As negative interest rates spread from Switzerland, Japan and Germany to the rest of the developed world, people with money to invest face some life-defining choices.

Retirees who need to generate 6% to avoid dipping into principal can’t get there with bank CDs. Pension funds that have promised an 8% return in order to meet obligations to future retirees can’t get anywhere near that with government bonds. Same thing for insurance companies and money market funds, whose business models require positive returns with low risk.

What to do? Well, a retiree can either stop being a retiree — that is, go back to work — or invest a lot more aggressively to meet the required 6% return. That means loading up on equities and junk bonds, either blithely because she doesn’t know what they are (only that they’ve been going up) or with trepidation because she’s aware that every five or so years these things tend to crash.

For public companies, building new factories no longer pays as well as borrowing money and using the proceeds to buy back their own common stock. Pension funds, meanwhile, have more options though the end result is the same. They can, like our hypothetical retiree, load up on equities, as Japanese pension funds are reportedly doing…

Japan Pensions Sell Record $46 Billion Bonds to Buy Stocks

(Bloomberg) — Japan’s public pension funds, which include the world’s biggest, accelerated their push to dump local bonds and invest the money abroad to a record pace.The $1.1 trillion Government Pension Investment Fund and its smaller peers almost doubled net sales of Japanese government bonds to 5.56 trillion yen ($46 billion) in the fourth quarter, the most in Bank of Japan figures dating back to 1998. They bought an unprecedented 2.39 trillion yen of foreign stocks and bonds. Selling of JGBs and buying of overseas securities has continued for six straight quarters.

GPIF posted its largest investment gain in almost two years last quarter after shifting more money into stocks from Japanese bonds, as it came under government pressure to boost returns to cover payouts for the world’s fastest-aging population. The Federation of National Public Service Personnel Mutual Aid Associations, last month said it will boost its investments in foreign stocks and bonds and cut exposure to domestic debt, matching the plan by GPIF.

…or they can wander even further into the “alternative” investing universe by hiring hedge funds to generate “alpha.”

As Hedge Fund Returns Falter, Money Continues to Flow In

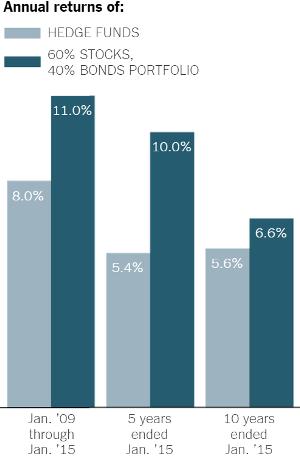

(New York Times) — Another year, and another mediocre performance by hedge funds, to put it kindly. The Barclay Hedge Fund Index gained a meager 2.89 percent in 2014, while the Standard & Poor’s 500-stock index gained over 13 percent and the Barclays United States Aggregate Bond Index rose over 5 percent.Even as their high fees have minted scores of new billionaires, hedge funds have now substantially underperformed a simple blend of index funds — 60 percent stocks and 40 percent bonds — for three-, five- and 10-year periods. And the 10-year numbers cover the period of the financial crisis and the sharp decline in stocks — the very calamity that hedge funds are supposed to protect against.

No wonder Calpers, the giant California retirement system, withdrew from hedge funds last year. I assumed that by now, many other big pension funds and institutions would be following its lead.Weak performance notwithstanding, “Investor interest in hedge funds has been continuously accelerating since the financial crisis,” said Peter Laurelli, vice president for research at eVestment, “and it has really picked up during the past two years.”

Mr. Laurelli mentioned two factors driving the trend: still-agonizing memories of the financial crisis and the persistent low interest rate environment. While the sales pitches for different hedge fund strategies vary, many funds promise to address both issues by blunting the impact of another market crash, while generating higher returns than United States Treasury bonds.

Institutions are not only pouring more money into hedge funds, but they also appear to be engaging in a classic pattern of many individual investors, which is to chase returns and shun losers. Last year, investor money surged into so-called event-driven strategies, like those pursued by the activist investors William Ackman and Daniel Loeb, who have had a string of recent successes. (A net $42.5 billion flowed into event-driven strategies, according to eVestment.) And after six months of strong results after years of underperformance, managed futures strategies (which make bets on commodities and other futures contracts) gained $4 billion in January alone.

At the same time, long-short equity strategies (funds that take both long and short positions in stocks) faced $7.5 billion in net outflows in January after far underperforming the S.&P. 500 in 2014.

“Most hedge fund investors are momentum investors,” Mr. Lack said. “The only data they have is performance data, so they chase returns. You don’t have many consultants out there saying you should invest in out-of-favor hedge funds. But there’s never going to be a good outcome with that approach.

There’s an enormous amount of research that shows hedge fund returns aren’t persistent. They revert to the mean. Of all the hedge funds I looked at, only 7 percent were consistently in the top 40 percent. What chance do you have of picking them?”

In the world of aggressive investing, retirees, corporations and pensions funds are all “dumb money.” They don’t do this kind of thing regularly so they have no institutional or personal experience to draw upon. The result, for pension funds and retirees, is the quintessential beginner strategy of trend following, buying what was hot last year because that’s where the biggest returns are being generated, while public companies are being even dumber, buying stocks on margin (i.e., with borrowed money) without regard for valuation.

Similar things happened during the previous bubble, when individuals became real estate speculators, pension funds embraced alternative investments, and corporations ramped up their share repurchase programs. All got creamed in 2008. Will this time around be any different? Definitely. It will be much worse because the numbers are so much bigger.

16 thoughts on "We’re All Hedge Funds Now"

On the business news we continue to hear they need their taxes reduces but yet they have enough money to buy back their stocks so when will the Republican workers wake up and relaize that they are being played? Most importantly, when will the small business community rebel with the workers against the party of no? If you raise their taxes they will find a place to put them and that usually is in a write off to expand and improve. They and the wealthy have had a free ride for to long and if they want a war and pay down the debt they have to step up or see an America slip further with a broken government with no infrastructure. It’s time to reign the unearned income and downsize the financial sector and get the money recycled into our education system, small business loans, and infrastructure.

The Great Moderation merely generated an asset market roller coaster, which gave birth to the hedge fund bubble industry. This is what happens when a fiat currency becomes untethered to economic reality.

I didn’t fivish the article because I didn’t understand this: “Public companies are finding that investing in their current business doesn’t pay nearly as well as borrowing money and using the proceeds to buy back stock.”

How can that be? Please explain.

I assume that means the comoanies own stock, right?

You’re right, that sentence is unclear. See if the revised version makes more sense.

You’re right, that sentence is unclear. See if the revised version makes more sense.

If you’re a company, you can do a couple of things with retained earnings and borrowed money. You can invest that money in initiatives designed to grow the company and create greater profits. That typically involves coming up with innovative development plans, investing in plant and equipment, hiring people, etc.

OR, you can use retained earnings … cash in the till… and borrowed money (costs you almost nothing now if you’re big big company) and use it to buy your own stock back.

When the company buys back stock, those shares are retired. That means fewer shares are now outstanding. That means fewer pieces of the pie to divide earnings among. So, the company’s gross earnings may be the same as before. They may not be making any more money, but when divided PER SHARE, they look better (P/E ratio goes down making the stock look like a better value), again, because there are now fewer shares. T

The stock goes up in price because the company is buying, bidding up the price, and earnings per share look better, which attracts more investors

And voila, with its higher price, the company is worth more without doing anything to create one penny of additional value.

This is financial engineering … a rather disgusting feature of late stage degenerate capitalism … disaster capitalism … fostered by the Federal Reserve.

The executives do this because they don’t have to take the risk of a profit seeking initiative failing or taking a long time to pay out … god forbid. That’s old fashioned real capitalism and is so very 20th century.

But it’s mostly because they get rewarded with options to buy stock at set prices ABOVE the market. They’re just given these as an incentive to do something to boost share price. They have to get the price up. because If it doesn’t climb above the price at which the options are awarded, they’re worthless.

So … hmmm … how to get the stock price up? Build a bigger, better more profitable company via old fashioned creativity, capital investment and good management? Hell no. You just borrow a slug of money and buy tons of your stock, which forces the price up high enough for your options to vest … and just like that, you’re rich.

Clear now?

If you’re saying to yourself, “That’s sick,” you’re right … and my work here is done.

Thanks for your reply. But my first reaction is that “financial engineering” has nothing to do with capitalism – “late” or early. It’s just financial fiangling. Period.

Secondly, I can’t believe most investors don’t know what you just said about boosting stock stats by “insider buying.” That isn’t new nor is it private knowledge.

Thirdly, the article is about ways to increase returns but what you’re saying is that only the executives are increasing returns by this scheme, not that the corporation is actually more profitable than making capital investments. I guess that’s the insight I was missing. It’s not more profitable for the companies in general, only for the executives.

Sick? I guess. But I would say it’s more an example of the market not being that efficient and that most investors are dumb, although most of those these days are just company treasurers. But still.

You have executives confused with corporations, executives are not the ones buying stocks, the corporation is.

That’s a difference that makes no real difference, only a legal one. That is what “corporate personhood” is all about. Individuals operate as only they can and must and yet their actions are hidden or protected behind the corporate “veil.”

Besides, it really doesn’t matter who “actually” buys the stock, the point is that the executives benefit from the performance of the stock no matter how those benchmarks are reached.

“It’s not more profitable for the companies in general, only for the executives.”

not quite, it benefits all the shareholders in the short term since it provides liquidity for those who want to sell while increasing the unrealized capital gains for those who continue to hold.

in the long term, it is a complete disaster because the purchases are not motivated by long-term considerations like valuations or building sustainable competitive advantages. typically, corporate stock buybacks peak near market tops and shrink dramatically near market bottoms.

IMO, the uncertainty created by the Fed tends to push everyone to favor short-term thinking over long-term thinking.

One simple way to understand this is for many companies ZIRP makes it cheaper and easier to borrow money (practically for free), then buy back shares reducing their outstanding dividend liabilities, all the while with lower risk than other investments to grow the company.