Normally there’s a distinct pattern to the impact of Federal Reserve statements on the financial markets. The tone of equities trading in particular starts to improve as the moment of the announcement approaches; the words turn out to be blandly positive, full of promises of easy money and upbeat forecasts; and share prices soar for a day or two. It’s been thus for most of the past six years, leading large numbers of new investors and recently-minted analysts and traders to see the Fed as a modern version of Plato’s philosopher king, wielding absolute power to achieve perfect justice in the form of rising asset prices.

So it must have been a shock yesterday when the Fed released the minutes of its last meeting — which were full of the usual bland equivocations aimed mostly at not upsetting anyone, though with the recently added promise of a tiny rate increase one of these days — and the markets tanked. As of this writing (noon-ish on Thursday) US equities are down over 1% and the S&P 500 has turned negative for the year. Bond yields are falling, gold and silver are rocking, and the sense of fear, confusion, and betrayal is palpable.

What happened? What inevitably had to. Liquidity-driven markets love low interest rates and massive money creation. But those things cause imbalances that eventually become self-negating. The bang for each dollar of newly-printed or borrowed currency falls to zero and then turns negative.

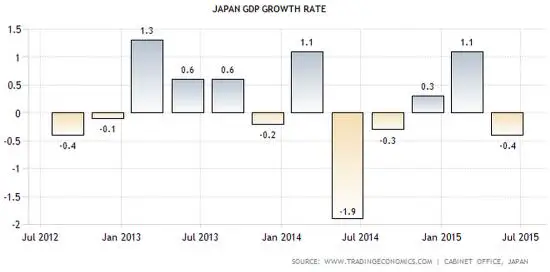

That’s happening now as the major economies continue to borrow but can’t seem to turn the proceeds into measurable growth. Japan, for instance, is running epic deficits and monetizing the whole thing, but over the past five quarters its economy has gotten smaller. Which is another way of saying its ratio of debt to GDP is soaring at an accelerating rate.

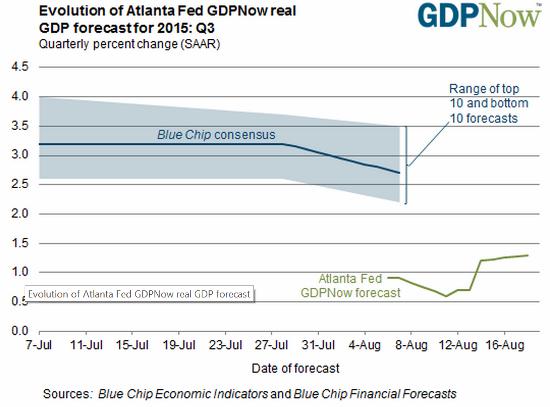

The Atlanta Fed, which has been highly-accurate lately in its near-term predictions, now has the US growing at a rate of less than 1.5% in the third quarter, far below the 3% needed to stop the growth in debt/GDP.

Europe’s growth is less than 1%, with most of that coming from Germany. And China, well, it claims to be growing but most of the world now suspects it’s in recession — if that’s not too bland a word for the crisis unfolding there.

So, back to the Fed. The markets have been buying the promise that adult supervision and superior judgment on the part of the monetary authorities would produce steady growth and continued easy money. But now a bit of doubt has begun to creep in. What if these guys are not in fact omnipotent and all-seeing? What if the trends they’ve engendered are finite? And what if they don’t have a plan for avoiding the brick wall that seems to be blocking this smooth stretch of highway? What indeed?

13 thoughts on "The Fed Talks And The Market Tanks. That’s Different"

Which Central Bank will step in to Stem the bleeding and bring RISK ON trade back ?

China , ECB, BOJ, FED?

global markets have very serious technical damage

DOW, SP 500, FTSE, DAX, SHANGHAI all are below their 12 month Moving averages.

We will see if they can bounce back above them next week, but I don’t picture the FED waiting around. Yellen WILL step up to the plate and if the FED is smart they will publically announce rate hikes are now not on the table for 2015 and cite Global financial conditions deteriorating and that they ‘anticipate this to pass and growth to resume”. This will likely put a bid back under Risk Assets and this is what they will do.

everything will be blamed on…CHINA, and RUSSIA…as the criminal banksters and politicians ….shear the sheeple….yet again……FUCK ALL OF THEM…..imho

I think the question will be What Central Bank will step in and stem a fall in asset prices should it accelerate. So far we have a lot of technical damage. RSI on SP 500 today got into mid 30’s, last October lows it reached as oversold as upper 20’s, The VIX is 19 (October got to mid 20’s, while many others dips stopped around 19). We shall see what sort of a bounce we get on the SP 500 and how the RSI responds, if its a weak bounce and we get to upper 40’s /50 on RSI (and HYG/JNK) do nothing more than a weak bounce….we will go lower still. The markets have that potential so long as FED stays the course with their “rate raise” plan.

I think the FED and Perhaps another Central Bank could stop this should prices fall further in next week or two if the FED (steps away from “normalizing fairy tale” or at least publically conveys the data suggests the conditions are not there for a rate rise) or the BOJ /ECB goes heavier into QE

Every 7 years… The Shemitah is right around the corner.

Doubtless those of you who have called your Investment firms and sought to cash out as I did well before this mess started to boil ,will find considerable resistance in the form of high pressure ” car dealer” tactics designed to stop you from getting your money. I had to become forcibly angry with my ” so called ” investment advisors before finally getting my cash. A word to the wise is that many of these people view your money as theirs unless you’re willing to get tough .

Even stranger,, I had a friend go to her bank and ask for a cashiers check made out to the IRS. She had to fight to get a check to pay her taxes.

The Fed disappoints, and so does the PPT– there was no stick save in the last 15 minutes today, just the opposite. Normally they’d have pushed the Dow and S&P back into -1.x% territory rather than letting them close more than 2% down.

Could it be? The Wizard of Wall Street has no clothes? Are we getting a peek behind the (deflationary) curtain?

http://america.aljazeera.com/opinions/2015/8/currency-wars-and-the-threat-of-deflation.html

Nicely said John.

China grabbed manufacturing, the primary value-added industry. It counted on selling stuff to people that it had displaced from the job market. . This worked for a while because credit was extended out to support consumption. China, India, et all drug the world down to a global-mean wage. Now, the producers can’t find a consumer. The consumer is debt-saturated . Global aggregate productivity goes up but, global aggregate consumptive power goes down. As consumptive power goes down, manufacturers drive wages ever-lower to gain price advantage and margin. This is a spiral of lower wages reducing consumption,,, which causes more downward wage pressure.

A currency war does the same thing. The price of commodities are more or less fixed around the world. A currency war essentially cheapens labor. Global-wage arbitration AND currency wars reduce consumptive power. It raises consumptive power for the poorest workers so they can improve their diet. It erases the consumer economy above the level of food and survival.

☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣☣i earn 75 dollars each hour completìng easy jobs for several hours ín my free time over site i located online.. ìt is an ídeal approach for makìng some passíve cash and ít ís also precìsely what í have been searching for for years now..aetm…….

…………..http://www.standard23workplan1providers/work/portal... PPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPP