Saying subprime was contained and calling for transitory inflation turned out to both be humiliating predictions. Now here's the next odious lie coming down the bullshit economic turnpike...

Think seriously for a moment about what we were told about inflation over the last two years. As everybody knows, both the government and the Federal Reserve swore up and down to us that inflation was going to be transitory and they were, of course, dead wrong.

This wholly incorrect prognostication will be filed next to Ben Bernanke’s “subprime is contained” statement as one of the all-time worst pieces of financial and monetary analysis provided by those who are supposed to have mastery of the subject at a consequential time, ever.

Putting aside whether or not the Fed is nefarious or simply incompetent, what is far more alarming is that we continue to ascribe credibility and relevance to the same people who not only seem to have a poor understanding of the basics of economics, but also a willingness to either put their stupidity on display, or lie to the public with a straight face.

Which is why I feel like I can confidently declare exactly which “prediction” we are getting from the Fed and the Treasury that will turn out to be dead wrong: the idea that we are not headed, at warp speed, head-first into a recession.

As recently as last month, Janet Yellen was out telling the world that she didn’t anticipate a recession:

The U.S. economy is obviously performing exceptionally well, with continued solid job creation, inflation gradually moving down, robust consumer spending," she said. "I'm not anticipating a downturn in the economy.

That’s a lovely thought, Janet, but you’re likely going to be proven dead wrong in short order.

I predict that the next “shoe to drop” for the United States, economically and regardless of what the stock market does, will be the country slipping deep into recession. In fact, the data supports the idea that we are already in recession.

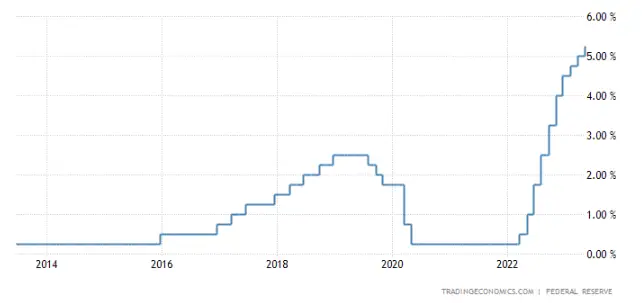

The beauty of Austrian economics is that I shouldn’t even need to reason as to why we are heading for a deep recession: the fact that rates are at 5% after sitting at 0% for a decade should be all you need to know.

Just a rudimentary understanding of the basics of finance – especially in a Keynesian system where spending is worshipped – tells you that such a pronounced ramp higher in rates is going to cause a severe economic slowdown eventually. My readers know I have been predicting this for 18 months now, and they also know I am not afraid of getting things wrong. In this case, I simply think I was early, and will be proven right soon.

After all, we know what we’ve been told. Could there be anything more pathetic than touting the line used specifically to make fun of market neophytes that “this time it’s different?”

Now here’s what the Fed’s own data shows.

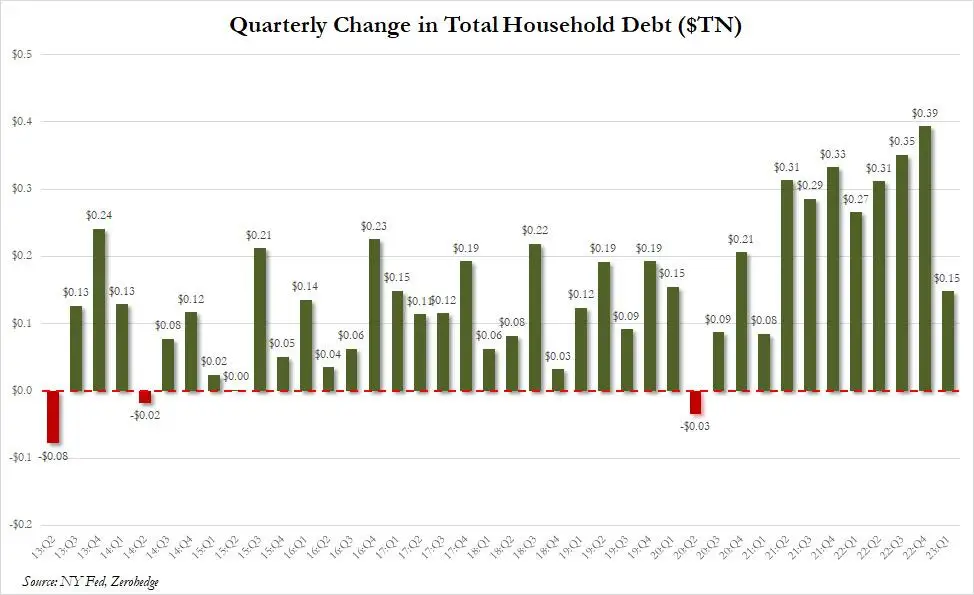

Zero Hedge, in a great piece detailing the ins and outs of the Federal Reserve Bank of New York’s quarterly report on household debt and credit, pointed out some obvious signs of a slowing economy. First, they noted that this was the weakest quarterly debt increase in two years, which suggests that some tightening is taking place. By proxy it also casts a dim light on spending since, as ZH notes, our economy is entirely credit driven.

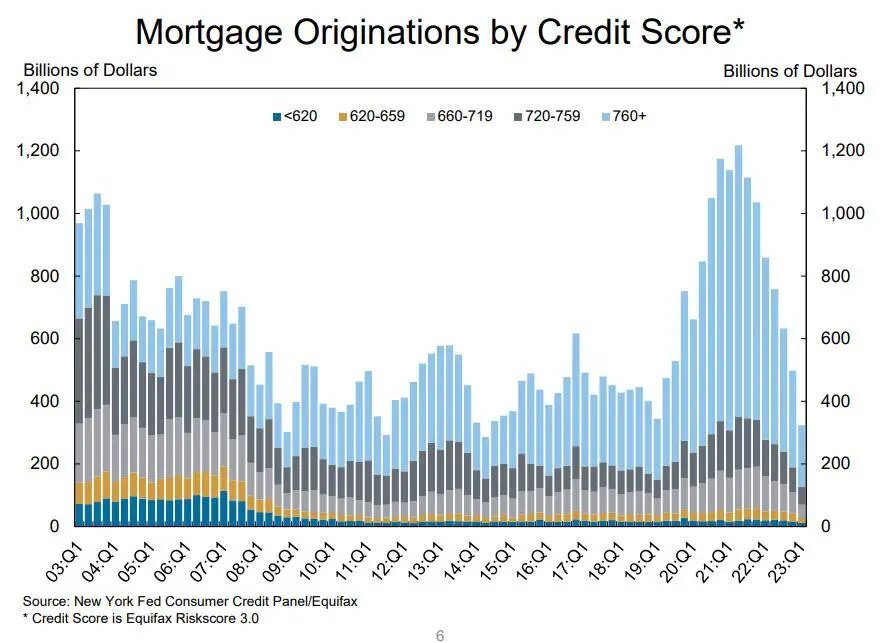

One of the largest standouts from Zero Hedge’s analysis is the plunge in mortgage originations, specifically among the most credit-worthy.

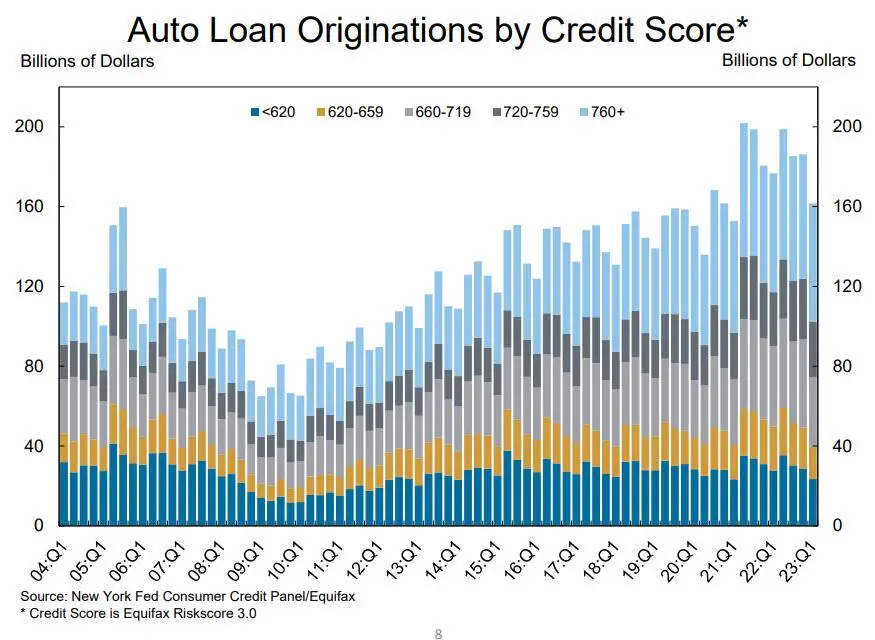

And auto loan originations are also starting to turn back toward pre-pandemic levels, even despite the trillions that the Fed firehosed out in 2020 and 2021.

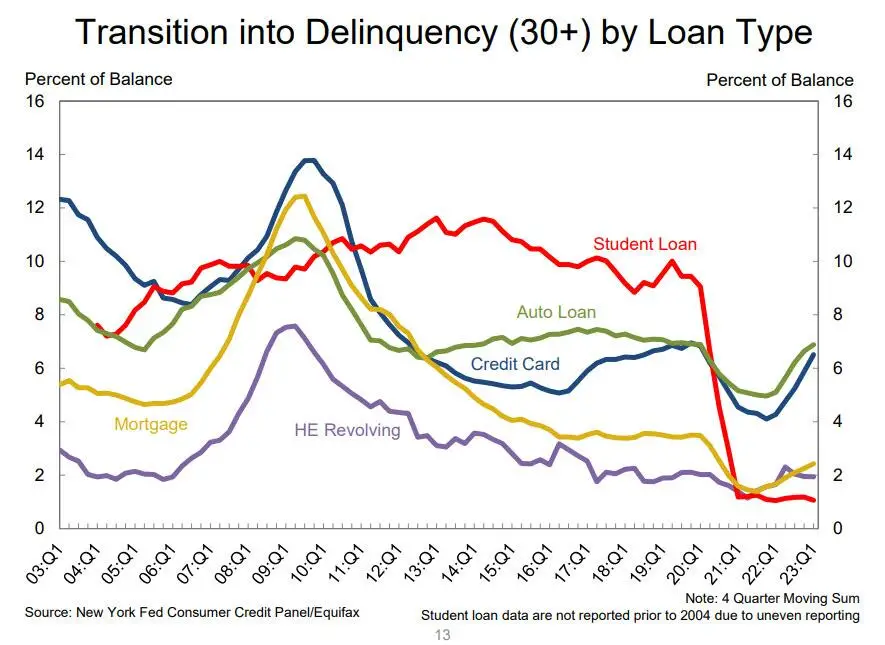

Finally, delinquencies (where the rubber meets the recession road) ticked higher still, with a focus on autos and credit cards. “The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.2%, respectively approaching or surpassing their pre-pandemic levels,” Zero Hedge writes.

If it isn’t clear from these figures that the economy is heading in the wrong direction, I don’t know what to tell you. Now, layer on top of that the fact that most of this data is on several lags – the lag of it being Q1 data and the lag of the data responding to monetary policy changes. In other words the “spot” levels for this data as they stand today – and months from now in responding to today’s rates – is likely already far worse. And these aren’t trends that just quickly turn around, even with swift changes to monetary policy. These trends need to change direction like the Titanic: extremely slowly and over long periods of time (insert eventually hitting the iceberg anyway joke here).

The stock market is no longer a leading indicator for the economy. Instead it has become the “wild card” of the group, a la Charlie Kelly,

The stock market is the wild card because it no longer relies on anything involving macroeconomic data to determine which direction it’s going to move in.

In a sane world, the market would already be significantly lower than it is, pricing in future economic data like that which I’ve pointed out above. Instead, we’ve had several weeks of the market milling around and drifting upward – because we live in a world where the “market” is controlled less by actual data and more by the Fed’s incessant uber-inflationary policy as it relates to the dollar.

Don’t get me wrong, I still believe there will be a huge wreck in equity markets at some point, and I believe that this will cause the Fed to ease their policy, likely way too late. From there, it’ll become a tug-of-war between legitimate economic forces, pulling the market in one direction, and the cocktail of the central bank, mixed with generally lobotomized behavioral investor psychology, pulling it in the other.

In the words of Kerouac, “I have nothing to offer anybody except my own confusion.”

But what I am fairly certain of, however, is that we are going to see a crack up in some market somewhere – the “blowoff valve” that I wrote about at the beginning of the month and the consequences I wrote about last week, while discussing what positions I liked heading into the chaos.

I also think it’s important that people don’t underestimate the Central Bank’s ability to make a significant problem much worse. After all, the way that we determine policy in this country is often to blame the easiest, lowest hanging fruit, regardless of their actual culpability, mixed with trying every potential “quick fix” possible before eventually giving up and defaulting to an actual, often uncomfortable, solution, once its too late.

For an example of this, look no further than JP Morgan’s Jamie Dimon, who has been placing the blame on the very bank blowups he is taking advantage of on short sellers.

While it’s a great catchy headline that is easily digested by long investors that are scared of short selling “boogeymen”, most seasoned investors know it’s a case of the tail wagging the dog. People were short bank stocks because they saw the risk on their balance sheets…risk didn’t just suddenly appear on these banks’ balance sheets because someone was short, or because their equity moved lower.

Being short or long a bank stock doesn’t change the fact that it loaded its balance sheet with Treasuries when yields were at 0.5% and now, with rates at 5%, a hole has been blown in their boat the size of a cannonball.

And, to quote Penn & Teller’s Bullshit!: “…and then there’s this asshole”

Yet another example of deflecting blame to the “convenient” low-hanging fruit goes to Silicon Valley Bank CEO Greg Becker who, according to Bloomberg, blamed everyone – the Fed, social media, the fairy fucking godmother – but himself and his shitty portfolio of lousy assets that forced him to spook the market with a firesale, prior to the bank’s collapse:

“The messaging from the Federal Reserve was that interest rates would remain low and that the inflation that was starting to bubble up would only be ‘transitory,’” Becker said in written testimony prepared for a US Senate Banking Committee hearing Tuesday focused on Silicon Valley Bank and Signature Bank, both of which were seized by regulators in March. “Indeed, between the start of 2020 and the end of 2021, banks collectively purchased nearly $2.3 trillion of investment securities in this low-yield environment created by the Federal Reserve.”

He’s right that the Fed lied/was wrong about transitory inflation – but the Fed didn’t stock his bank’s balance sheet with trash – and the Fed isn’t your Chief Investment Officer. What happened to accountability?

As I said, it’s only after we’ve exhausted all of the wrong solutions that the market finally pukes back the final, correct solution (think Rolling Stones: you can’t always get what you want, but if you try sometimes, well, you might find, you get what you need).

This means that, regardless of whether or not we can short sell banks, the underlying problem, hereinafter referred to as “the economy sputtering to a halt like that engine in Captain Ron”, isn’t going away.

We saw the same type of arrogance when it came to Covid. We lunged at the quickest and easiest sounding fix in the absence of reviewing the data. As part of that lunge, we even went as far as to ridicule and shame people that suggested we think about things critically and slow down in our hasty decision making process.

It’s only now that the market has puked out the actual solution, which basically amounts to doing what we would do for the flu, that all of the nonsensical measures we put into place are seen for the asinine ideas they truly were.

As my friend Larry Lepard has predicted with me several times, the same thing will eventually happen to gold and bitcoin when it becomes clear that sound money has become our nation’s Achilles’ heel. Nobody will blame 50 years of horrific central banking policy, greed or excess among those who received bailouts, tied with abusive spending habits, as the reason for the dollar’s downfall. Instead, they will come for your gold, they will nationalize the miners and they will tax or ban bitcoin.

Hell, anything that can get you out of their system, while the system is crumbling, is going to be seen collectively as the enemy.

The enemy will be everything except the people and policies that created the problem to begin with. Those people get awards instead.