“Student loan debt is crushing young people. And so they’re not doing the things we would expect them to do.

They’re not moving out of their parents’ homes in as big a numbers, they’re not saving up money for down payments, they’re not buying homes or cars or starting small businesses or doing any of the things that help move this economy forward.”

– Elizabeth Warren, U.S. Senator (D), Massachusetts

Written by Bryan Lutz, Editor at Dollarcollapse.com:

Over 44 million student loan payments resumed in October, 2023, last year, starting what looks to be a student loan debt spiral for millennials.

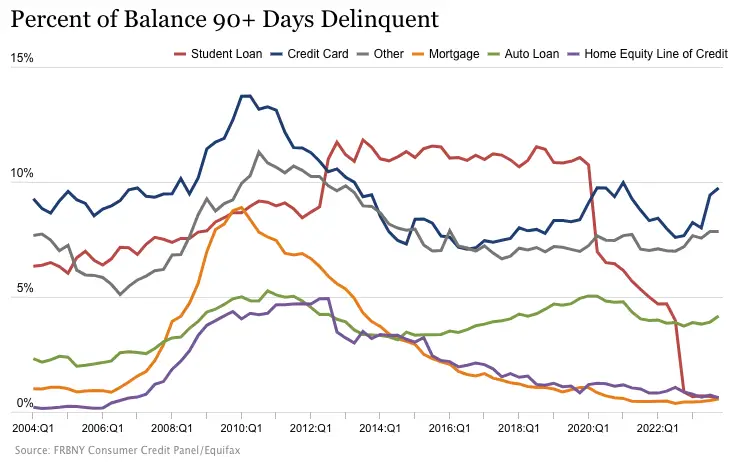

Deficits in household budgets are spilling over onto their credit cards…

Yahoo!reports:

Millennials are struggling under mounting credit card debt, NY Fed finds

“Millennial credit card users, those born between 1980 and 1994, first began exceeding pre-pandemic delinquency levels in the middle of last year, the report found…

The sharp uptick in delinquencies among millennials could be due to federal student loan repayments, which resumed in October. According to a separate report from the New York Fed, nearly 23% of borrowers said they expected to miss a student loan payment.

Additionally, 39% of borrowers with incomes below $60,000 said they expected to miss a student loan payment, compared to 14% with incomes above that mark. Overall, about 12% of borrowers said they expected to miss a non-student debt payment once student debt repayment resumed.

“The resumption of student debt repayment can cause spillover effects on other debts,” New York Fed researchers said.”

Millennials seem to be choosing to pay their student loans instead of paying off their credit cards.

While all credit cards delinquencies are rising fastest, and auto loans(so they can keep showing up at work) are also moving up slowly…

as many as possible(930,000 people) are taking advantage of Biden’s student loan forgiveness program.

What is peculiar though, is that the New York Fed researchers are perplexed as to why millennials own the top spot for credit card delinquency rates.

They have the data…

According to the Fed’s own data, Millennials have the lowest savings rate among all other age categories.

Gen Z hasn’t had time to accumulate student loan debt, purchase cars with auto loans, and put the rest of their life on the line with a mortgage like Millennials have.

And much of Gen Z are still living in their parents basement. Although they are showing up crying on social media…

If push comes to shove, Gen Xers and Baby Boomers need only dip into their savings account, or make a hardship withdrawals from their retirement accounts to pay off their credit cards.

But hard times aren’t that hard yet.

Yet…

The banks will draw this out as long as possible.

There are a few things banks can do to reduce credit card delinquencies and thereby reduce the financial stress.

They can lower credit cards interest rates, they can raise credit card limits, and they can change the required minimum payment.

But those moves don’t reduce debt.

They only delay the inevitable.

Student loans will be an interesting one to watch as the data roles in over the next two years.