I have a theory about technical indicators, which is that most people only pay attention to the ones that confirm what they already think. Technicals are primarily entertainment, in other words. But every once in a while a market’s charts, graphs, and images line up in a persuasive way, and for U.S. stocks this looks like one of those times. A few examples:

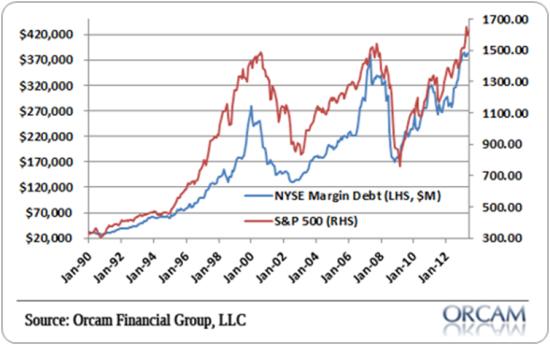

Margin debt

This is a measure of how much money investors have borrowed against their stocks to buy new stocks. The more exciting their recent gains, the more willing they are to borrow. By definition, they’re most excited when stocks have been going up for a long time (otherwise stocks would have stopped going up), so high margin debt tends to precede big corrections. Today, margin debt is just shy of 2007’s all-time record.

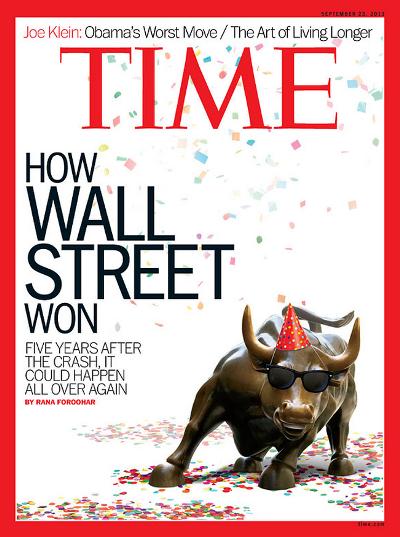

Magazine cover hyperbole

The big consumer magazines are known for being inappropriately excited or depressed at major market turns. Businessweek’s “Death of Equities” cover – just before the beginning of the 1982-2000 super-bull market – is the most notorious. Time came in a close second with its “Home Sweet Home” cover just before the housing bubble burst, and is now back with a cover titled “How Wall Street Won” – though its subtitle, “Five years after the crash, it could happen all over again,” implies that the editors may be hedging their bets. This isn’t a perfect example of magazine hubris, but is close enough for our purposes.

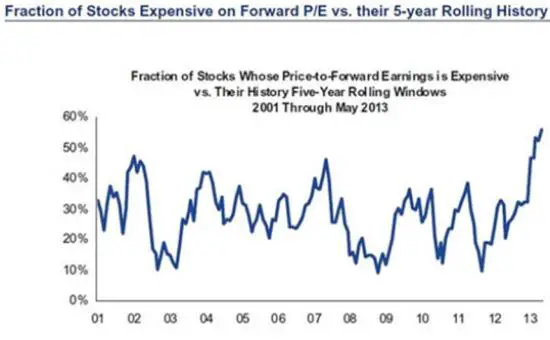

Excessive P/E ratios

Another measure of investor (over)confidence is the amount they’re willing to pay for a given dollar of public company earnings. When pessimistic they’re not willing to pay much at all, but when convinced by a few years’ of nice gains that they’re geniuses, they’re willing to pay a lot. Currently, according to Gordon T. Long of Macro Analytics, they’re willing to pay even more than in 2007, just before the world almost fell apart.

Consumer Sentiment

Various organizations like to survey US citizens about how they’re feeling and what they intend to buy in the year ahead. They then cook the responses down to a “consumer confidence” number that analysts use to predict retail sales and GDP growth. As you can see from the following chart (also from Macro Analytics’ Gordon T. Long), consumers have been repeatedly coaxed out of depression by successively larger rounds of money printing, only to collapse back into despondency when the resulting bubble bursts. Each peak has been lower, implying that stimulus is losing its potency. If the pattern holds, the top is in and another collapse is imminent.

Broadening triangle on the Dow

This one is from David Chapman, manager of the Millennium Bullion Fund. As he describes it in a recent SafeHaven article:

A broadening triangle pattern is rare and if it does occur it normally is not seen over such a long period of time. This pattern saw its first peak in 2000 (A) followed by the initial bottom in 2002 (B) followed by the huge 5 year rally that topped in October 2007 (C) then the 2008 financial crisis crash (D). The current rally that got underway in March 2009 could soon make its final top (E).

A bearish broadening or expanding triangle would normally break down through the bottom of the triangle and have objectives that could in theory equal the widest point of the triangle. In this case, that would be D to E. This scenario could result in a complete collapse of the DJI. Some technical analysts such as Robert Prechter of Elliot Wave International www.elliotwave.com and Robert McHugh of McHugh’s Market Forecasting & Trading Report www.technicalindicatorindex.com have long been forecasting a potential final top to the current Grand Supercycle and that it could culminate in a huge financial collapse. This appears to fit their model.

11 thoughts on "Terrible Technicals"

America needs to claim back money creation, issuance, and destruction powers back to itself and stop paying a non-federal corporation to terrorize the markets. Default on the debt, say sorry, re-issue real USD based on the value of the USA itself. Destroy money through taxation to control inflation. Done.

As I’ve said before, I don’t know any one who doesn’t think that a major stock and economic crash is coming. It’s just a question of timing. However, at the same time everyone also acknowledges that things seem to be getting better (e.g., housing prices are rising, sales are picking up, construction in general seems to be accelerating, etc.) That said, if I had to characterize the behavior of the financial markets since 2009 I would say that they have acted almost exactly opposite to what I considered rational (other than simply following the Fed’s lead). The perversion of logic, cynicism, short-term thinking, naiveness, and absolutely grotesque dysfunction, greed and corruption has reigned. Therefore, I would not be surprised if all of these conventional near-term market predictions are completely obliterated this time. Not that things will continue onward and upward forever but that a totally different framework is in play now that can’t be predicted by past behavior.

I would also add that a lot of people/investors have become a lot more aware and educated about macroeconomics and monetary policy in the last few years so the traditional patterns of behavior are changing, partly because the laws or rules of the game have changed. Prechter, et al have been predicting a market crash for years based upon past market behavior and their timing predictions have been off repeatedly. One reason could be that, in Prechter’s case at least, unprecedented fiscal and monetary policies have been the driving force, policies that Prechter believed were politically impossible just a few years ago.

And then there is the constant backdrop of a thousand different voices spouting a thousand different opinions. For example:

“You need to realize…” says one radio host of an investment show, “…that everything going on in Washington and with the Fed has no effect on your daily life and will prove to be just a blip on your financial life in 10 or 20 years from now, because productivity all over the world is booming and millions of new people every year are becoming middle class and demanding Western/American lifestyles.”

But then the same radio host also says on different day, “Here’s what you need to understand: The politicians in Washington know that the US is due for another recession, but they don’t want it to hit during the 2016 Presidential election, so they’re trying to make it happen next year to get it over with.”

Or, a financial newsletter writer writes, “It is much easier to make money if we assume something that is already happening will continue to occur, rather than fearing or hoping something that is not happening will begin to happen.”

Fed is the whale in the market. Money from QE had gone straight to the stock and bond markets, with a bit of leakage into main street. Whales move markets but cannot get out of the market without upsetting them. It is easy to buy but difficult to sell. In Fed’s case, Fed could not even stop buying bonds. All assets depend on Fed to continue pumping money as they are not productive assets. Fed had made a mistake by not ensuring money goes into productive industries like manufacturing.

Absolutely correct on the first part. As to the mistake part, that presumes the Fed’s goal is to help the economy. It is not. They were created by the banks for the banks. All that matters to the Fed is that the banks make money and have a reliable backstop when they go all casino on us and lose all their chips.

That is the problem with elites nowadays. They try to hide their real intentions by saying they are trying to help the poor and downtrodden. Take for example, the TARP dispensed by Hank Paulson. According to David Stockman in his book ‘The Great Deformation’, most banks would have remained solvent during the GFC and TARP is not required. Those banks that required rescuing are the well known ones like Goldman, JP Morgan, etc which dabbled with derivatives. Hank’s reason that US will go into depression if TARP is not approved by Congress was not correct. Those banks that would go bankrupt should have been nationalised and bond and shareholders zeroed out. These banks should then be recapitalised and relisted. It would have cost taxpayers less and the finance industry would have gone through deep cleansing. The economy would have been re-vitalised and money pumped in later by Fed would have gone into real productive industries instead of some good for nothing financial products as no one will not touch them, not even with a ten foot pole. I think the self serving elites need to know that being rotten smart is not good. A good system is good for everyone. A bad system is bad for everyone. If they continue to be rotten smart, then one day they will be living in a rotten country.

Note that the Wilshire 5000 has completed it’s expanding triangle. So which is the better read on the state of the stock markets, the Dow with its 30 stocks or the Wilshire 5000 with pretty much all the stocks.

Bill