Government statistics are always suspect, for at least one obvious reason: Modern economies are way too big and complex to measure in real-time. So virtually every number is revised in the months after its release, frequently to the point of saying something very different. But by then lots of new data has come out and no one cares about the old numbers.

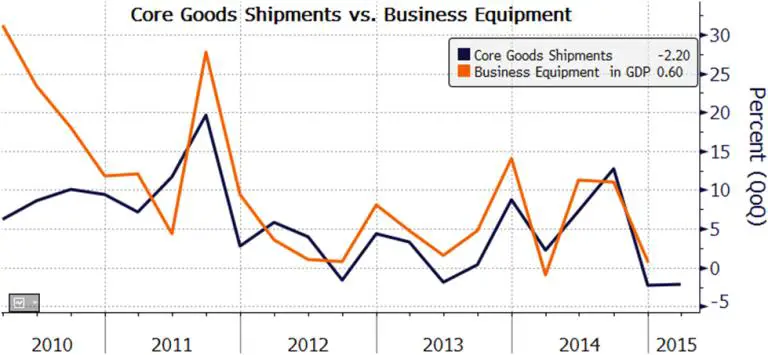

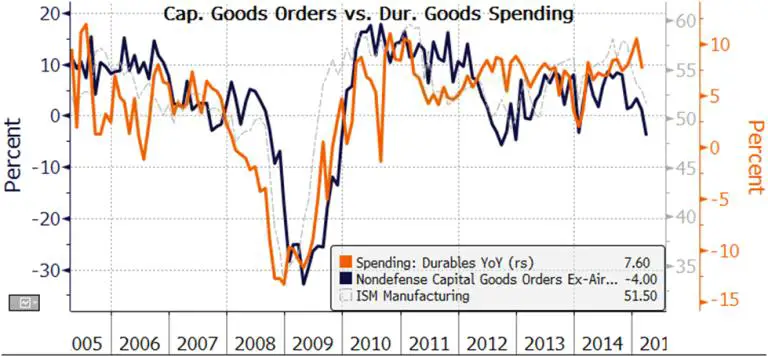

So to the extent that any government report is trustworthy, it’s the trend and not the data point that matters. And lately a whole slew of data points have been coalescing into downtrends that should be taken seriously. Today’s example is durable goods, which measures the health of US factories making big, long-lasting things like cars, planes and refrigerators. Bloomberg this morning put out a good analysis showing how “core” capital goods orders — for things that don’t bounce around by double-digit rates every month — is now firmly in a downtrend, featuring the following charts:

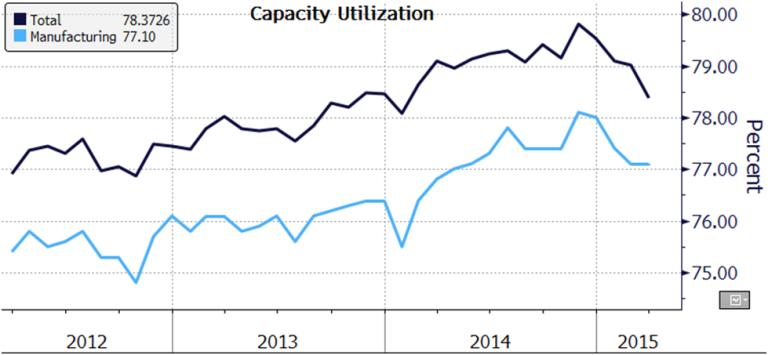

The obvious explanation is that the dollar’s exchange rate is way up, making US goods more expensive and foreign goods cheaper and leading the rest of world to buy less from us. Domestic factories are seeing their order books shrink and are as a result producing less. They’re also hiring fewer and/or firing more workers. And the downtrend seems to be gaining momentum. Core orders in particular turned down in mid-2014 and are now in free-fall.

Since the rest of the world isn’t likely to start buying larger quantities of US trains, planes and automobiles anytime soon, the trend probably won’t reverse without a favorable change in the terms of trade. That is, the dollar has to go down before US factories will pick up. And that won’t happen while the Fed is promising to raise interest rates (which would, other things being equal, boost the dollar).

So this looks set to continue until the Fed springs a surprise. And the longer that takes the bigger the subsequent reversal.

6 thoughts on "US Factories Crushed By Strong Dollar"

Then again, blaming the strength of the dollar may be like blaming the weather. Maybe the real problem is slowing global economic growth in general (decreasing demand). After all, the euro is “weak” and Germany’s (and all of the Eurozone’s) output is slowing in real terms, and the yen is also super weak and Japanese exports are still too low (especially in real terms) to stop Japan from circling the drain too.

Car manufacturers have been moving to Mexico to escape the Fed’s monetary policy as well as the wages and regulations. The Fed policy is killing industry and making the one percent rich creating a whole new underclass that’s are becoming more and more angry at our government who sits in the lap of luxury and caters to the high and mighty in the business community. When enough wake up, the next revolution will come and who knows how that will work out. The command and control polices are a failure and they keep doing the same thing over and over, seeing the same results. There’s a saying for that.

These policies work well for the Soviet Union, DOH!

The reason for the end collapse can be summed up in 1 sentence,….Gigantic & unpayable leveraged debt!

All of the Graphs & charts are background noise.The financial sector has run up so much leveraged bad debt that they can only end up in default.If they managed to cash in every possible piece of wealth from the the whole world the total sum available would still be less then the debts.

In a desperate attempt to somehow pay their bills the financial sector is squeezing the wealth out of the Middle Class.When the middle class is impoverished to the point at which it can no longer buy consumer goods the consumer economy will collapse!

When this happens the Welfare State will also go down!

Can anyone out there envision the political state of affairs that will ensue after even 1 card is pulled out of the center of our current economic ‘House of Cards’?

Blame Putin and North Korean hackers. Then print.