Written by Bryan Lutz, Editor at Dollarcollapse.com:

Every time the Federal Reserve holds a meeting, Powell gets behind the podium and makes a point of giving the general direction our economy is supposed to go.

This week, the direction was more clear than normal.

The New York Times reports:

Fed Chair Powell Still Expects to Cut Rates This Year, but Not Yet

“We believe that our policy rate is likely at its peak for this tightening cycle,” Mr. Powell said during testimony before the House Financial Services Committee. “If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

Mr. Powell’s comments on economic policy were largely in line with what markets have been expecting. Policymakers raised interest rates in 2022 and 2023 to slow growth and bring inflation under control, and they have been signaling for months that they could soon begin to lower those rates as price increases cool. Fed officials have also been clear that they do not want to begin cutting borrowing costs prematurely, and have kept their options open on timing.

But while Mr. Powell said little that was new about the rate outlook, he made significant news on another topic: bank regulation.”

The Fed will cut interest rates some time this year, but the fact is, the Fed can’t raise rates anymore.

Anymore raising rates, and liquidity would get sucked out of banks causing two things:

- More Bank reserves would go towards paying debt leading to defaults, and more bank crises.

- Banks would have less cash to loan for the profits they need to pay bad loans.

So Powell wants more bank regulation.

Why does Powell want more bank regulation?

Because the Federal Reserve needs to spread the distribution of new money out across the profitable banks, and the banks with losses.

If they can do that, there might be better opportunity to manage the losses some banks are taking from bad loans.

While at the same time, banks doing well will soon be required to purchase a certain amount of debt from the Federal Reserve every year.

You see, whenever the Federal Reserve drops interest rates, it usually happens within a year, or less.

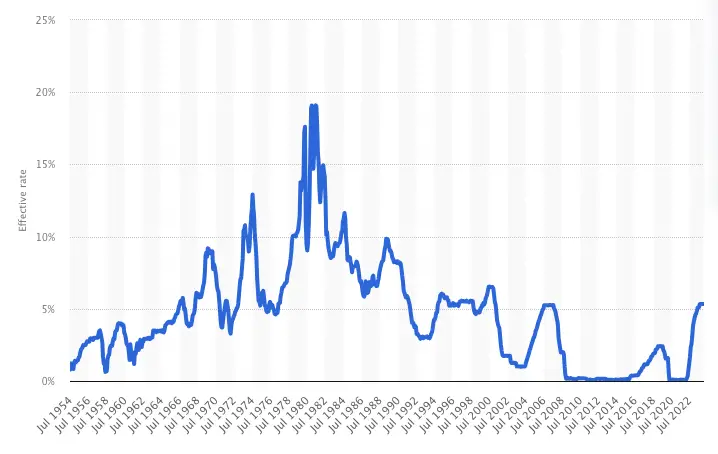

Here’s what Statistica shows the rate cycle history looks like from 1954 to 2022:

So more funny money will be floating around the market…

Quickly.

Maybe this time’s different though.

Maybe with more centralized banking, regulation, and market intervention we will conquer a crash.

Maybe the finger pointing Fed is a kind, paternal direction after all?

Or, maybe the Fed has been looking out for its own relevance – it’s own interests…

Best to hedge against the fiat system in my opinion.

Soon, we’ll be releasing a serve we think will help protect and prosper your wealth.

The video driven portfolio service will mainly focus on what’s stood the test of time over the past 5000 years…

GOLD…

Silver, and other resources.

Talk to you more about it in the coming week.