This morning’s housing report was huge. As one representative headline put it: “Housing starts up sharply; permits highest since 2008”.

Dig just a little deeper and it’s still huge, though in a different way. Turns out that all the increase was in apartment building, while single family homes — the linchpin of what used to be thought of as the American Dream — actually fell yet again. Here’s a brief but on-point analysis from the New York Times:

Housing Is Recovering. Single-Family Homes Aren’t

The headlines in the new report on home building activity — which is being closely watched, after many other kinds of data point to a softening in housing — are pretty terrific.The number of permits for new housing units soared 8 percent in April, the Census Bureau said on Friday, to an annualized 1.08 million. And the number of homes on which builders began construction rose a whopping 13 percent, to an annualized 1.07 million. If nothing else, the numbers help assuage fears that the housing industry is losing momentum. It now looks like the rough winter was indeed a major factor holding back home building activity so far this year, and there is now a spring thaw underway.

But even in the good new numbers, there is a clear trend evident: The entirety of the improvement is coming from more building of housing in structures with five or more units, most commonly rental apartment buildings.

The number of permits issued for single-family homes rose by a mere 2,000 annualized rate in April, where the number for units in these so-called multifamily structures rose by 81,000. The same story applies for housing starts, where the number of single-family homes rose a measly 5,000, versus 124,000 for multifamily units.

In other words, if you think that this housing recovery involves any meaningful increase in the number of traditional, suburban single-family homes with a yard and picket fence, you have it wrong. The number of single-family homes started is well below its level of late last year and still at February 2013 levels. Multifamily construction, meanwhile, has been soaring throughout the last five years.

Parsing more detailed data available for the first quarter, Jed Kolko, chief economist of real estate firm Trulia, notes on Twitter that 93 percent of the multifamily construction was intended to be rentals, and 89 percent of the units were in buildings with 20 or more units.

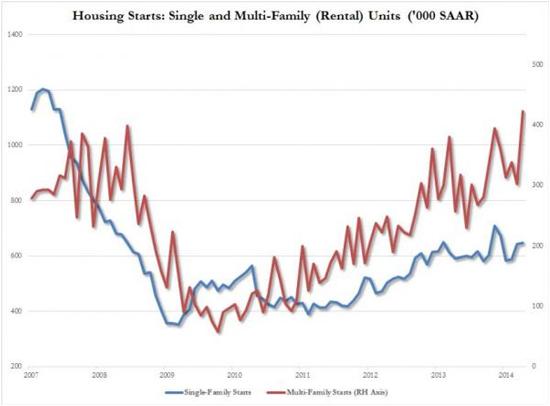

And here are some supporting charts from Zero Hedge:

United Renter States Of America: Spot What’s Wrong With These Housing Charts

The blue line is conventional, single-family housing starts. The red line is “New Normal”, “Blackstone is America’s landlord“:

Some thoughts

There are two ways of looking at this:

1) It’s a return to a more rational way of organizing a society in which people who shouldn’t buy houses don’t. Rather than borrowing huge amounts of money against modest incomes and inadequate assets, the typical American family will henceforth rent an apartment or small house until they’ve saved a hefty down payment, say 40%, and proved to themselves and a local bank that their income stream is highly predictable. This kind of world is better for all involved because it avoids the massive, family-disrupting upheavals that now occur with every “housing recession.”

2) It’s yet another signpost on the middle class descent into what used to be thought of as poverty, but is now the new normal. Owning a lot of stuff — house, new SUV, major toys like boats and sports cars — is beyond the reach of more and more families, and in place of this financial freedom-to-act-stupid is something akin to serfdom: dependence on one or several crappy service industry jobs that pay barely enough to cover rent and health insurance; college financed with student loans rather than savings; an inability to save enough to prevent a growing dependency on government and loan-sharky lenders.

In this scenario the US comes to resemble one of those old-style company towns where workers work to survive while their needs are met by dominant, paternalistic entities (government and hedge funds in this case) that charge exorbitant prices and high rates of interest, guaranteeing that most families fall deeper into debt over time.

Where a typical middle class American once had a realistic prospect of paying off their mortgage and thus owning a big, valuable asset free and clear while also saving other money to give themselves a reasonable retirement, both sides of that equation — homeownership and excess income that enables savings — are a thing of the past for a growing number of people.

Unfortunately, explanation number two looks more likely, which means in the absence of a surge of high-paying jobs, this Road to Serfdom will be very busy in the years ahead.

10 thoughts on "Welcome to the Third World, Part 14: Homeowners Become Renters"

Owning is have a clear title; no debt. Possessing things is made much easier with easy credit. Possession is not ownership, if there is outstanding debt. What ones possesses, in most cases, is over time worth less than the unpaid debt. $20,000 of purchases on a credit card might net $700 – $1,500 in a yard sale, as most of what we get on credit is consumed/or becomes obsolete. Even things that last, say oak furniture, won’t get that much when on your front lawn in the sale. Driving in a McMansion suburb, the houses, vehicles in the driveways and fancy decorations looked like wealth, but really it was credit/DEBT, that was demanding interest, even as items were wearing out, being used up or becoming obsolete. Because it seemed to be deserved, the ancient notion of living below your means in order to have a down-payment never crossed most people’s mind. The goal is to own the ranch; but with refinancing – people were betting the ranch on feel-good optimism. Oops. Enter the old religion: “Neither a borrower nor a lender be.” Since banking profits became based on transaction fees and not the ultimate pay-off of the loan to get the interest, the more credit extended – the better. Oops. Welcome to debtor hell. Credit is absolutely necessary in an economy, but when the risk strategy is to charge those that do pay more in rates and fees, thus to cover losses to crime, fraud and customers who should not have been granted credit, we have a toxic business model. Financialization – throw out those money changers which are parasitic.

There is another dimension to this – real estate taxes. My RE taxes went from $1900 per yr to over $13,000 per yr and there is no end in sight here in NJ – the most insolvent state in the union.

You become a tax cow living in a milking stall in their tax milking barn. They need more – they take it. And the unions get theirs and the politicians get theirs…

Thankfully we can still pull up stakes and move. But the US has made it very difficult to leave the US because you always still owe taxes.

Load 16 tons and what do you get? Another day older and deeper in debt. We have and are being sold out to China lock, stock and barrel. Russia is in there somewhere. Preplanned? …so I have been reading as of lately. Thank you NWO…may an AK be put up yours where the sun doesn’t shine.

I wrote this earlier today: http://seekingalpha.com/article/2223563-beneath-the-headline-reports-housing-starts-data-appear-bearish

The situation is even worse than as described by the author above. Single family home sales are going collapse. That’s why Mel Watt is going to try and reinflate the role of Fannie and Freddie. We’re also starting to see the return of “liar” loans on FHA refis and the return of 125 LTV paper.

This will end very badly.

True. Take a look here: http://confoundedinterest.wordpress.com/2014/05/16/u-s-housing-starts-rise-13-2-in-april-back-to-1991-levels-mostly-multifamily/

None of this is happening by accident. The currently unfolding plan is to create a

functional world government within the framework of the United Nations. Often

referred to as The New World Order by its advocates, the proposed

global government is designed upon the principles of collectivism.

One of the firs tindustries to feel the raw power of “emergency measures” was the home

industry. During the early stages of inflation, people were applying their increasingly

worthless dollars to pay down their mortgages. That was devastating to the lenders. They were being paid back in dollars that were worth only a fraction of the

ones they had lent out. The banking crisis had caused the disappearance of savings and investment capital, so they were unable to issue new loans to replace the old. Besides, people were afraid to sell their homes under such chaotic times and, if they did, very few were willing to buy with interest rates that high. Old loans were being paid

off, and new loans were not replacing them. The S&Ls, which in the 1980s had been in trouble because home prices were falling, now were going broke because prices were rising.

Congress applied the expected political fix by bailing them out and taking them over. But that did not stop the losses. It merely transferred them to the taxpayers. To put an end to the losses, Congress passed the Housing Fairness and Reform Act (HFRA). It converted all Bancor-denominated contracts to a new unit of value—called the “Fairness Value”— which is determined by the National Average

Price Index (NAPI) on Fridays of the preceding week. This has nothing to do with interest rates. It relates to Bancor values. For the purpose of illustration, let us convert Bancors back to dollars. A $50,000 loan on Friday became a $920,000 loan on Monday. Few people could afford the payments. Thousands of angry voters stormed the Capitol building in protest. While the mob shouted obscenities outside, Congress hastily voted to declare a moratorium on all mortgage payments. By the end of the day, no one had to pay anything! The people returned to their homes with satisfaction and

gratitude for their wise and generous leaders.

That was only an “emergency” measure to be handled on a more sound basis later on.

Many months have now passed, and Congress has not dared to tamper with

the arrangement. The voters would throw them out of office if they tried. Millions of people have been living in their homes at no cost, except for county taxes, which were also beyond the ability of anyone to pay. Following the lead of Congress, the counties also declared a moratorium on their taxes—but not until the federal government agreed to make up their losses under terms of the newly passed Aid to Local Governments Act

(ALGA).

Renters are now in the same position, because virtually all rental property

has been nationalized, even that which had been totally paid for by their owners. Under HFRA, it is not “fair” for those who are buying their homes to have an advantage over those who are renting. Rent controls made it impossible for apartment owners to keep pace with the rising costs of maintenance and especially their rising taxes.

Virtually all rental units have been seized by county governments for back taxes. And since the counties themselves are now dependent on the federal government for most of their revenue, their real estate has been transferred to federal agencies in return for federal aid.

All of this was pleasing to the voters who were gratified that their leaders were “doing something” to solve their problems. It gradually became clear, however, that the federal government was now the owner of all their homes and apartments. The reality is that people are living in them only at the pleasure of the government. They can be relocated to other quarters if that is what the government wants.