Excerpted from Michael Pento’s Pento Portfolio Strategies

China appears to have more to lose from a trade war with the US simply because the math behind surpluses and deficits renders the Bubble Blowers in Beijing at a big disadvantage. When you get right down to the nuclear option in a trade war, Trump could impose tariffs on all the $505 billion worth of Chinese goods exports while Premier Xi can only impose a duty on $129 billion of US goods. However, this doesn’t mean China completely runs out of ammunition.

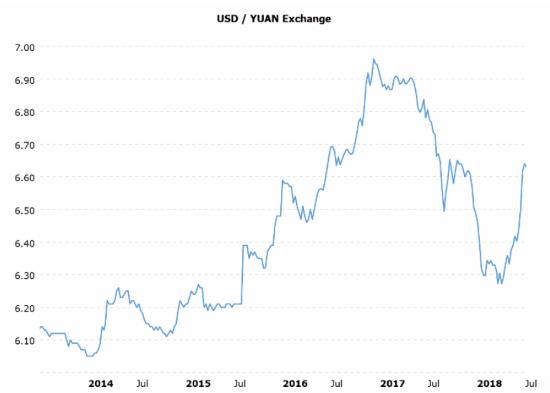

The Chinese could seek to devalue the yuan once again, as the nation did during August of 2015.

This would partially offset the effect from the 25% tariffs placed on its exports; however, it would exacerbate the distress on Emerging Market (EM) dollar loans, which total over $11 trillion. After all, if EM countries allowed their currencies to appreciate greatly against the yuan, their exports would become uncompetitive. Therefore, in order to maintain a healthy trade balance with China, these nations would have to devalue alongside the yuan.

China could also dump $1.2 trillion of US Treasury holdings. The timing for this would hurt the US particularly hard because deficits in the US are already over $1 trillion in fiscal 2019 that begins in October. When you add in the Fed’s reverse Quantitative Easing (QE) plan of selling $600 billion worth of Mortgage Backed Securities (MBS) and Treasures, and you have a condition that could overwhelm the private sector’s demand for debt. Of course, a trade war with China also means there will be less of a trade surplus to recycle back into US debt. And if the incipient trade war caused a recession in the US, deficits would soar much further than the already daunting $1 trillion level.

When you combine the baseline fiscal 2019 deficit of $1 trillion and $600 billion of Quantitative Tightening (QT) with a potential Chinese dumping of $1.2 trillion worth of Treasury reserves, and hundreds of billions of increased deficits arising from the reduced revenue from a recession, the potential for an annual deluge of debt that needs to be absorbed by the public in the next fiscal year could approach $4 trillion dollars!

If you’re looking for the pony behind the dung pile you could say the yield curve perhaps would not invert in this scenario as quickly as it is now-maybe-but the spread between the 2-10 Year Note has collapsed from 265 (basis points) bps in 2014 to just 27 bps today. Hence, the next 25bp rate hike from the Fed in September could be enough to flatten out the curve completely. Nevertheless, the resulting yield shock would be much worse than your typical inversion because runaway long-term bond yields are the last thing the massively overvalued equity market, which sits on top of record debt levels, can endure.

In other words, this upcoming tsunami of debt issuance would equate to a giant black hole that would suck all available investment capital from the private sector and send it towards the wasteful arms of government. This would virtually guarantee a sharp slowdown in productivity and GDP growth. In truth, a productivity slowdown is something the US economy cannot afford because Non-farm Productivity increased by a paltry 0.4% annual rate in Q1.

Since GDP is the sum of labor force + productivity growth, a further slowdown in productivity from here would be extremely recessionary, especially given the slowdown in US immigration and fecundity rates.

The major takeaway here is that China has more bullets in the chamber other than just putting a tariff on all US exports. And even though China has more to lose on face value, an all-out trade war is an extremely negative sum game for all parties involved. The resulting global recession, which is already approaching due to the impending removal of central banks’ bid for inflated asset prices on a net basis, is becoming expedited and exacerbated by the Trade war. Debt-fueled Tax cuts have greatly boosted earnings growth on a one-time basis. And this has been completely priced in by the Wall Street carnival barkers. However, global trade war and the bursting of the bond bubble–with its effect on record debt and asset prices–will more than offset tax cuts in the coming quarters. All that is left now is the panicked hunt for bids as the greatest financial bubble in history unwinds.

7 thoughts on "Michael Pento: How The Trade War Will Hurt The US — And The World"

Everyone seems to keep overlooking or completely ignoring how much GOLD China has now, and keeps piling it up with each passing day. Doesn’t ANYONE “get it” that they, with Russia behind them, are about to PLAY the “Gold Card”????

DO something about these G/d SPAMBOTS!!!!!!!

Limited-time offer from the Private D_a_ting Site! Due to the high number of female members, men join FREE for a limited time! >>> http://rurl.us/MkfMK

TOS this G/d SPAMBOT!!!!!!!

A trade surrender will hurt worse than a trade war.