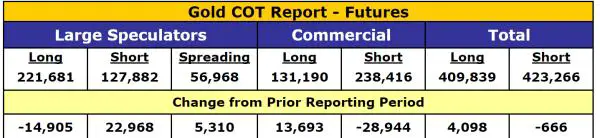

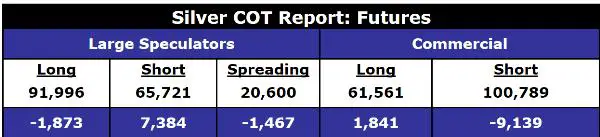

The stars — in the form of smart and dumb money futures contract positions — have once again lined up favorably for precious metals. Here are those positions for gold and silver as of Tuesday the 4th. Notice that speculators (the dumb money) got a lot less optimistic — that is, less long and more short — while the commercials (the smart money) got much less pessimistic. The closer each group gets to neutral, where their longs and shorts are about equal, the greater the likelihood that metals prices will rise in the subsequent six or so months.

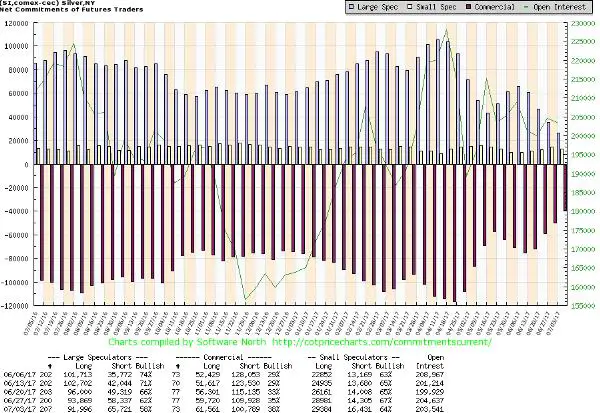

And here’s the same data for silver presented in graphical form. The top bars are speculator longs and the bottom are commercial shorts. When they approach the zero line that’s bullish.

So here we are once again, at the tail end of a grindingly-protracted precious metals correction that has led a lot of people to give up altogether and sell their mining stocks. The next few months should be much better, especially for holders of the junior miners that were caught in the GDXJ downdraft.

Playing this indicator — known as the Commitment of Traders Report, or COT — is of course just a way to pass the time while the real underlying forces affecting precious metals work themselves out. Those forces — rapidly accumulating debts which leave central banks no choice but to inflate away their currencies — are still accelerating in most places, and the inevitability of mass-devaluation will become clear when the central banks now talking about “interest rate normalization” and “balance sheet reduction” are forced to admit that those things are impossible, and all that’s left is debt monetization as far as the eye can see.

On that day it won’t matter what futures traders — or junior miner ETFs — are doing. The physical precious metals bid will go infinite — that is, big players holding useless cash will buy up all the gold and silver that’s available, at pretty much any price that’s demanded.

41 thoughts on "Speculators Sour On Gold And silver, Which Means The Bottom Is Near"

Maybe it will never be worth more than I paid for it…no big deal I will just leave it to my children…you can bet they will find a way to spend it…Love those kids!

Been meaning to get over to the coin store…(but been too busy earning fiat)…and trade some dirty paper for the shiney…..anyone that knows anything knows its all a big paper scam (why prices are where they are)…one day it will burn and then? who knows maybe you will only be able to buy a loaf of bread or a carrot…but at least you will have the bread and the carrot…No?

Don’t care if silver and gold = zero or better yet -o…Holding on to what I have…Dollars are fiat and history has shown us what eventual outcome of all fiat moneys become…Value = zero…

5000 years the only “real money” that has stood the test of time…BTW might want to check with China India and a few other nations that cant seem to get enough of the two shiny metals…Got to wonder why?

I have a question. The fed isn’t answerable to anyone but it’s owner banks (which we aren’t allowed to know ) and can’t (really) get audited. Apparently they gave $16 Trillion to banks globally after the 08 crash, (in a c “swap”) which we don’t know if they ever got back. https://www.sott.net/article/250592-Audit-of-the-Federal-Reserve-Reveals-16-Trillion-in-Secret-Bailouts

What if they are already buying stocks, etc ? Can’t they just print trillions, buy stocks and push the market up forever ? If need be, they can just buy treasures, not collect the interest, and at maturity not ask for the $ back from the government ? They can just print the $ and give it to their owner banks, without ever telling us, no ? Who’ll stop them ? I know about Weimar, but it wasn’t the global reserve currency, and didn’t have the military capacity to force most countries to do as it wants. If so, no important bank will ever fail , the debt is irrelevant (as they said all along). This would serve the banks, corporations, government, and only the middle/lower classes would have their standard of living gradually decrease – which wouldn’t bother the masters (they have been militarizing the police for a reason). Btw the Canadian govt sold ALL its gold recently, and if pushed, so will the ever subservient Germans, Brits, Aussies etc, so the notion of a physical shortage is far fetched, isn’t it ? It would make my day to get debunked, so anyone, please…

I love the articles and comments but I have been riding this wave since baby 2011 and been crushed to the point I don’t have the stomach anymore and I keep reading this big wave is coming and we will all make lots of money. I just feel it’s not worth the time anymore and I am dumping my shares to hold cash for now.

all the way since 2011? you are quite the veteran!

so basically, you are saying that you bought at the top, and now are selling at the bottom?

just a suggestion, but perhaps you might want to hold on for a bit.

or what the hell, sell it all and buy bitcon, uh, I mean bit coin.

and pay no attention to 5000 years of history where every paper fiat currency has failed, where every government has defaulted on its debt, and gold has always held its value.

Stack like there’s no tomorrow.

A stacker for many years, I’m ‘floored’ that in 2017 I can still get ASEs & maples delivered to my door for under $20/oz.

Just shows you how upside-down the world really is.

Thanks for the COTS data John. Good to know.