A recurring theme of modern financial crises is the “temporary” nature of the extreme steps governments take to fix the system.

Recall that the massive increase in the Fed’s balance sheet during its Great Recession asset-buying binge (which is another way of saying “currency printing binge”) was going to be reversed out.

But a funny thing happened on the way back to normal: We couldn’t get there from here. The Fed actually did raise interest rates and shrink its balance sheet a bit in 2018, but towards year-end the financial markets melted down. Here’s the S&P 500:

This flash bear market was enough to send the Fed back to cutting rates and printing money. And just like that, zero-to-negative interest rates and QE to eternity became permanent features of the global economy.

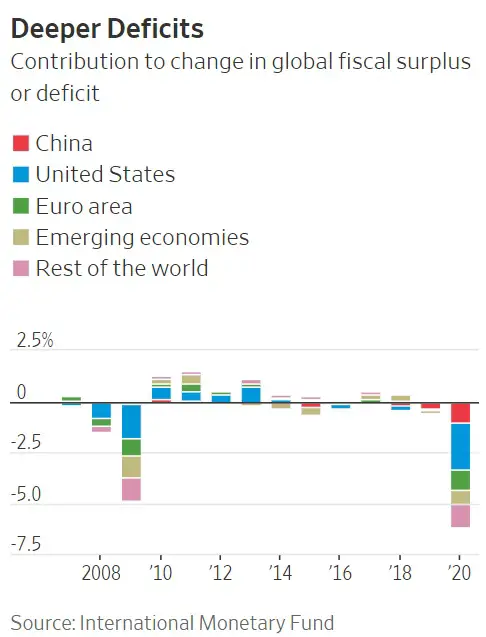

Then came the pandemic that not only ratified QE but expanded it to cover pretty much any financial asset anywhere, while sending government deficits to levels last seen during World War II. The IMF now projects that by year-end global debt will be $8 trillion higher than it would have been otherwise. Advanced economy sovereign debt will surge from 105% of GDP to 122% — in one year.

Now let’s assume the best-case scenario going forward, which is that a cure for covid-19 is developed and the global lockdown ends in a few months. The world goes back to work and growth returns to the previous 2 or so percent.

What happens to all this new debt? Nothing. We’ll simply carry it into the next crisis, amplifying a mess that would have been spectacular in any event.

2018 proved that tightening of any kind is destabilizing for a society this highly leveraged. So currency once created and debt once incurred can never be retired, only rolled over.

And rolling over ever-rising amounts of debt requires ever-easier money, which means the current loan guarantees, direct payments to individuals, industry bailouts and all the rest are just a taste of things to come. The true crazy begins when one-off relief payments are made permanent (hello, UBI), when the Fed makes QE equal to the entire federal deficit (come on in, MMT) and when whole categories of private sector debt are simply forgiven (step out of the bible, Mr. Debt Jubilee). Oh, and when interest rates go firmly negative in the US (see you in the rear-view mirror, zero bound).

Put another way, the entire socialist/corporatist wish list is about to be enacted in one ear-shattering primal scream of “WE GIVE UP!”

It hardly needs to be said that when faced with this financial murderers’ row, holders of the world’s major currencies will run screaming for the exits. The obvious response to this would be to load up on precious metals. But since they’re apparently no longer available, I don’t know what to tell you, other than “snooze, you lose.”

One thought on "Now Comes The Real Crazy"