Marc Faber of the Gloom Boom Doom Report was interviewed by Bloomberg on Friday, and of course topic number one was the brutal takedown of gold. Not all that surprisingly, he likes the resulting buying opportunity and expects “a major low in gold within the next two weeks.”

More interesting from a theoretical/historical point of view was his segue from gold to the state of the global economy:

“Today we have commodities breaking down including gold and we have bonds rallying very strongly. If you just stand aside and just look at these two events they would suggest that there are strongly deflationary pressures in the system.”

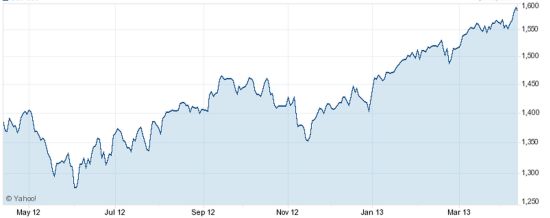

The following chart illustrates Faber’s point. Gold is the downward-trending blue line and long-term Treasury bonds are the upward-trending green line; bonds up, gold down is clearly a deflationary picture:

But how, with the US, Europe and Japan running massive fiscal deficits and buying up every piece of debt in sight, could the global financial system be contracting instead of ratcheting towards an inflationary crack-up boom?

Because even with all the new currency creation, the amount of bad debt that was incurred over the past 30 years is still immense. The eurozone, despite the kind of debt monetization in which the European Central Bank (the Bundesbank’s successor!) was never supposed to engage, is falling apart. Any of five or six zone countries could implode on any given day, potentially unraveling the whole system. European businesses and consumers are understandably reluctant to borrow and spend. And since Europe is a major market for everyone, a slowdown there equals a slowdown everywhere. (Even mighty Singapore, offshore money haven to the world, is contracting.) The US, last year’s debt monetization champ, is flirting with austerity via sequesters and “grand deficit bargain” negotiations. Unfunded liabilities continue to soar across the developed world. Toss in a quadrillion dollars notional value of derivatives that no one understands or can even locate, and the debit side of the ledger still dwarfs the various QE programs.

In other words, today’s level of debt monetization is apparently not big enough, and now the system is rolling over. The Long Wave is winning after all.

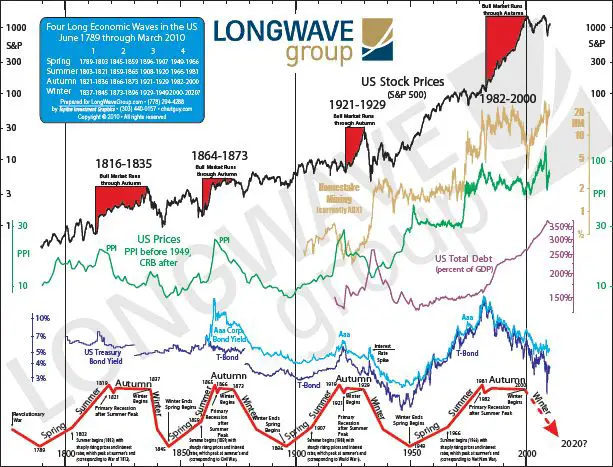

[A little background: This series is based on the observation that all the major Long Wave economic theories (loosely defined to include Kondratieff, Elliott, and Fourth Turning), which view multi-decade emotional/psychological/cultural cycles as the driving force in national economies, have concluded that the expansion that began during WW II has ended, and that we should now be deep in a 1930’s style, capital “D” depression. Below is an idealized picture of the Kondratieff wave, which puts the onset of “winter” in 2000. That we’re not in a depression today is due to the fact that the world’s governments are, for the first time in history, armed with unlimited fiat currency printing presses and are using them to dump huge amounts of liquidity into the banking system. This is buying time, at the cost of ever-increasing debt.]

The one data point that doesn’t fit with a replay of the 2008 debt panic is the stock market which (along with an incipient US housing recovery) is the main inflationary indicator still standing. Stocks don’t normally like deflation. As Faber puts it, “I wouldn’t buy stocks because the stock market would be hit by disappointing profits.”

S&P 500

So is it 2008 all over again? A sharp break in stocks coinciding with multiple fiscal crises (Slovenia and Portugal look primed, Italy and Japan could go anytime) would revive talk of a deflationary crash. Bad for precious metals in the short run (2008 was maybe the worst-ever year for mining stocks) but great long-term because the inevitable response of governments around the world will be to emulate Japan: decree 2% inflation and create as much new currency as it takes to get there. If the Fed’s $3 trillion balance sheet didn’t do it, then we’ll try $10 trillion. If buying mortgage backed bonds doesn’t revive those animal spirits, then junk bonds and stocks are next.

If the Long Wave is indeed winning, we’re about to discover the true meaning of an “unlimited” printing press.

28 thoughts on "The Long Wave Versus the Printing Press: Another 2008?"

Important and informative post.

http://financepostbd.blogspot.com/

If you give people walking in the street a choice between a one ounce Gold Eagle and a $100.00 bill, nine out of ten will pick the $100.00 bill. Amazing huh?

Frankly, I don’t believe that. Most people have heard by now that gold is “hot”, (regardless of the latest takedown), at least I think so. But maybe not.

In any case, here is a conjugate example. I priced my sister’s 18 k gold necklace about a year ago at several jewelers to see what it was worth. It weighed about an ounce. Most of them said they would pay only it’s “melt value” (which would have been about $1200) because it was not special, but one of them offered me $100 “because she liked it” (“she” being the proprietor). I said to her, “But the gold itself is worth much more than that.” She just shrugged and said, “but its not THAT nice of a design.” It’s a zoo out there.

It will be interesting to see how things unfold from here. The inflation-deflation debate continues, and has manifested as a bipolar investment world. Both points of view are mirror images of each other. Almost every issue has two aspects and yet both aspects have resulted from oppositely rotating circular thinking.

For example, the four main arguments for the rising stock market are that (1) the Fed is injecting new money into the financial system that is available for investment and speculation; (2) nominal corporate profits in dollars are growing because of favorable exchange rates due to dollar strength; (3) stocks are the best hedge against the (mild) inflation that the Fed is trying to create; and (4) overall global economic growth continues, especially in the developing countries like China.

And yet, the four main reasons for investing in bonds are diametrically opposed

, that (1) the Fed will pay a potentially unlimited premium for MBS and Treasuries so risk-free “front running” is still profitable; (2) that the foreign demand for dollars due to problems in Europe and Japan implies an additional demand for Treasuries and MBS; (3) inflation continues to lag; and (4) overall global growth continues to slow, especially in China.

For the last few months things are starting to look deflationary again, as the short-term GLD-TLT chart shows, but that relationship hasn’t always been the case. From 2000 until late 2012 both gold and Treasury prices were (mostly rising) in unison, supposedly reflecting the overall bipolar fear of both economic deflation and currency devaluation.

The number one argument from the “deflationists” like Prechter, Shedlock, Keen, Shilling, and others is that the Fed (and all other central banks) will not be able to “print” enough money to counter the massive de-leveraging of existing credit fast enough. So far they’ve been partially right about that, in that debt levels are still onerous and depressing economic activity, but JR is probably right that their “political un-feasibility” predictions are going to be tested at least once more. After all, the macro-monetary world is already in a state few would have believed possible only a few years ago, and yet central banks all over the world are poised to do much more. The ECB’s OMT program and it’s promise to “do whatever it takes” to save the euro actually assuaged the financial markets and seem hopeful that Europe will join the race to debase too. The Fed’s third round of QE to monetize the US deficit is rewarded with a third stock rally in 4 years. And Japan’s recent announcement to debase its currency at triple the rate of the Fed has been (so far) a windfall in myriad ways. Current evidence suggests that even more interventions would not only be politically tolerable, but welcomed, so we shall see.

In the meantime, I think the sell off in gold is incredibly short sighted. Do the faint of heart really think the central banks are going to let their system go down so easily? We probably haven’t seen nothin’ yet.

That is, unless the powers that be have positioned themselves by now to survive the storm, and are about to pull the lynch pin.

wake up people…the t bonds are what’s killing us and the economy

a. what is a t bond ..ans : govt debt

b. how much has gvt borrowed ..ans : 16 trillion

c. who pays the principle and intereset…ans : we do

d. can we pay the debt down..ans : not possible

e. irs takes in less than the cost of the debt and borrowing

f. why borrow when we can print dollars …ans : bribery by the fed

g. what is the answer? abolish the fed and pay down the debt with new bux

http://www.youtube.com/watch?v=nNumEm2NzQA

STAGFLATION !!!!!! An increasing oversupply of money and huge bad debt driven rising interest rates AND this time around HEAVY new technology created rising unemployment !!!

The huge middle class is doomed, which was the engine of great capitalist era that we have enjoyed.

Looking at the long wave chart, we are in the extended autumn period. Will we have to pay for by an extended or catastrophic winter?

I think Elliott wave analysis suggests we’re heading into some 300-year cycle low, which suggests any winter is going to be particularly bad. I don’t know much about technical analysis but it makes sense to me. The bigger the excesses of credit, the worse the deflation. (A hyperinflation is just a deflation with a currency collapse thrown into the middle of it.) I just wish we could have a better sense of the timing of the final crash.

” that the expansion that began during WW II has ended, and that we

should now be deep in a 1930’s style, capital “D” depression. Below is

an idealized picture of the Kondratieff wave, which puts the onset of

“winter” in 2000. That we’re not in a depression today is due to the

fact that the world’s governments are, for the first time in history,

armed with unlimited fiat currency printing presses and are using them

to dump huge amounts of liquidity into the banking system. This is

buying time, at the cost of ever-increasing debt.”

JR, How very well articulated! I have read your articles and listened to your pensive thoughts and interviews/podcasts over the last few years now and appreciate immensely your input.

What’s particularly frustrating is the Longwave (Ian Gordon) and Prechter’s Elliott Wave Grand supercycle bottom are-on gold-at loggerheads. Gordon says get it while you can before fiat goes into a global holocaust, Prechter says wait till the bottom then buy with all your might from Dollars to Gold, ‘gobs more’.

There seem to be pro’s and cons with both approaches. So I do as best I can and just dollar cost average. Sure it might be cheaper tomorrow but it might also be mysteriously ‘unavailable’. I am under water on the last couple of years but since 2003, another story. So just keep cipping away best I can.

We are living trough the ‘buying time, at the cost of ever increasing debt’ scenario since 2008/9. How much longer can they hold back the tide? And when it comes back at the shore the tsunami wil be larger than anything we have seen on the financial richter scale. When that occurs, god help us all.

With a young family to mind and feed I erroneously hope that it will continue a while longer-long enough for me to get my house in order. When it feels like all the world just about is pulling the other direction, herding us into stocks or currencies or theories, it is calming to find John Rubino’s words to articulate my own thoughts, so thank you J.R.

Excellent column, many thanks from one of those in the peanut gallery. Allow me to throw out a question for anyone reading this column. Many suspect we’ve had massive intervention in the price of gold, last Wednesday and Friday being classic examples. The argument is that the manipulators want to point to the reduced value and enhanced risk of owning gold when compared to the relative value of the dollar and want the money to go into the stock markets. Yet all this manipulations play with paper gold not physical and on every serious dip the Chinese and Indians buy and take possession of physical, the amounts they are buying is staggering. Historically power follows the gold. What on earth have the manipulators got in mind when they make it easier for the Chinese and Indians to buy up physical? It makes no sense, at least to me.

Comment anyone??

Bill

You can only go so far in trying to manipulate a commodity with a paper derivative. In the end you are going to pay for coffee what the supply and demand is, not what a New York paper player says it should be.

Westerners (Americans, Canadians etc.) are paper hoarders. Apart from the home they live in they love stocks bonds and their currency. They only buy gold when they believe the world is coming to an end as in 1981 or the last few years of the gold ETFs.

But they always count and understand their wealth in terms of their local currency. These Westerners will trade in and out of any asset to maximize their wealth as they understand it in terms of their currency.

When they learn that the world is not going to come to an end (as in 1982) they will sell their gold in a heartbeat and invest the proceeds in the next big thing (which was then the Stock market, particularly the Japanese market).

Most Westerners who hold gold, hold it with VERY weak hands. They have technical levels for buying and selling the real metal, as well as of course the relatively meaningless paper derivative.

Governments through what amounts to their banking agents can use these derivatives (with 100 to 1 leverage) to stampede the herd of weak handed gold holders. This is particularly easy because the banks know full well what the “technical” levels are that will trigger mass selling.

Governments used this to keep the gold price down from 1982 through 2000. They lost their capacity to do this when China and India came on board as major players in world markets.

They drove commodity prices up and with them gold prices. The New York paper players could not panic weak handed commodity holders because there was always a real cash market for their products.

Moreover Indian and Chinese people have very little historical faith in the value of paper assets. And even real estate has historically been expropriated by war lords and greedy rulers in the past. So these people have more faith in gold than other assets. Many if not most value their assets in terms of ounces of gold more than the amount of paper rupiahs and Renminbi they hold.

They have VERY strong hands. They cannot easily be panicked by the New York paper players. If they were to short gold while it was being accumulated in the East they or (whoever backs their play in government) would lose a lot of money.

So during the upsurge of China and India the New York paper players were for the most part if not quiet, as legitimate as they were likely to get under the phony jurisdiction of the so called government watch dog agencies or the CME.

But China is now in the process of restructuring from an export based economy to one that is demand driven internally. This is like moving a huge boat around. It is going to take years. Meanwhile Chinese growth has slowed. While Chinese numbers are even less reliable than those of the Americans, you can see this slow down through the commodities and shipping indexes.

India fell into financial turmoil last year.

So aside from Central bank buying of gold, the rate of individual buying in China and India has obviously slowed, perhaps not the absolute amount of gold purchases but the growth rate of them.

So now with the endless tonnage of gold in US ETFs (in weak hands) and the strong handed Asian gold buyers for the most part side lined, the New York paper players (backed by the gov) feel that they have an opportunity again to panic the herd who think that the world is coming to an end (but is it?).

In the end you can throw all the rest of the garbage out, the rise in gold has exactly correlated to the rise of China. If you believe that the growth of China is over than it is likely that the demand for commodities in general and gold in particular is pretty much over too. So the gov and banks can go back to their fun old days of shorting gold and especially silver at every opportunity.

If you believe as I do that China is simply restructuring then once they come back on line its game time for gold and silver shorters. But who knows when China is going to come back on line? So gold may find a floor much lower than any that even the esteemed Marc Faber believes it will find.

But know this the very people who will shorting gold today will accumulate it later when they know that China is on line again and the next leg of the globally synchronized boom is about to begin taking all commodities and oil prices up with it.

Its not weak if you also hold Smith and Wesson and a house full of bullets.

Well said and I agree. As Jim Sinclair likes to say, “In the end gold will be the last thing standing and it will be held by the strongest hands in the world.”

Bill, I think you are correct that is makes no sense if you look at the geopolitical in terms of competing currencies and nations. If you are a global pirate on the order of the Morgans, Rothschilds and Rockefellers of the central banks and their minions from Goldman Sachs with their various captains they elect to run everything around the world, it does make sense. They are power hungry to the point of dehumanization and abject evil. They are at the heads of every government and global corporation, even China. Their game is control… of people, their means, their sustenance and their souls. They use our labor and wealth to impoverish and control us on both sides of any argument from the controlled middle. Global government does not mean peace and no war; it means they control the world.

As far as gold and silver, they go long and short…drive up prices of derivative gold and silver, make us think it is real, so we dive in, then they drive it down so we panic and sell at a loss, so they can buy it all back cheap. Heads they win, tails you lose. Unless, that is, you know who they are, what they are doing, and stay out of their game. Mike Maloney is dead spot on, as is Jim Sinclair and Jim Willie and as was Bob Chapman. They, aka “the elites”, want to own all the real resources when this debt driven cycle is driven off the road. Gold and silver have always been money and always will be. Otherwise, we all are forced to take the “mark” and we have bigger problems to deal with!

Very few Westerners think the way you do and the people you quote. These people are painted by the media as holding extreme positions, and being for the most part pretty crazy.

Much if not most of the gold in US ETFs is controlled by people who have weak hands. They are easily stampeded. And that is exactly what the Gov- Banker shorts are trying to do now that the strong hands from China and India are slowing their buying.

The Gov-Banks are going to keep shorting gold and silver until they find a strong bid under them. That may take awhile. Try not to let ideology overwhelm reality, even when you are ideology is true.

The west is decadent and about to implode.

Exactly to the T.

Your article on the Long Wave vs the printing press I found very helpful and your linking of kondratieff, long wave, Elliott wave and The fourth Turning which all point in the same direction was insightful. I am reminded of the saying, “no pain, no gain”. I actually sense there will be immense pain but coming out on the other side we will have returned to community, sharing, local government vs federal government, knowing and respecting our neighbours, modesty in all forms, self responsibility vs entitlement, knowing how to grow your own garden, patience, little debt, discipline, sharing and so many more positive attributes and behaviors both personal and on a national level. Tough that we have to go this way but I suspect it is in our human genes to have to go the “no pain, no gain” route, time will tell. Very good article, thanks Perry

If you have been taking something Perry please let me know what it is.

Poor Robert.

Perry,

That would be an ideal outcome. I could only wish that it were possible. I’m afraid though that we’re seeing the chaos which will eventually produce the one-world government that appear to be the inevitable outcome. What you paint is a very pleasant dream though. I wish we could live in the type of world you describe.

Way too optimistic, Perry. You will do as you are told or end up as Bantha fodder.

Holy Shite ! This is MAdness !!!