The article below is an excerpt from our Q4 2022 commentary.

“The Decade of Shortages” was the unofficial theme for our investor day, held on November 3rd, 2022. Our audience heard presentations from five guest speakers and the two eponymous partners, outlining fundamental trends in various commodity markets that confirm our thesis. We discussed how we believe the shortages in the first two years of this decade were destined to be repeated multiple times in different commodity markets as we progressed through the remaining years. ESG pressures have forced significant redirection of capital spending away from extraction industries to renewable projects, shifts in global power from unipolar to multipolar, war, supply-chain breakdowns, changing weather patterns, and under-appreciated shifts taking place in the geology or extractive industries — all were discussed as well their supply impacts on various commodities.

What was not discussed at our conference is a great shortage we believe is in the making.

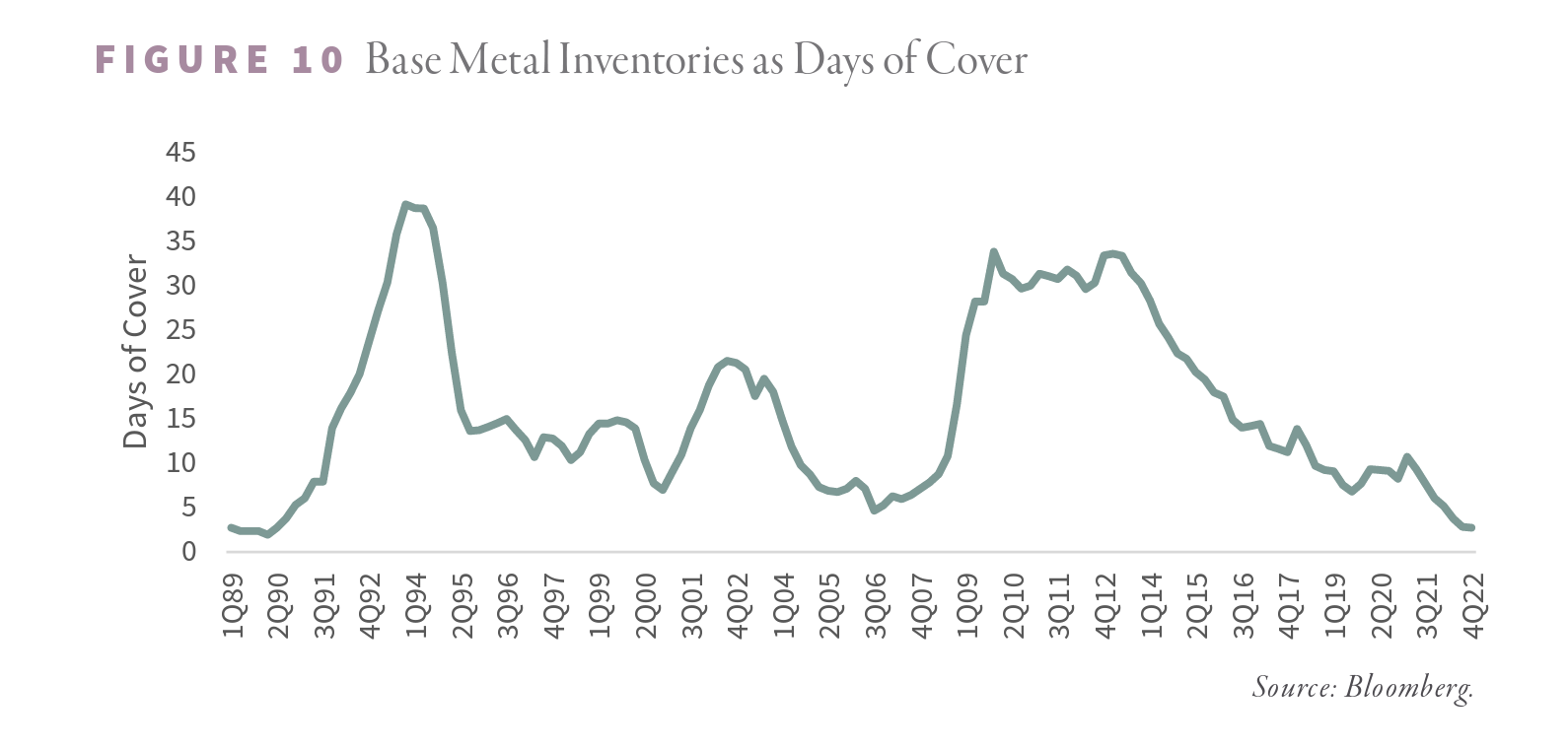

Although the global mining industry, over the last decade, has been able to side-step most of the negative publicity that has engulfed the world oil and gas industry, ESG pressures have placed substantial downward pressures on global mining industry capital expenditures in the last ten years. Environmental and related permitting issues have made both greenfield and brownfield mine development projects extremely difficult to bring into production. Given the vast ESG–related restrictions put on mining projects today, it is not uncommon that significant, economically robust discoveries made over 20 years ago are still not in production today. In a world where metal demand is already beginning to see substantial accelerations—ironically because of ESG-inspired environmental pressure – mine supply has, for many years, started to fall behind demand. If metal demand exceeds supply on a sustained basis, then metal held in quickly mobilized inventory should decline, which has transpired. Below is a chart showing the base metals inventories held at the three big metal trading exchanges: the London Metals Exchange (LME), the New York Metals Exchange (COMEX), and the Shanghai Metal Exchange.

Since peaking at 9 mm tonnes of inventory in Q1 2013, base metals inventories have drawn steadily and are down 90% today. Today, exchange inventories have fallen below 1 mm tonnes and are dangerously low. Adjusted for days of consumption, inventories have never been lower. In Q4 2022, exchange metal inventory covered daily consumption by only 2.7 days, surpassing 45% of the lows seen in 2005-2006 of approximately five days and reaching the lows seen 35 years ago back in 1988-1989.

The late 1980s saw robust base metals demand as the global economy boomed and Japan seemed destined for world economic domination. In response to inventory tightness, from 1988 to 1990, zinc prices surged 230%, copper rose 175%, and nickel prices skyrocketed 700%. However, the tightness in base metals inventories and the enormous upward pressure in prices were short-lived. The implosion of the Former Soviet Union (FSU) began in 1990, which significantly impacted the base metals supply fundamentals for over a decade. The FSU’s military-industrial complex, an incredibly intense and inefficient user of base metal, collapsed post-1990, flooding the West with new supply. After 70 years of communism, the FSU had become a massive base metals junkyard, and all this scrap added to the flood of supply headed west. Also contributing to the global inventory build post-1990 in base metals was the “popping” of the Japanese financial bubble. Japan became one of the world’s largest consumers of base metals from 1960 through 1980. The economic crisis, which eventually produced Japan’s lost decade, severely impacted their metals demand.

The flood of excess FSU supply and the easing of Japanese demand can be seen in the chart above. By 1993-1994, the days of demand cover of exchange inventories had soared to almost 5 mm tonnes, representing nearly 40 days of consumption, a level never seen since. Excess base metals inventories significantly contributed to the second leg of the significant commodity price bear market, stretching 20 years—from 1980 to 2000.

It took the next 15 years to work this excess inventory off, but surging China metal demand by the mid-2000s again drew base metal inventory levels back to dangerously low levels. In 2006 exchange inventories fell to briefly 1 mm tonnes, and when adjusted by days of consumption, inventories had fallen to less than five days of consumption—the lowest levels since 1990. And just like in the late 1980s, base metals prices experienced a massive surge. From the end of 2004 to the beginning of 2006, copper, nickel, lead, and zinc prices surged between 300% and 400%.

High base metal prices kicked off a new mine investment cycle. The increase in base metal mine supply, combined with the 2008-2009 financial crisis and slower increases in Chinese base metals demand, caused the inventory pressure in base metals markets to increase markedly. Between 2010 and 2015, exchange inventories, when adjusted for consumption, had risen to levels not seen since the early 1990s.

Today with exchange inventories sitting slightly below 1 mm tonnes, these inventories cover only 2.7 days of consumption.

In global base metals markets, we are well past the former tightness levels experienced in 2005 and 2006. Given the strength of worldwide demand and supply constraints, we believe it’s only a matter of time before shortages in various metals reach detectable levels, with potentially tremendous resulting upward price pressure.

Investors over the last year have become convinced the world will become gripped by several global recessions, driven by rising interest rates and continued real estate-related problems in China—both of which will produce noticeable impacts on global base metals demand. However, investors are missing the vast new sources of demand now embedded in international base metals demand figures.

In previous letters, we have stressed how metal intensive the coming renewable power investment cycle will be. Last summer, S&P Global’s Commodity Insights paper “The Future of Copper: Will the looming supply gap short-circuit the energy transition?” received significant press attention. The study warned of an “unprecedented and untenable” copper shortfall of 10 mm tonnes as suppliers grapple with copper demand that will double by 2035. We believe even S&P’s “pessimistic” copper supply outlook is still too optimistic.

For years, we have been warning that copper was slipping into a “structural deficit.” The S&P study confirms this—including the under-appreciated copper metal intensity of renewable investment. Given that inventory of exchange copper adjusted for consumption has now reached the record low levels of 1990 and 2005 and that we are only now seeing the structural gap emerge between copper demand and supply, we believe that the copper market will become the first base metals market to display severe shortage characteristics.

We believe this is going to be the decade of shortage across multiple commodity markets. Base metals markets give investors a great example of what a looming base metals shortage looks like. We find it fascinating that investors are paying no attention to base metals inventories that have reached record lows.