Written by Bryan Lutz, Editor at Dollarcollapse.com:

At the start of the Great Financial Crisis(2008), ‘The Hershey Chocolate Company’ stood out among others because of one thing:

Capital Efficiency.

Here’s why Porter and Co. says about capital efficiency is important:

“This term refers to the fact that not all profits are created equal. In short, when a business earns money, there are two primary places those earnings can go:

- Profits can go back into the business to be spent on “capital expenditures” (i.e., replacing or upgrading the business’ fixed assets including buildings, vehicles, machinery, land, etc.), or…

- Profits can go back to the business’ owners (i.e., returned to shareholders). Shareholder returns can come directly from dividend payments, or indirectly through share repurchases – when the business buys back its own shares in the open market. The latter reduces the total number of shares outstanding, thereby increasing the ownership stake of remaining shares.

You can think of capital efficiency as the ability of a company to convert its profits into shareholder returns, rather than having to sink them back into the business.”

Since the Fed initiated quantitative easing in 2007, other companies felt it was safer to use debt as an instrument for the maintenance and growth of their company.

Hershey’s used its own money.

They were capital efficient.

And because of that, the company grew.

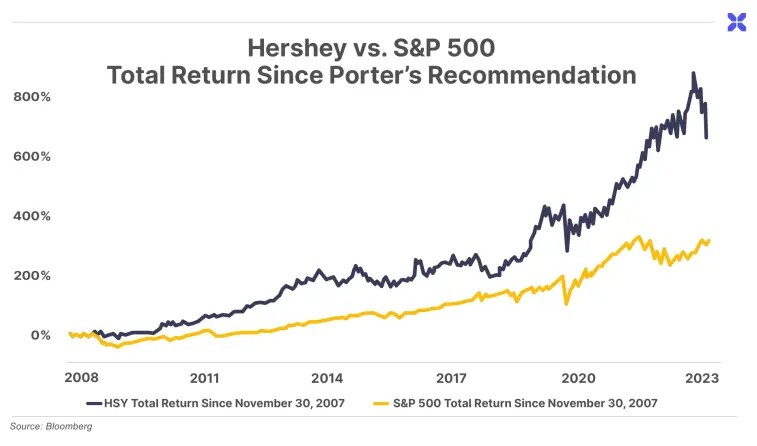

Until 2022, when the company’s return would have been 600% more than the S&P 500 over that time period.

Hershey’s even continued to climb, while the S&P declined and then went sideways.

All because of its capital efficiency in an inflationary, fiat-driven economy…

Along with its efficiency, the company’s industry is also a classic grocery recession stock. People will always buy chocolate. Even in war time, soldiers need chocolate rations.

But, since the start of 2023, the company’s stock has been on the decline. Not because of the markets, but because of a shortage in cocoa.

Which has sent cocoa prices soaring just before Easter.

Bloomberg reports:

Cocoa Is More Expensive Than Copper as It Tops $9,000

“Cocoa extended its surge — surpassing $9,000 a ton for the first time ever — as a supply crunch grips the market and chocolate makers grapple for beans.

Futures are up about 50% this month alone and have more than doubled already this year. Poor harvests on the back of bad weather and crop disease in West African growers, where most of the world’s cocoa is grown, and little sign of production relief elsewhere have left the industry in a bind…

While prices have soared, speculators have actually been pulling out of the market. Open interest — the number of outstanding contracts — has dropped from a peak in late January, and money managers cut their net-bullish wagers to a one-year low in the latest week. That suggests that physical buyers may have played a key role in the price rally.”

First, capital efficiency doesn’t always equal future returns. Hershey is spending more money on supply, which will not allow them to put as much money back into maintenance and growth, or share profits with shareholders.

This also presents opportunities for the few willing to bet on prices, or those willing to wait it out.

With a slow down in cocoa futures contracts, cocoa prices may decline post Easter. Prices being in what looks to be a bubble.

Also, if they do decline to supply levels, cocoa prices may remain high for sometime…

This may cause a continued decline in share prices for Hershey(HSY).

But crops can only stay poor for so long, and when supply fails to meet demand, the market can only respond with people willing to farm cocoa beans – more producers to raise the supply.

Plus, cocoa crops from the Ivory Coast and the rest of West Africa can only produce poorly for so long. Prices may generally come down…

If Hershey suffers from continued higher cocoa prices for several years, and manages to use it’s capital efficiency to work through the hard times…

That would make Hershey a great contrarian investment to put on your watchlist…

And great return on chocolate.