Towards the end of a financial bubble, the people who benefit from the bubble’s continuation — politicians hoping to be reelected, bankers hoping to complete the next deal, money managers talking their books — start touting “record household net worth” as a sign of societal health.

But they’re wrong, for the following reasons:

Deceptive leverage. Pretend that you borrow $1 million to buy some JPMorgan Chase shares and that this transaction pushes the value of the stock higher. Without realizing it, you’ve just raised the net worth of millions of other JPMorgan Chase stockholders. Total household net worth — that is, assets minus liabilities —increases by vastly more than the money you borrowed. Society gets “richer” and the economy gets more robust and “safer” because of its growing net worth cushion.

So far so good. But since leverage works both ways, as soon as you turn around and sell your stock, thus pushing down the price, that incremental net worth vanishes, because it never really existed.

False comparison. Most adults understand that their stocks, bonds, and houses fluctuate in price, rising in good times and falling in bad, while their mortgages, credit card debts, and auto loans only fall as they’re paid off. Which is to say instead of falling, these obligations mostly just rise as new debts are incurred and old debts are rolled over. A statistic derived by combining things that can evaporate (asset prices) and things that generally can’t (debt balances) does not measure what they say it does.

The takeaway: In a society of borrowers and speculators, asset values increase because of borrowing and speculation, which makes rising household net worth both a negative indicator of future growth and a sign of fragility rather than strength. But until people figure this out, it remains a great tool for convincing consumers that everything is fine when it’s actually not.

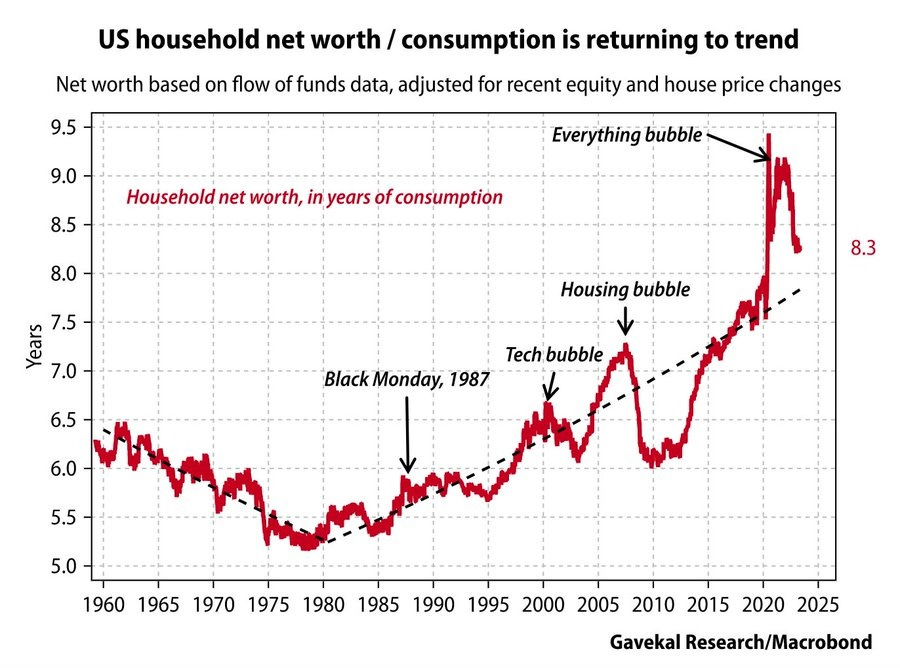

The following chart (courtesy of European money manager Gavekal Research) shows household net worth peaking just before the onset of recessions and/or brutal bear markets.

Notice how as the economy becomes more and more addicted to leverage, the volatility around the trend line increases, indicating that the next downturn — which we’ve already entered — will lop around 40% from household net worth via plunging asset prices.

And that’s assuming that the trendline itself is a real thing. If the credit supercycle that began in the 1970s is now ending, we’re facing a generational, not a cyclical, mean reversion in which the other edge of the leverage sword cuts financial assets even more deeply.

Here’s how CNBC covered the subject last year, noting the increase in debt without exploring the link between debt and net worth:

Household wealth tops $150 trillion for the first time despite surge in debt

Americans got considerably richer as 2021 came to a close, thanks to a nice boost from their stock market holdings and an increase in real estate values, the Federal Reserve reported Thursday.

Household net worth in the fourth quarter eclipsed $150 trillion for the first time, rising at a healthy 8.2% pace from the previous quarter for the fastest growth period since the first quarter of 2020. The increase came thanks to a combined $4 trillion rise in holdings from corporate equities and housing.

The total level — $150.29 trillion, to be exact — represented a 14.4% increase from a year ago. The boost came with U.S. economic growth running at its fastest pace since 1984 and the stock market enjoying another robust year.

The move came despite a rapid increase in debt at all levels.

Total nonfinancial debt came to $65.1 trillion, including $17.9 trillion at the household level, $18.5 trillion in the business world and $28.6 trillion from government. Each category saw substantial rises.

Household debt jumped at an 8% annual rate, owing to a 6.9% rise in consumer credit and an 8% surge in mortgages. Nonfinancial business debt increased at a 6.7% clip, while federal government debt leaped by 10.8% after declining 1.3% in the third quarter.

The key sentence: “The move came despite a rapid increase in debt at all levels.”

The CNBC writer is apparently bemused that net worth would rise along with debt as if the two are unrelated, when if fact rising debt is the source of rising net worth. Americans did not get “considerably richer in 2021.” They got considerably more leveraged and fragile, and one step closer to the mother of all mean reversions.