Guest Post by Richard Mills from Aheadoftheherd.com:

Earlier, we listed the various reasons why the US dollar is headed lower. But this doesn’t mean all safe-haven assets are in for a reality check. In fact, this might be an opportune time to invest in precious metals, in particular gold and silver, given the current state of the global economy.

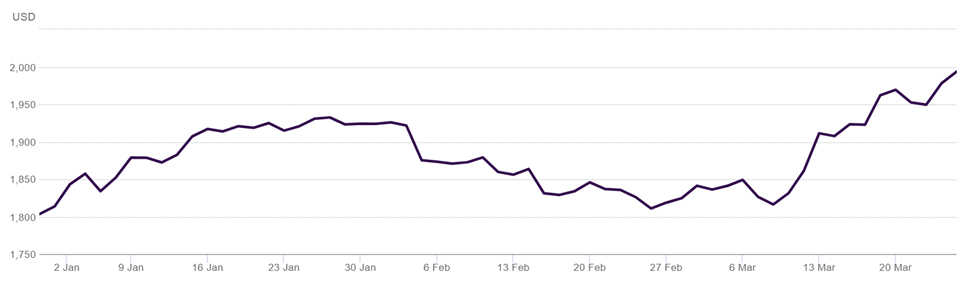

Just recently, gold prices crossed the key $2,000/ounce mark for the first time in a year on the back of insane market volatility, and it did that not once, but twice, in the span of a week. Silver prices, too, surged.

Driven by fears induced by the banking sector and the imminent end to Federal Reserve’s tightening cycle, investors are now turning their attention to precious metals to hedge their bets. For most, the unwritten rule is that during times of financial uncertainty, gold (and by association silver) is the way to go.

The bullish sentiment is being echoed across the analyst community. Last week, those at Goldman Sachs reiterated their positive outlook on commodities and upped their 12-month gold forecast by a hefty $100 to $2,050/ounce. Fitch Solutions was even more aggressive, predicting that gold would notch $2,075, which would match its all-time high, “in the coming weeks.”

For silver, prices may even outpace its sister metal and hit a nine-year high of $30 per ounce this year, Refinitiv analysts told CNBC.

While the latest rally was short-lived, the general consensus is that precious metals will continue to thrive over a longer horizon. This is because a multitude of market forces are currently in favor of gold, as highlighted below:

- Peaking US Dollar

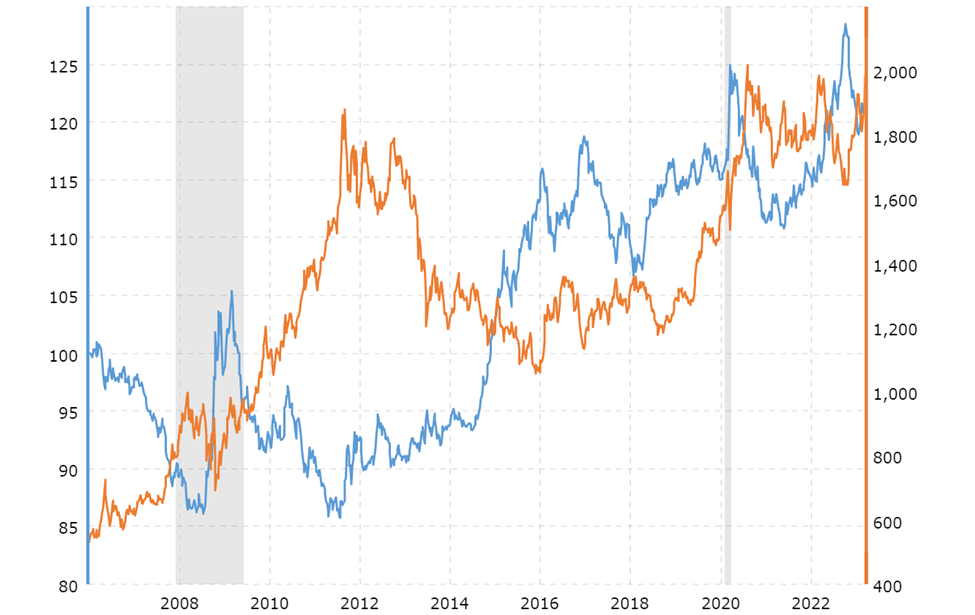

Despite both being safe haven assets, the values of gold and the US dollar tend to move in opposite directions, with investors often preferring one over the other depending on the returns.

As we had previously mentioned, the US dollar is entering the end of its bull cycle after 12 plus years. Over the past year alone, the dollar index has gained 4%, an indication of its resilient dominance in international trade.

But a correction is long overdue, as USD’s spectacular performance in 2022 coincided with the Federal Reserve’s monetary tightening to curb inflation. It’s widely expected that interest rates will peak sometime this year, and so too will the dollar.

In addition, mounting fears of a regional banking crisis and whispers of a national debt default by the US government are also forcing down the dollar’s value.

With everything going against the US currency, it’s natural for investors to pivot towards gold as their go-to safe haven against widespread financial risks.

“A weakening of the dollar may support gold prices,” HSBC’s chief precious metals analyst James Steel recently told CNBC, who correctly predicted the Fed’s recent 25 bps rate hike.

Steel also noted that the simultaneous events of both gold and the dollar going up last week are “quite unusual”, adding that investors tend to like the perceived safety of gold during periods of financial stress.

- Federal Reserve Decision

Last year, the Fed rate hikes helped pave the way for the US dollar rally, but 2023 could spell the end of the road for more central bank tightening, dragging the greenback back. This, according to many, is only a matter of when, not if.

“A sooner Fed pivot on rate hikes will likely cause another gold price surge due to a potential further decline in the US dollar,” Tina Teng, an analyst at CMC Markets, told CNBC last week. Based on her assessment, Teng expects gold will trade between $2,500 to $2,600 an ounce.

Craig Erlam, a senior market analyst at foreign exchange company Oanda, is also high on gold this year, stating that “interest rates are at or near their peak, cuts are now being priced in sooner than anticipated on the back of recent developments in the banking sector.”

But even if the US central bank is playing its cards close to its chest with its next decision, gold would still benefit regardless of where interest rates are going.

“Overall, the Fed will have to choose between higher inflation or a recession, and either outcome is bullish for gold,” Nicky Shiels, head of metals strategy at precious metals firm MKS Pamp, said in a CNBC interview, adding that gold could extend to $2,200 per ounce.

Oanda’s Erlam also agreed that the current market dynamic will boost gold demand, even if it coincides with a softer dollar.

- Financial Market Uncertainty

Simply put, gold’s value rises during times of economic uncertainty.

Evidently both times that spot prices touched the $2,000/ounce mark in recent memory were predated by some significant, catastrophic event; the first was Russia’s invasion of Ukraine last February, and second was the collapse of two major US banks (Silicon Valley Bank and Signature Bank).

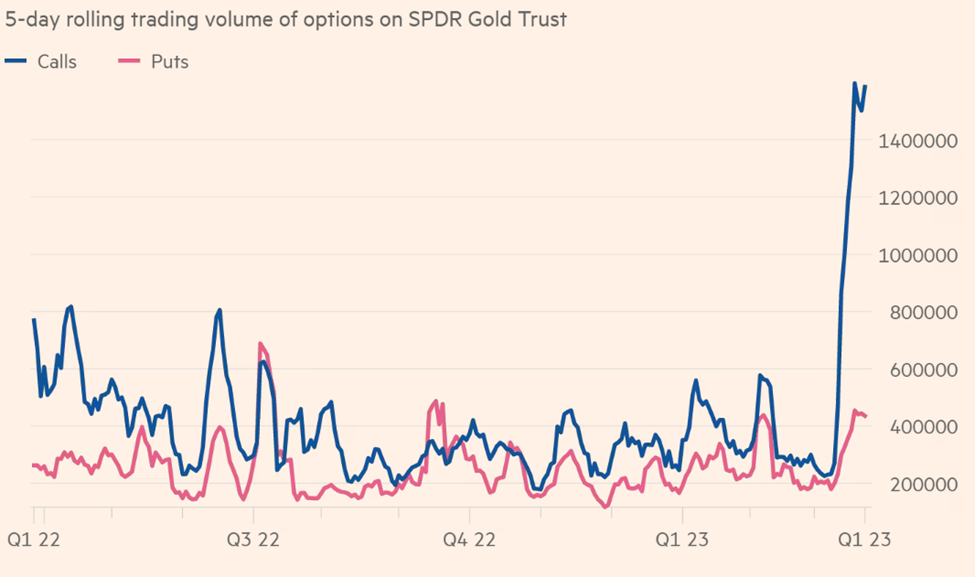

And despite a pullback from the latest rally, traders are still betting on further increases in gold prices on the back of heightened safe-haven demand, whether it be through futures, exchange-traded funds or options.

Aakash Doshi, head of commodities for North America at Citigroup, told Financial Times that there had been a surge in investor activity across all three channels in recent weeks. “The big catalyst has been the stress in the regional banking system in the US … and it has been pretty much one-directional buying,” he said.

As things stand, March is set to be the first month of net inflows into gold ETFs for 10 months, while the volume of bullish options bets tied to the funds is also approaching record levels.

For example, the five-day rolling volume of call options on the SPDR Gold Trust — the most popular gold-backed ETF — has surged more than fivefold since the start of the month (see chart below). A similar increase in interest was recorded in CME’s gold futures and options tied to them.

Suki Cooper, precious metals analyst at Standard Chartered, said in the days immediately following the US bank failures, there was a massive increase in “tactical” positioning as traders looked for assets considered safe havens in times of crisis.

It is estimated that around 24 tonnes of gold have flowed into SPDR Gold alone since the start of the banking crisis over two weeks ago, according to Goldman Sachs.

- Central Bank Buying

It’s not just the traders that are betting big on gold and elevating the metal’s demand.

Central banks too have been stockpiling gold, adding another 77 tons to the global reserves during the month of January, the World Gold Council’s latest data shows. This follows up on a record year in 2022, during which central banks bought a record 1,136 tons.

According to WGC, there are two main drivers behind the gold buying — its performance during times of crisis and its role as a long-term store of value. Given 2022 was a year scarred by geopolitical uncertainty and rampant inflation, it’s hardly a surprise that central banks opted to add gold to their coffers and at an accelerated pace, WGC global head of research Juan Carlos Artigas recently told Kitco News.

Looking ahead, there is “little reason” to doubt that central banks will remain positive towards gold and continue to be net purchasers in 2023, the WGC predicts.

It emphasized that gold remains an important asset in the global monetary system, underscored by the big purchases by central banks.

“Even though gold is not backing currencies anymore, it is still being utilized. Why? Because it is a real asset,” Artigas said.

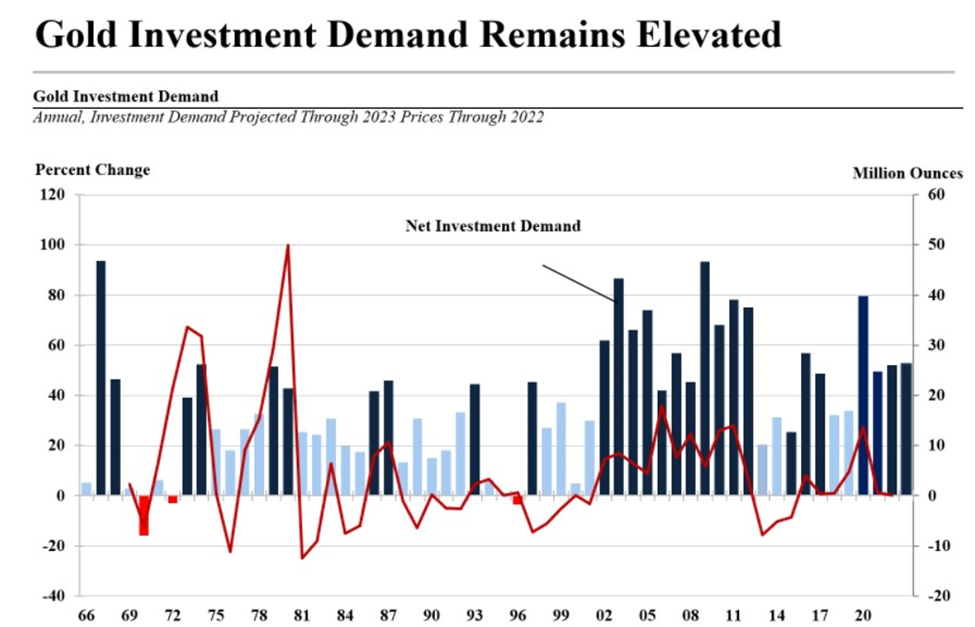

- Recession Fears

Lastly, and perhaps the most obvious factor in investors’ decisions, is the impending “doom and gloom” in the global economy that many are foreseeing. When market conditions don’t seem favorable, gold’s appeal rises dramatically.

In a webcast hosted by CPM Group’s Jeffrey Christian, a renowned analyst and advisor in commodities markets, he predicted that gold’s demand will stay elevated as the world economy enters a recession, which is likely to occur as soon as the fourth quarter of 2023, and certainly by next year.

“The recession will most likely hit the industrialized nations more so than the emerging economies, similar to 2007 and 2011,” he noted in Tuesday’s presentation.

Christian also likened the recent US banking fiasco to the collapse of Bear Stearns in 2008, calling it the “foothills of a bigger crisis that will arrive in nine months, which is why we’re likely to see higher gold prices in 2024 and 2025.”

The safe-haven boost will also trickle down to silver, despite most of the metal’s demand being from industrial activities. “Silver has historically delivered gains of close to 20% per annum in years inflation is high. Given that track record, and how cheap silver remains relative to gold, it wouldn’t surprise to see silver head towards $30 per ounce this year,” Janie Simpson, managing director at ABC Bullion, said in a CNBC interview.