“If you want to spend time saying this is cool, you’re going to get your ass kicked.“

~ Phil Knight, Founder of Nike

Written by Bryan Lutz, Editor at Dollarcollapse.com:

Nike is a household name.

And with $250+ sneakers, an almost luxury brand at that, but how did the brand get there?

Everyone knows “Just Do It.”

Here’s how they’re representing the “Just Slowing Down” Economy.

Their Founder, Phil Knight, grew the brand and following through what he calls “guerilla warfare.”

You could call “guerilla” underground, subversive against the norm, or the start of plain ol’ celebrity endorsements.

Endorsements like Nike’s 1984 partnership to produce the ‘Air Jordan’ shoe.

Over thirty three years later, the shoe has become a classic, but now…as a new generation forgets the who and what Michael Jordan accomplished, Nike’s “cool” is melting.

While competition against new shoe brands like On, and Hoka may be a new reality, tougher sales mean consumers aren’t as willing to splurge on luxury brands – a sure sign of recession.

Bloomberg reports:

Nike’s Aging Sneaker Models Feel Heat From Upstarts On, Hoka

“Nike Inc. warned that sales will take a hit as it responds to a growing challenge from upstart running-shoe brands like On and Hoka that have exposed the US sporting-goods company’s reliance on classic basketball models such as the Air Force 1.

The world’s largest sportswear retailer expects revenue to fall by a low-single-digit percentage in the first half of its fiscal year, which starts in June. Analysts had projected a 4% rise in the first quarter and a 6% gain in the second, according to estimates compiled by Bloomberg.

Nike shares fell 7.5% at 9:42 a.m. on Friday in New York, and they’re down 16% for the past 12 months.”

But lately, mainstream news isn’t focusing on recession.

This year, the news is focusing on competition and Nike’s need to produce new products. This is most likely just information backed by Nike’s $1 Billion in Marketing and Public Relations expenses in the first quarter of 2024.

Last year, the story was much different.

Americans spent big money while stuck at home during the pandemic “pump economy.”

They received stimmy checks.

They saved.

And they splurged a little.

Now, as inflation staples into the economy, more competition arrives, Americans just don’t have the money to spend on $250+ shoes ($175 on sale).

Bloomberg reports:

The Sneaker Bubble Is Bursting Around Nike

“Few companies benefited from government largesse during the pandemic era more than Nike Inc. Stuck at home and with little else to spend their trillions of dollars in stimulus money on, consumers couldn’t get enough of what the athletic-gear maker was selling.

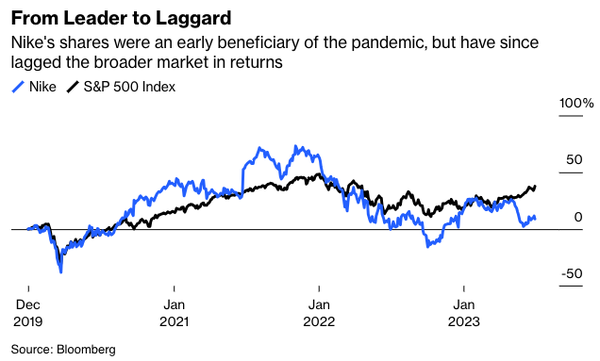

In 2020, Air Jordan 1 Highs were going for a 61% premium on the resale market. Nike’s share price soared 40% in 2020 and as much as 25.5% in 2021, reaching a record high that November.

Those heady days are long gone. Nike’s shares have tumbled 37% from their peak.”

Nike plans to make up the losses the same way many other companies are already choosing to do so. By laying off employees Nike plans to make up for their losses by $2 Billion.

““We know Nike’s not performing at our potential,” Chief Executive Officer John Donahoe said on a conference call with analysts. “It’s been clear that we need to make some important adjustments.”

Donahoe outlined a restructuring plan in December to cut $2 billion in costs over the next three years in response to weaker sales. Nike said in February that it would slash 2% of its global workforce as part of the plan, with layoffs to take place over two phases.”

While the signs of a recession are popping up more and more, (such as the declining sales of luxury items like Nike shoes) the prudent will have already cut down their personal expenses.

Nike is responding to the market, but the market is not you.

You control your expenses before your money hits the market.

“Just Slow Down” on spending before the economy forces you too.