Here’s one for the Clueless Regulator Hall of Fame:

Corporate executives are using stock buybacks to pad their own compensation, according to SEC official

(CNBC) – Share buybacks have surged since the Republican-backed tax bill made it through Congress in December.

Corporate executives are using tax cuts and share buybacks to boost their own compensation, a top regulator said Monday.

Companies have announced a record-breaking level of share buybacks since Congress passed the Republican-backed tax reduction in December. Critics of the $1.5 trillion measure had worried that it would lead to big rewards for shareholders and only limited benefit to the broader economy.

Robert Jackson Jr., a member of the Securities and Exchange Commission, said corporate bigwigs have been selling their shares after the buyback announcements hit, cashing in from the stock price surge that often happens after a repurchase notice.

The rules exempting companies from securities law violations for the timing and pricing of buyback announcements need to change, said Jackson, who President Donald Trump appointed earlier this year to fill a designated Democratic SEC seat. Jackson pointed out that the Dodd-Frank banking reforms passed after the financial crisis included language aimed at keeping investors informed about how executives cash out their shares, but specific rules remain in limbo.

“But it’s not just that the regulations haven’t been finalized. It’s that the problem itself keeps getting worse,” he said. “You see, the Trump tax bill has unleashed an unprecedented wave of buybacks, and I worry that lax SEC rules and corporate oversight are giving executives yet another chance to cash out at investor expense.”

Indeed, buybacks totaled $178 billion during the first quarter, hit a record $171.3 billion in May alone and have seen $51.1 billion announced so far in June, according to market data firm TrimTabs. At the same time, insider selling has totaled $23.6 billion.

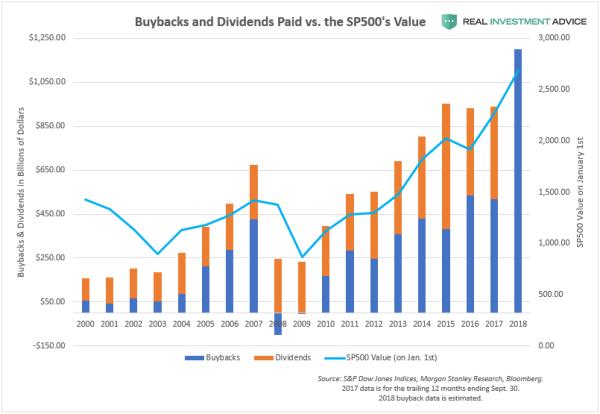

Wall Street analysts expect full-year buybacks to total as much as $800 billion, part of what UBS recently forecast to be a $2.5 trillion tsunami of cash pumped into repurchases, dividends, and mergers and acquisitions activity.

Jackson and his staff studied 385 instances of buyback announcements over the past 15 months. They found that the announcements boosted share prices by 2.5 percent, leading in half the cases to at least one company executive selling shares. Insider selling occurred twice as often in the eight days after a buyback announcement. In that eight-day period, insiders sold an average of $500,000 worth of stock each day, a fivefold increase from the days before a repurchase notice.

While Jackson acknowledged that executives who use buybacks to boost their compensation aren’t breaking the law, he said they are contributing to the short-term nature of trading that has plagued the market. “Safe harbor” provisions allow corporate insiders to sell on buyback announcements.

For an SEC official to be surprised that corporate share repurchases enrich executives is, well, surprising, since share repurchases tend to push up share prices and executives are compensated at least in part based on that metric.

So the executives doing the repurchasing benefit one way or another – otherwise why would they bother?

What’s more concerning is that corporate tax cuts were sold as a way to encourage companies to invest in new factories and other productive gear, thus creating jobs and raising wages. Instead they throw a trillion-dollar dividend/share buyback/M&A party that mostly just pushes up stock prices and enriches the people at the very top.

You’d think regulators would be more concerned about that than by some arcane issue of stock sale timing. The fact that they’re not just reinforces the already rock-solid contention that big companies own the regulatory apparatus and can bend it to their will.

Which is yet another sign that not just the cycle but the super-cycle that began in the 1940s is reaching a peak.

2 thoughts on "Shocked! To Hear That Corporate Share Buybacks Line Execs’ Pockets"

Yoda comes along every hundred years or so.

Darth Vader is in charge the rest of the time.