Guest post from John Rubino on his substack:

Gold miners come in lots of different shapes and sizes. But by universal agreement the best business model in that space is the royalty/streaming company, which works as follows:

Say you’re running a small exploration company and you’ve found a promising gold deposit. If mined successfully it’s probably worth a lot of money. But building a mine costs millions of dollars and traditional banks won’t fund such a risky venture. What do you do?

One possibility is to show your discovery to a “royalty” or “streaming” company which, if it likes what it sees, will offer to finance all or part of the mine, in return for which you agree to pay your benefactor some portion of the gold you produce (a royalty) or sell it part of your future production for a very low price (stream). You get your mine and most of the wealth it produces, while the royalty/streaming company gets a predictable inflow of gold without the complexity or risk of actually running a mine. (This works for silver too. I’m focusing on gold for narrative simplicity.)

The biggest royalty/streaming companies have dozens of deals producing steady cash flows which, thanks to being diversified across many mines in different locations, carry vastly lower risk than a single mine.

Here, for instance, is what happens to a small miner if one of its handful of mines doesn’t work out.

An established royalty/streaming company, in contrast, isn’t existentially threatened by trouble at any one mine. But it retains the operating leverage of a miner, with profit margins that can explode if the price of gold rises.

This presents a lazy gold stock investor with a very easy strategy: just buy a bunch of high-quality royalty/streaming companies, and that’s it. No need to research mine operating results or stress over political risk or environmental issues in exotic places. Just create your portfolio and spend the next decade on the beach or the golf course, safe in the knowledge that when (not if) gold finally soars, your gold stocks will soar even more.

This strategy has literally only one, easily managed, drawback: Because the advantages of this business model are so obvious and well-understood, the royalty/streaming companies tend to be valued more richly than other equities in this space, which makes timing crucial. You don’t want to load up on these shares after they’ve already had a nice run because that limits your upside and increases the risk of a quick 50% paper loss.

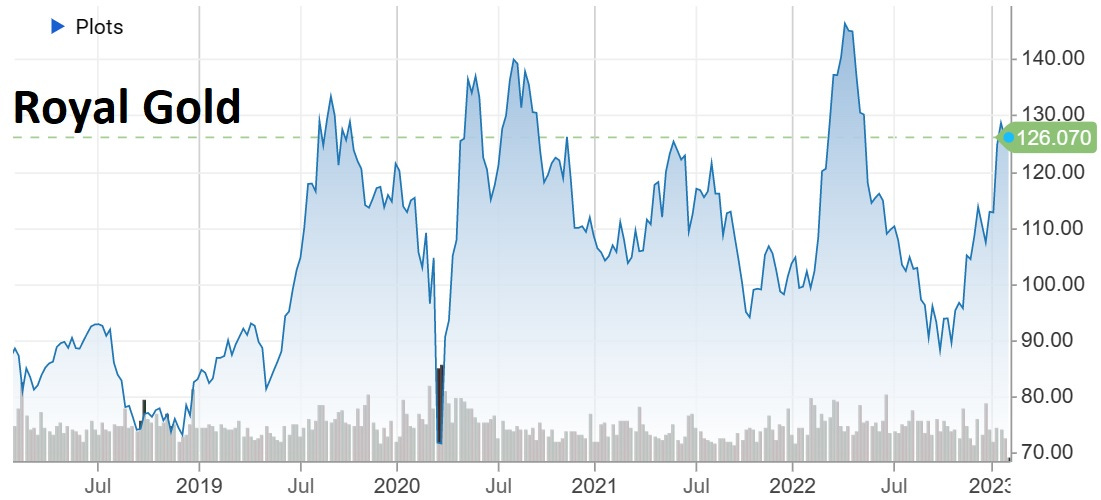

Luckily, most of these stocks are volatile, which means they frequently present nice entry points. An example is Royal Gold, which will do just fine in the long run but tends to bounce around in the moment. Today it’s trading at 126 but in the past few years it could have been bought below 90 multiple times. So use good-until-canceled low-ball buy orders, or sell puts (more about this strategy in a later post), or just wait until your targets correct. Or dollar cost average by buying a fixed dollar amount of these shares each month.

For a deeper dive into the royalty/streamer story, here’s a video in which mining analyst Rick Rule calls them his favorite kind of mining stock, “when the price is right.”

The following table lists some well-regarded royalty/streamer companies. A portfolio of these stocks – bought after corrections – will, says Rick Rule, generate most of the gains of actual gold and silver mining stocks, with a fraction of the drama.

Guest post from John Rubino on his substack.

Claim $10,000 In FREE silver In 2023

Thanks to forgotten 50-year-old legislation, often ignored by investment advisors, gold bugs, and silver hounds… You can now collect $10,000 or more in free silver.

Millions of Americans know NOTHING about this… Because it exploits a “glitch” in the IRS tax code that helps protect your retirement… While paying ZERO TAXES & PENALTIES to do it. That’s why you need to see this NOW.