Coming into this corporate earnings season, everyone seemed to expect disappointment. But they thought it would come from the energy sector and the banks that had lent that sector way too much money (see Goldman Sachs is a flattened slug).

Technology was, as always, thought to be immune to the vagaries of the Old Economy. But apparently what’s bad for Exxon and Caterpillar is also bad for Google and Microsoft. Here’s what Big Tech is doing this morning:

Why the sudden carnage? Various reasons, including a strong dollar (Microsoft) which makes US software more expensive for foreign buyers, the decision by several big players to ramp up growth in hot divisions at the cost of lower profits (Google and as usual Amazon), and rising competition in niches like video-on-demand (Netflix’s share price is down 30% in the past year).

But the strong dollar is by far the most common complaint. Take Microsoft’s surprisingly weak Q1 report:

(Ars Technica) – Microsoft posted revenue of $20.5 billion in the third quarter of its 2016 financial year, down 6 percent from the same quarter a year ago. Operating income was $5.3 billion, a 20 percent drop, net income was $3.8 billion, down 25 percent, and earnings per share were $0.47, a 23 percent decline.

Over the past few quarters, Microsoft and other tech companies have reported significant impact from the high value of the US dollar and have offered equivalent financial figures that show what their numbers would have been had the value of foreign earnings not been eroded by this conversion. This currency impact was estimated as reducing revenue by about $0.8 billion. The company also reports that there was a $1.5 billion impact from a combination of revenue deferrals due to Windows 10 upgrades and restructuring charges. Excluding this impact, and assuming constant currency values, the company says that its revenue was $22.1 billion (up 5 percent), operating income was $6.8 billion (up 10 percent), and net income was $5.0 billion (up 6 percent).

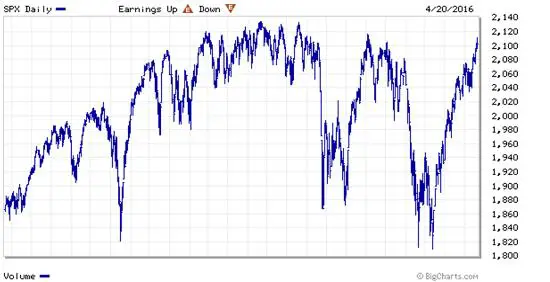

Now the question becomes, if Google and Microsoft are underperforming, what’s left to push US equities higher? The chart below illustrates the dilemma facing the S&P 500. Repeated stabs at the 2200 level have failed, with the latest beginning to roll over this week. The implication: The next leg up, if it’s going to happen, needs a catalyst of some sort.

So let’s consider some possibilities.

First, given the inverse relationship between interest rates and the value of corporate stock dividends, you’d expect falling interest rates to result in higher stock prices. But a consensus seems to be forming that monetary policy in general and zero-to-negative interest rates in particular have stopped working. Here’s an excerpt from Mervyn King Joins Central Banks Seeing Limits of Monetary Policy.

(Bloomberg)- Former Bank of England Governor Mervyn King added to calls by central bankers to recognize that monetary policy is close to its limit, saying the world faces a “major disequilibrium.”

Central banks need to “argue much more forcefully than they are doing that the answer is not monetary policy,” King said in an interview Wednesday on Bloomberg Television’s “The Pulse” with Francine Lacqua.

While policy makers have bought time, they can do little more, he said, noting that the introduction of negative interest rates by some central banks demonstrates they are facing “diminishing returns.”

King’s comments come amid increased questioning of monetary policy’s effectiveness even within the central banking world. Reserve Bank of Australia Governor Glenn Stevens said on Tuesday that “maybe we need to be clearer about what we can’t do,” and Stephen Poloz, who heads the Bank of Canada, said policy might be “close to its maximum ability.”

Mark Carney, King’s successor at the BOE, told lawmakers in London Tuesday that officials have room to cut the U.K.’s benchmark rate still further. Policy makers last reduced it, to a record-low 0.5 percent, under King’s tenure in 2009.

Let’s assume that this is true, and that falling interest rates aren’t going to ride to stocks’ rescue anytime soon. To push the S&P 500 beyond its current record level, then, a major buyer or group of buyers will have to analyze US equities, accept that interest rates aren’t going to fall further, and decide nevertheless to go long the market. Two logical candidates are foreign investors and US corporations. The first, according to recent reports, is not looking good, while the second is a maybe.

Chinese investors dump U.S. stocks, but corporate buybacks offset losses

(MarketWatch) – Last year, Chinese investors dumped nearly all the stocks that they had acquired over a span of seven years and are likely to remain cautious this year amid ongoing financial market volatility at home. But aggressive stock buybacks by U.S. companies flush with cash will likely offset the sting of waning Chinese appetite, according to Goldman Sachs.China accounted for $96 billion in sales of U.S. stocks in 2015, wiping out almost all of the $97 billion purchased between 2008 and 2014, said David Kostin, chief U.S. strategist at Goldman Sachs, in a recent report. That is more than half of the $171 billion in U.S. equities sold by foreigners last year with much of the Chinese exodus occurring in the fourth quarter.

“Investors in China also sold $130 billion of U.S. debt securities in 2015, suggesting an overall reduction in U.S. investment from China rather than a rotation from U.S. equities to bonds,” he said.

The steady decline in oil prices accelerated U.S. stock sales with outflows from Canada and the Middle East hitting their highest levels since 2004.

Canadians sold $80 billion in U.S. stocks, contrasting with $3 billion in purchases in 2014. Investors from the Middle East sold $39 billion worth last year, nearly doubling the $20 billion in sales in 2014.

“Despite a low positive correlation between oil prices and flows from the Middle East, the drop in oil prices appears to have magnified U.S. equity outflows from both the Middle East and Canada,” said Kostin.

Goldman estimates that international investors will divest a total of $50 billion worth of equities this year, the second year in a row that foreigners are net sellers.

Still, corporate buybacks are expected to more than make up for dwindling foreign interest with U.S. companies projected to repurchase $450 billion in shares this year. That is below 2015’s $561 billion but above the average of $360 billion buybacks between 2011 to 2015.

“With the U.S. economy expected to grow at a modest 2% pace and cash balances at high levels, firms are likely to continue to pursue buybacks as a means of generating shareholder value,” said the strategist.

J.P. Morgan Chase, Rockwell Automation, and Bank of America have all announced sizable stock repurchase plans in the past couple of months with more companies likely to follow suit. Among the most scrutinized will be Apple, which could release its capital allocation plan as early as Monday when it reports fiscal second-quarter earnings amid expectations that the company may boost its buyback program by $40 billion to $50 billion.

Goldman Sachs expects the S&P 500’s earnings per share to rise 9% to $110 in 2016 from $100 in 2015.

We can of course dismiss Goldman’s EPS projection out of hand. Corporate operating earnings are more likely to fall by 9% than rise by any amount in 2016, based on Q1 results (see below). So for earnings per share to rise by 9% would require financial engineering on a supernatural scale.

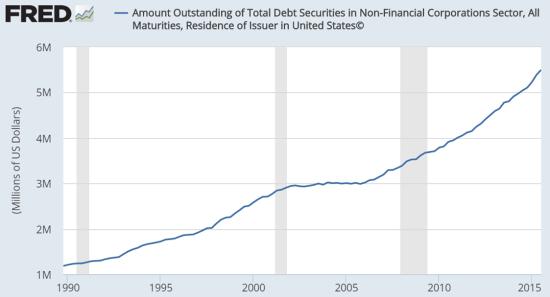

And what about all the cash corporations are supposedly sitting on? It turns out that most of it came from borrowing, which means it’s not really cash at all, but simply the asset side of an asset/liability entry that nets to zero. Assuming there’s a limit to how much companies can borrow before new debt spooks investors and becomes a net negative, then that point is, if not near, at least closer than ever before.

Add it all up — a strong dollar that hampers exports, already-high US equity valuations, foreign investors souring on US financial assets, corporate debt at five times the 1990 level — and catalysts for another up-leg are scarce. But catalysts for the next crash are many.

7 thoughts on "Tough Day For Tech Stocks — Tough Year For The Rest Of The Market?"

You can’t increase the GDP using low interest rates without velocity…..

A question for everyone: is the recently confirmed global Draghi put (http://www.zerohedge.com/print/529561) as dangerous as I fear. Will this action potentially distort all commodity pricing around the world? If Draghi can prop up equity and bond prices on a world-wide basis irrespective of market internals, we might not see any meaningful correction for years. John, I hope you explore the implications of this action in a future note.

Bill I believe you are right that it is very dangerous and will delay the correction for at least months. Look at what is happening now. Everything is lower on an EPS basis and still the stock market only rises. At these valuations something is in control of the market that is not based on the facts. However, I am sure the .1% are very thankful for it.

“Helicopter” money. I know it’s fun to foreplay and maybe there still needs to be some more discussion about it but that’s the next “solution” for keeping the can moving. Think about it, consumer consumption will rise (unless we “dumb asses” save it in the form of cash instead), prices will rise because there will be more currency chasing the same goods and services (i.e., the CB’s coveted price inflation will finally rise), the US dollar will weaken as the FX markets react to the latest round of monetary insanity (which would be “good for exports”), there won’t be the urgent need to raise the minimum wage because everybody will get a raise, the Fed will be able to raise interest rates in June because nobody will care any more, debt levels will look a lot smaller and manageable so maybe everybody can start “living a little” again, stock prices will continue their rise because corporate sales and profits will increase, and articles will start coming out about how brilliant central bankers are for finally solving the age old problem of poverty, recessions and the lack of money.

That would be the plan that I think everyone is waiting for. If it works out it will only do so for a short time but it would kick the can down the road a little longer.

It does seem to be the next obvious step. And yet… the elites have a history of being oblivious to the struggles of common people and blind to their rising anger. They are mystified by both the non-Clinton Democrat candidate (what?? someone is running that they didn’t sanction??) and to the Trump vote. It’s like they had no idea anyone was pissed off. They drink their own kool-aid about the reportedly low unemployment rate, the modest inflation rate, the bull market in stocks (as if it’s not all due to QE and buybacks). This is true in the EU as well as the US.

Which gives me pause about whether they would really resort to helicopter money and toss the proles a few crumbs. They may not do it until they can see the torchlight on the horizon, and they might be out of road by then. We shall see!