One of the signposts on the road to recession (or in today’s case Depression) is a sudden increase in the number of former Wall Street favorites going bankrupt. The reason this happens when it does is that when money is easy, new companies are able to finance their emergence by selling a “disruptive” story to speculators who get swept up in the hype and shower those companies with cash. The companies expand aggressively, generate rising sales and come back for more cash, which is supplied enthusiastically.

During this exponential growth phase, no one pays attention to operating losses, cash flow burn rate, or any other profit metric, because it is assumed that the company will eventually get big enough to raise prices while cutting costs via economies of scale, thereby generating a tsunami of cash. Amazon did it that way, so why not these other revolutionary upstarts?

The answer is that for every Amazon there are a hundred unworkable business models, and it’s only when money gets tight that the latter reveal themselves and start to fail.

Why does this matter for investors like you who avoid speculative “story” stocks in favor of real assets and the companies that produce them? Because market psychology can turn very dark when a critical mass of big-name bankruptcies start making headlines. The resulting bear market can suck everything down in its wake, a prospect which affects the timing of, say, gold mining stock entry points.

Here are two examples of what’s coming:

Carvana (CVNA)

A couple of decades ago, electronics superstore chain Circuit City got the idea of expanding its general business model to cars. It set up a network of CarMax (KMX) lots, vacuumed up thousands of vehicles at wholesale auctions, and sold them at competitive prices. CarMax now has a market cap of $11 billion, so its strategy seems to be viable.

In 2016 Carvana emerged to take the concept virtual, with a very appealing pitch:

GET THE CAR WITHOUT THE CAR SALESMAN®

Your experience doesn’t end once you get the keys. Our goal is to make sure you have peace of mind when it comes to your new ride.

100% Online

Shop our wide range of affordable vehicles from the comfort of your home. Plus, there’s no bogus fees so you can find the right car at the right price.

Pick up your car or have it delivered

With Carvana, you decide how and when you’ll receive your ride. Have it delivered right to your driveway or pick it up from one of our Car Vending Machines. Your choice.

WE’RE LOOKING OUT FOR YOU

Every Carvana car comes standard with a limited 100 day/4,189 mile warranty. Should anything happen, we’ll take care of it so you can rest easy.

Inspected and reconditioned

All of the vehicles in our inventory and our partners’ inventory are inspected and reconditioned by technicians and have no reported fire, frame, or flood damage according to CARFAX™ and AutoCheck®

7-Days to love it or return it

Every Carvana car comes with a 7-day return policy. Take it for a spin and see if it truly fits your life. If you don’t love it after 7-days, simply return it. It’s that easy.

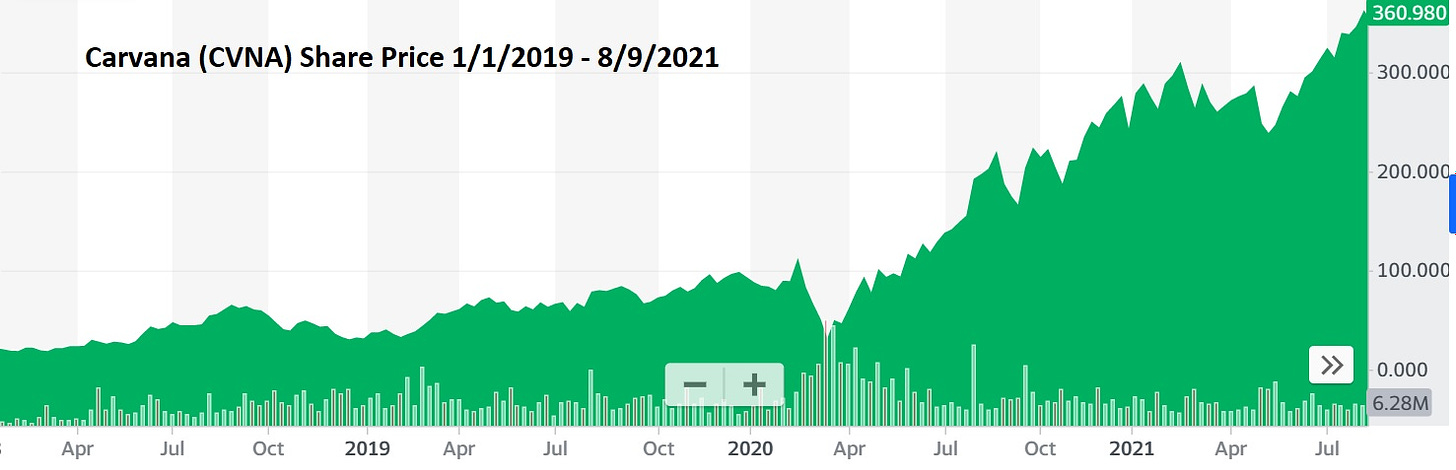

It’s stock reflected the classic “disruptor” arc, rising from $20 in 2018 to a high of $360 in 2021.

But it never managed to convert rising sales into solid – or any – profits:

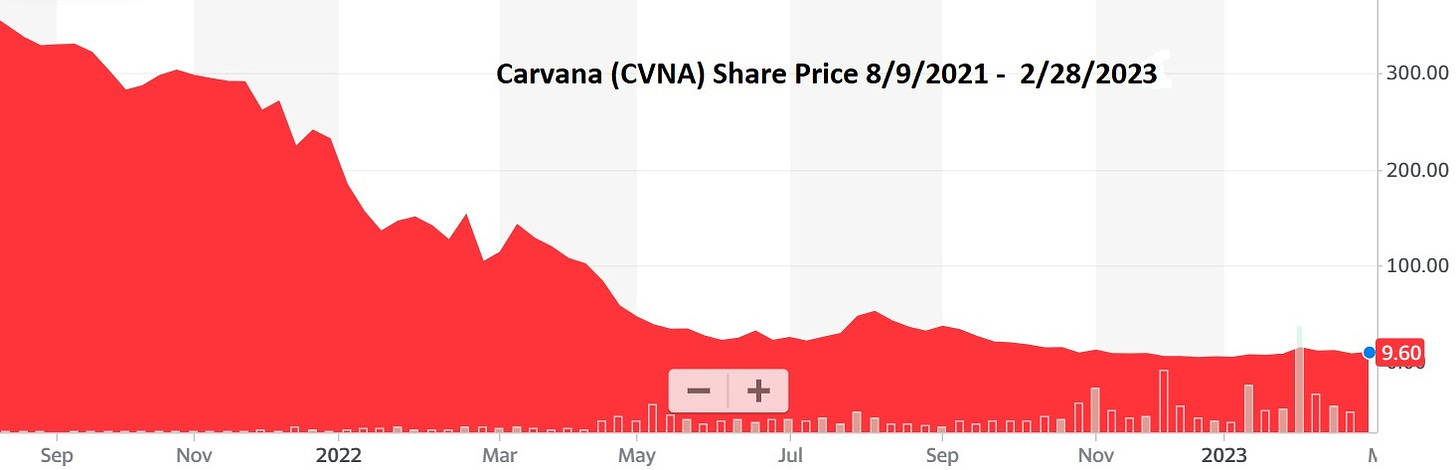

And now the stock has tanked…

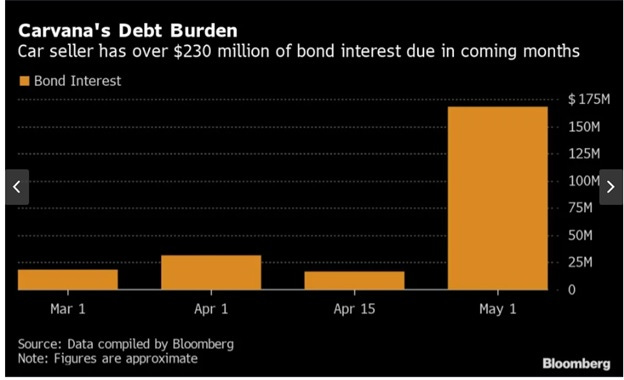

…and the debt that was so easy to incur back when no one cared about earnings is coming due.

With interest rates rising and disruptor stocks falling out of favor, it’s not clear how Carvana finances a turnaround. Expect a big announcement any day.

Beyond Meat (BYND)

Processed veggie burgers have been around for decades, and though they carved a niche in grocery store freezer sections, they never seriously threatened actual meat. Then came Beyond Meat and Impossible Foods, two start-ups promising to take the concept to the next taste and nutrition level where it would disrupt factory farming by displacing burgers, chicken nuggets, meatballs, and sausages in the food supply chain.

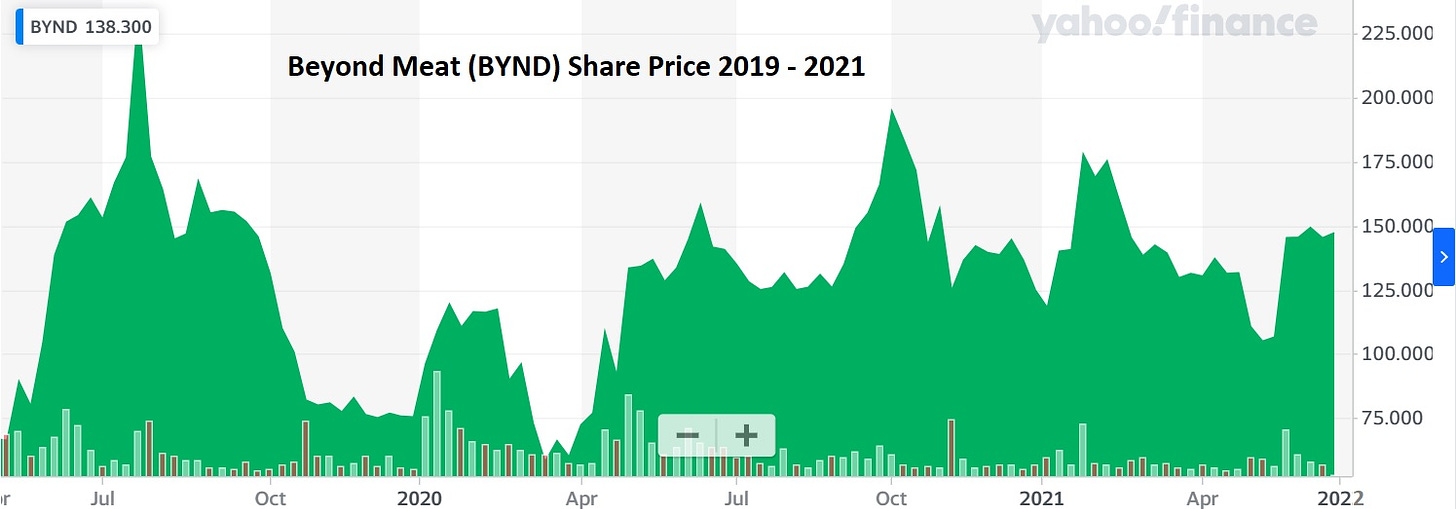

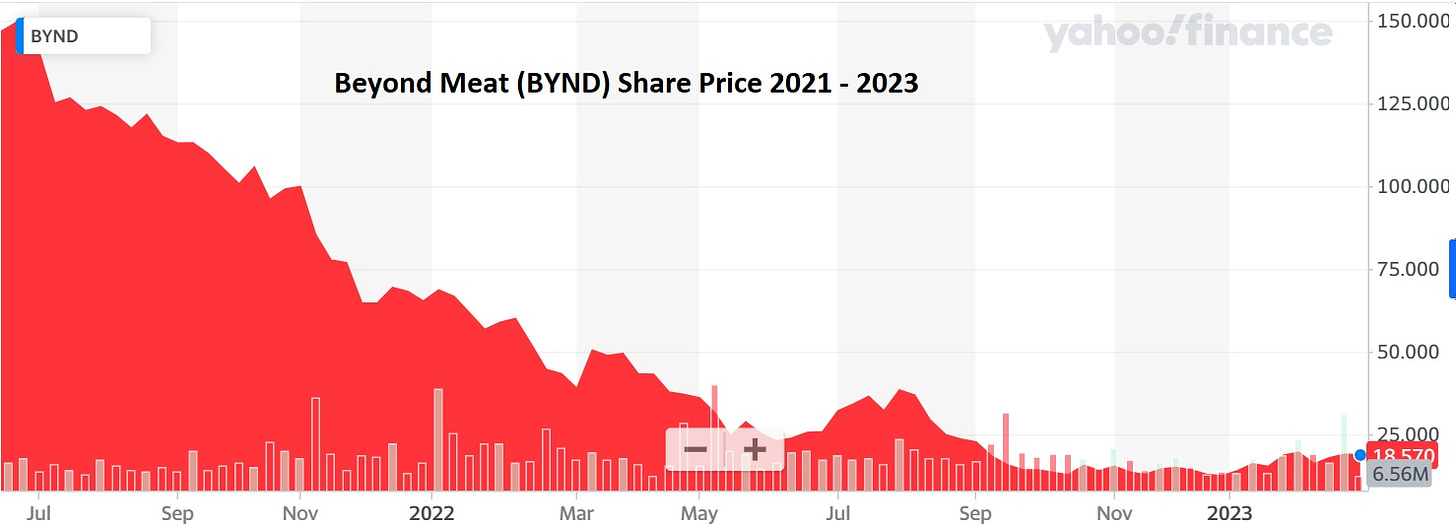

Impossible stayed private, but Beyond went public and was an instant hit both with investors who saw the meat market as ripe for disruption and restaurant and grocery chains eager to add veggie alternatives to their menus. Beyond’s market cap spiked into the $10 billion range and its stock bounced around in the stratosphere as new product launches stoked optimism and actual results fell short of expectations. Still, in its first couple of years as a public company, this was definitely a high-flyer.

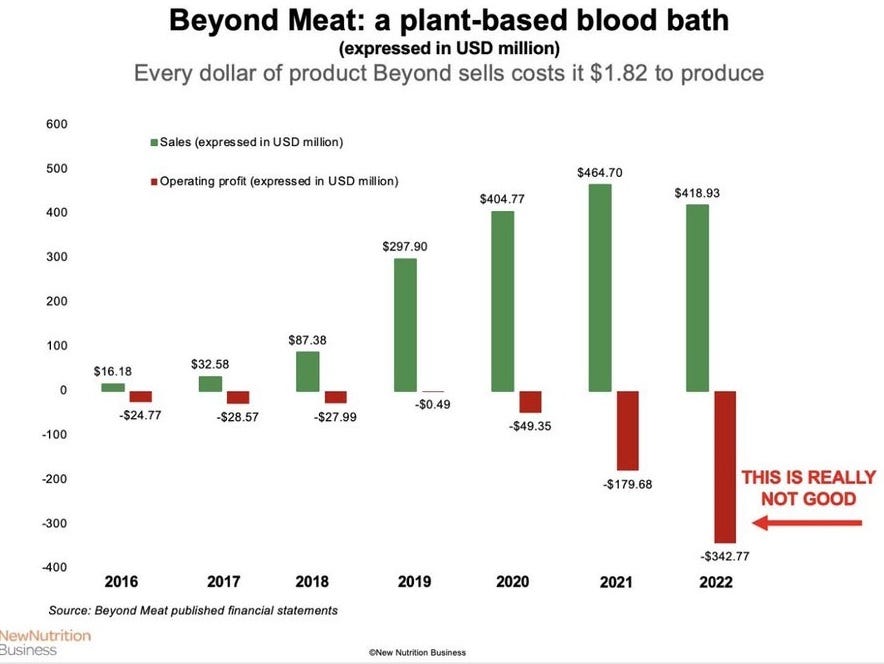

But the disappointments kept coming. Fast-food chains introduced plant-based burgers and then pulled them when customer demand was tepid. Production costs rose due to supply chain issues, so the promised economies of scale never materialized.

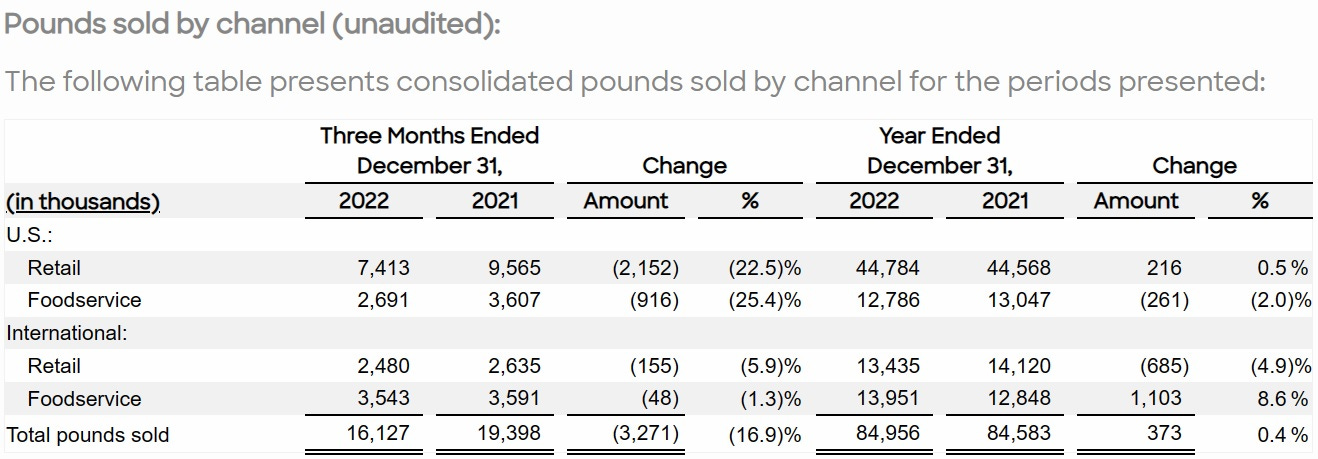

Now sales are actually falling, which is deadly for an emerging growth stock…

… while losses are mounting.

The stock, not surprisingly, has collapsed.

Expect an imminent announcement from this one too.

There are plenty more zombie disruptors shambling around the NASDAQ these days. And when they start restructuring their debts and/or filing for bankruptcy they’ll add to an already darkening mood. The result: Brutal losses for over-optimistic investors and a world of bargains for those who keep some powder dry in anticipation.

How To Identify Undervalued Stocks BEFORE They Rise In Value…

Trading expert and author Thomas Wood has finally released his highly anticipated guide, “The Easy Way To Find Undervalued Stocks” and right now, you can download it for free! Don’t let the chance to learn to trade like Warren Buffett slip away…