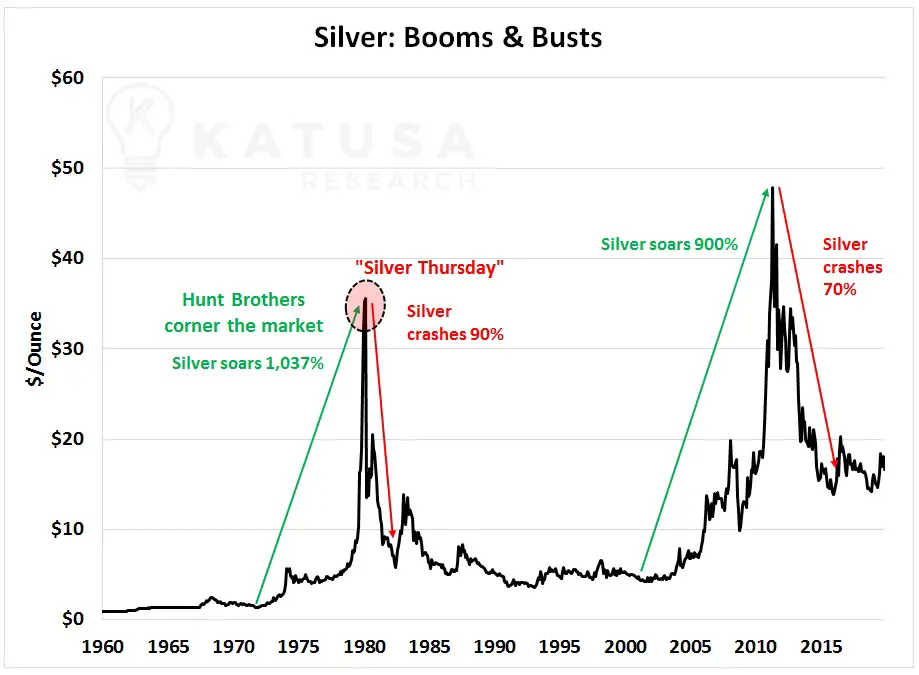

Silver’s Mighty Booms and Busts

Below is a chart which shows the epic booms and busts in silver over the decades.

Silver had a second spectacular rise before and during the global financial crisis in 2008. From 2000 to 2010 the price of silver climbed over 900%, well surpassing gold’s performance of 600% over the same time frame.

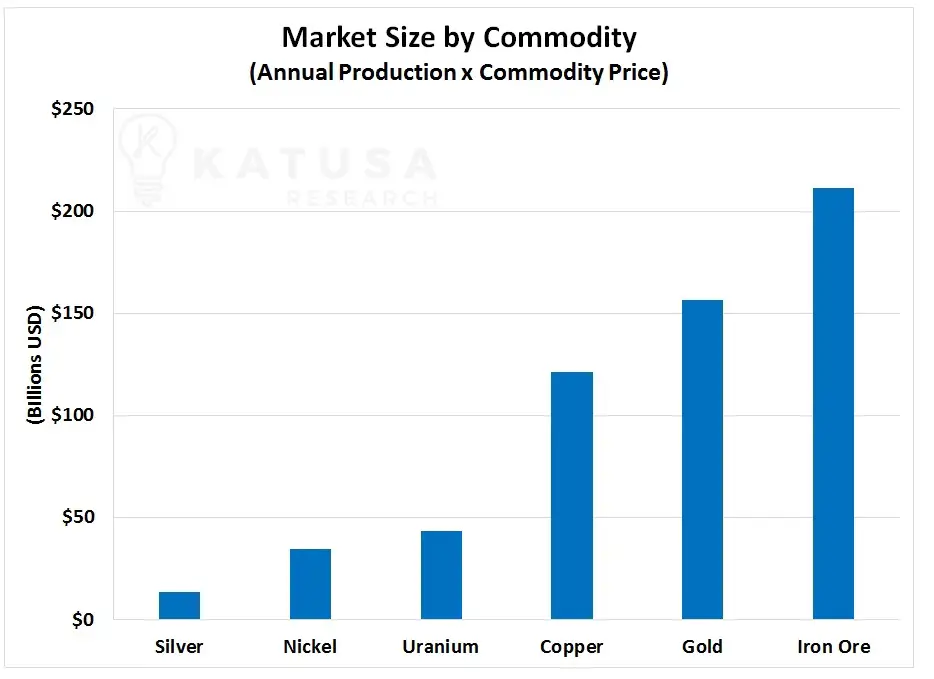

Just How Big is the Silver Market?

Many investors may be unaware, but the silver market is quite small.

Last year, 840 million ounces of silver were produced worldwide. Using a silver price of $16 per ounce, this makes it a $13 billion dollar a year industry.

For comparison, last year 108 million ounces of gold were produced. At a gold price of $1,400 per ounce, that represents $156 billion worth of value. That’s 11 times the size of the silver market.

To truly show a commodity comparison, we can make things visual.

Below is a chart showing the annual market value of mainstream commodities.

These days it’s getting harder and harder to find good silver deals. There just aren’t that many legitimate new projects.

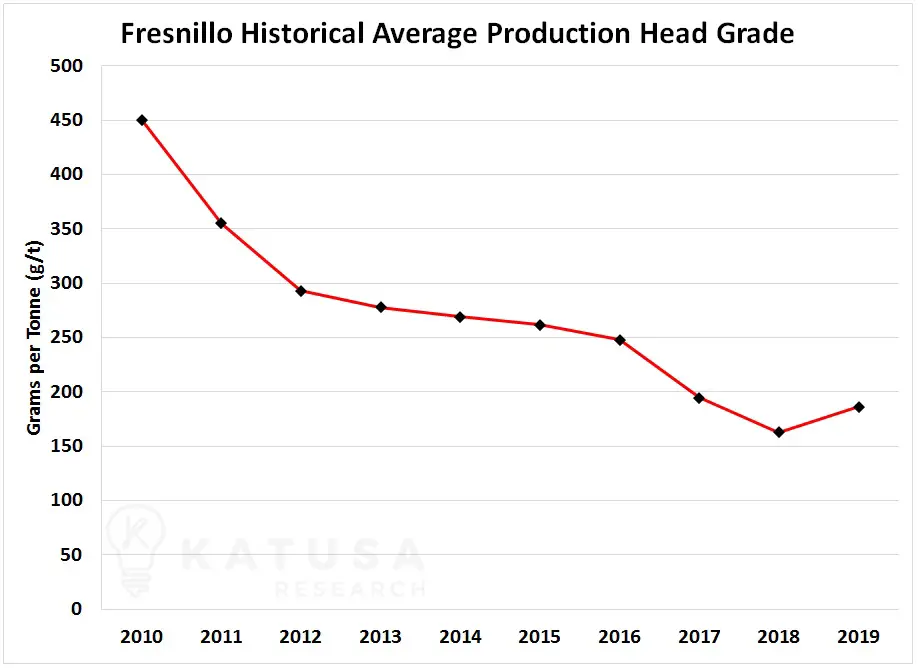

This has to be a scary thing for a company like Fresnillo, the world’s largest silver producer.

Below is a chart of Fresnillo’s average head grade. If you’re not a mining engineer, head grade is the average grade of ore that goes through the milling operation. The higher the grade, the higher the quantity of metal available to be processed.

The average head grade has fallen by over 50% since 2010. This is not a good situation for a miner. In a world where input and production costs are rising yet profit per tonne of rock has fallen by 50%, this poses serious long-term potential problems.

The key to solving this issue is new high-grade production. The problem is, finding world class deposits is becoming harder and harder. This makes new discoveries that much more valuable.

2019 was a liftoff year for the precious metals sector. And if this is truly the early innings of a massive gold and silver bull market, then you’ll want to ensure you have core positions in the best run and leveraged companies in both silver and gold. Click here to find those stocks.

3 thoughts on "Marin Katusa: Is It Time for Silver Stocks To Blast Higher?"

Are You Ready to Start Earning Great Dollars? Be your own boss and earn money nearly $500 to $1,500 Per Week. Finally, A True, Real Program Everyone! Proceed here in order to get started. 0se.co/MDCQC

Boost Your Earnings in Any Internet business. Can You Need a Program To Believe In?This Straightforward Method Just works!No Buzz, Just The Truth.Earn up to $100 per day part time. Funds PAID WEEKLY! You Are Able to Also do it… Check out it: sq2.me/1H

After five years I made a decision to get away from my old occupation which changed my life… I initiated working on a job using the net, for an association I found out on the internet, for a few hours each day, and I bring home way more than I made on my old job… Very last check I acquired was 9 thousand dollars… Amazing thing regarding this is the fact that I get additional time for my family and friends. Take a look, what it’s all about… cut.sx/auP/