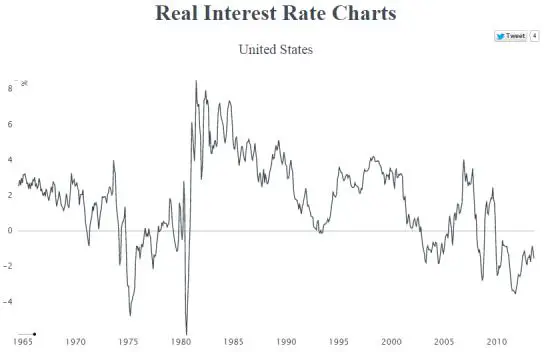

The folks at Gresham’s Law just published a nifty interactive chart of real (i.e., inflation-adjusted) interest rates since the 1960s that explains a lot about today’s world.

To make sense of this, let’s start with a a little background: Interest rates are the rental cost of money, but to figure out the true cost you have to adjust the nominal (or numerical) interest rate for inflation, which is the rate at which the currency being borrowed is falling in value.

If the nominal interest rate is higher than inflation, then the real interest rate is positive. If the real rate is both positive and high, that’s a signal that money is expensive and that one is better off being a lender (to reap those high returns) than a borrower (who has to pay the high true cost of money). The opposite is true for negative real rates, where the nominal cost of money is lower than the rate at which the currency is being depreciated. In this case a borrower actually gets paid to borrow because the true cost of the loan falls as the currency loses value. So negative real rates tell market participants to borrow as much as possible.

Given these incentives one might expect the following:

1) Slightly positive real rates should be the norm in a properly-functioning economy, since that’s the way a healthy market works for most other things, where sellers reap a reasonable real profit and buyers pay a manageable price.

2) Periods of very high real rates should cause borrowing to plummet and economic growth to slow.

3) Periods of sharply negative real rates should produce a burst of borrowing that leads to destabilizing booms, either in hot asset classes or across the board. As Automatic Earth’s Raúl Ilargi Meijer put it just this morning:

The simple truth about ultra low interest rates is so simple it’s embarrassing, at least for those who claim they benefit society. That is, ultra low rates make borrowing accessible to the wrong people, and to the right people for the wrong reasons. The former are people who shouldn’t be able to borrow a dime, because they have no credit credibility, the latter borrow only for unproductive or counter-productive reasons.

The above chart bears all this out. Back in the 1960s when growth was relatively steady and the dollar was still linked to gold, real interest rates fluctuated between one and three percent. But after the US broke the link between the dollar and gold in 1971 and embarked on its epic debt binge, real interest rates started to gyrate. They plunged to -5% in 1975, leading to an inflation spike and dollar crisis a few years later. They then jumped to 8%, producing the severe recession of 1982. They fell to zero in 1994, setting off the tech stock bubble, and turned negative in 2004, inflating the housing bubble. Then they spiked, producing the Great Recession.

Since the 2008 crisis the real rate of interest has been mostly negative, which accounts for the global boom in real assets. For someone with access to borrowed money it now makes sense to use it to buy fine art, trophy real estate, farmland, and other things that governments can’t create more of. All of these things are in raging bull markets, implying that the smart money is responding to negative interest rates exactly as you’d expect.

So what now? History as depicted here says the borrowing binge/asset bubble continues until real rates spike, either because nominal rates soar or inflation plummets. It also implies that the phase change, when it comes, will be sudden. Looking at 1975, 1980 and the volatility since 2007, it’s clear that a financial system based on fiat currencies is inherently unstable — i.e., incapable of finding a stable price for money. So the least likely scenario is a return to a nice, placid world of “normal” interest rates.

8 thoughts on "Real Interest Rates and Future Chaos"

good article, great comments Markus, JW,

I would just like to add. There are no real market forces here, at all…… the cost of goods, the cost of money, inflation/deflation, even labor/unemploment are meaningless in the face of such huge goverment and FRB deformation/intervention.

What is clear is that we are all living off of a credit card, not our labor and productivity

the poor eat for free & rent and medical are free, the unemployed get salary, the rich borrow at 1% and pump up stock mkt, where corporations buy back their own stock thus “improving profit per share” and raising share “value”. Our labor is done by fosil energy devouring robots, and computers, so work is now managing a machine. Farming is one man and his diesel tractor doing the labor of a thousand.

It is wierder and weirder as the “service economy” and “consumer economy” suplant the old concepts of wealth creation. One used to have to grow it, mine it, or manufacture it by the sweat of one’s brow BEFORE one could spend it.

There will be a reset when the credit runs out, the wealth is recalibrated, and the fossil energy flow slows. Til then what is one to do…mortgage the house and buy gold?

I pretty much see it as Markus does. One possible difference is that I have no idea how much longer this will drag on. If John is correct that a spike in interest rates will be the trigger for the next huge leg down, it will probably be off in the future at least a year from now.

USA gasoline sales peaked in 2004 and have been in a steady drop off since then, except for a short bump coming out of the Great Recession. A portion of this is better fuel economy. But most of it is people driving less. Around my town there are a lot of closed gas stations with no increase in public transportation.

The best explanation is that Shadowstats numbers for unemployment (and everything else) are correct, and underemployment is 23%. Hard to buy gasoline if you don’t have a job, or only a part time job. There is this sense of normalcy, since Food Stamp recipients pay for the their groceries with what look like normal debit cards.

If interest rates are kept low, this might just be a long grind down to 50% unemployment.

Great comments guys! Fascinating article too.

The problem with that chart and thus everything else in the article is that the real interest rate depends on the REAL inflation rate, as in nominal interest – inflation = real interest, but when the Fed and the BLS say inflation is under two percent when all HONEST people know it is really above 8% and probably more like 12% then the REAL interest rate is actually more like -8 to -10%.

This fits with the asset bubbles in equities which have more than doubled, almost tripled their gross dollar market capitalization since the 2008 crash. Ditto bonds though there is no way to easily estimate how many trillions have gone into the debt market, it is a huge number. And commodities, though they have mostly come down on agricultural/grain prices with two record harvest years in a row some notable exceptions remain, oil, meat products, PM’s remain quite high.

However; if inflation is as I say double digit, and we already have these bubbles, then going forward we are risking a hyperinflationary collapse masked till the last minute by the total refusal (or lies) to measure and admit a real inflation rate. The consumer knows though, when you have not had a steak in six months because they cost $14.99 per pound now, or your rent has gone up 40% in two years, to me it already feels like hyperinflation. Especially when I see prices like butter, which spiked by 100% in the last month from $2.50 to $5 now.

One of the problems is that with the exception of autos economic activity is measured in dollars only. So, you get readings on PMI, GDP, same store sales, retail sales, etc. measured in dollars giving false signals of prosperity. Yes, department store sales can be up 2% when in fact they sold a lot less stuff to a lot fewer people, because the data is adjusted by an ABSURDLY low inflation rate. GDP is collapsing at a rate few would even believe if you applied a REAL inflation rate to the readings. The reason autos are an exception is that it is one of few things sold where units sold and dollar sales are both closely monitored and widely reported.

For years now I have been hearing people wondering how we could have such a vigorous and prolonged JOBLESS recovery. Simple, we are just not. GDP is actually contracting at a rate that would scare Herbert Hoover and thus NO JOBS. This is also backed up by the FACT that working people have earned less and less both nominally and in real terms, not only are fewer people working they are making less. Apply a REAL interest rate to GDP and you see living standards for 99% of us are actually declining at the fastest pace in history, especially if you subtract revolving debt from net worth. Because consumers have plastered over this decline with credit cards. The monstrous increase in net worth of the top 1% also has been hidden by this claim of low inflation.

You will know and admit all this is true before October is over when the markets and consumer go teats up and unemployment goes back over 25% (another faked number if ever there was one).

You are absolutely right. One of the other things that clouds our view on economic reality when using statistics is that many things are added in aggregate or averaged per capita: this hides a much more complicated reality in which the effects of certain trends impact different people very unevenly. Average household wealth means nothing if 80% are losing and 20% are gaining. Inflation means very different things to different kinds of people with different spending habits and different life phases.

One of the most underestimated effects is what happens to spending and investment when only the higher incomes gain. Even though it is often repeated that the predisposition to spend is spread more or less evenly across savers and lenders, the fact is that for poor people no spending is discretionary, whereas for higher incomes it is. Moreover, many of the top incomes spend very little: they plough their income into buying (and bidding up) additional assets. For the economy (which is circulation of goods and services) there is a huge difference between 100 work-a-day people buying a chevrolet or 1 person ordering a yacht, perfume, and more corporate bonds.